Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The management of Matrix Stores Sdn. Bhd. are in the process of exploring the company's investment opportunities. There are six opportunities, the details and

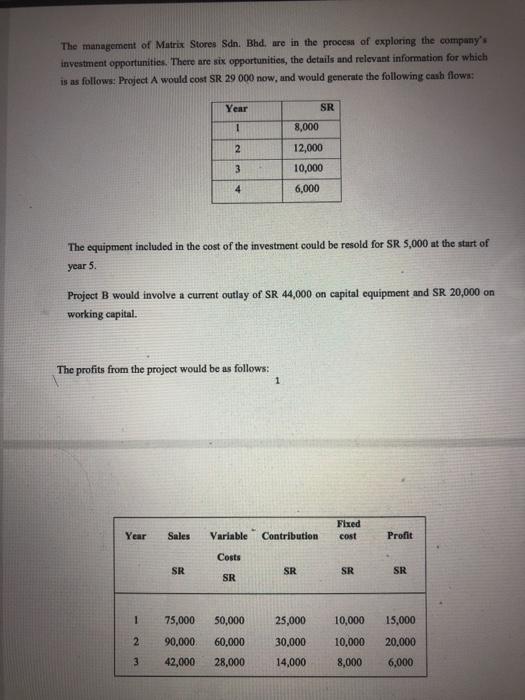

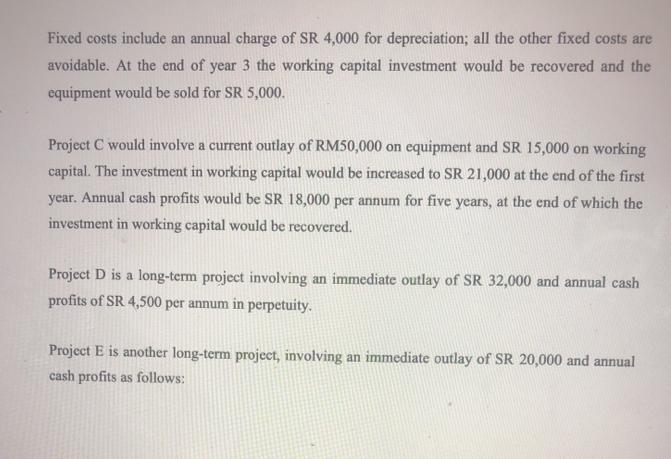

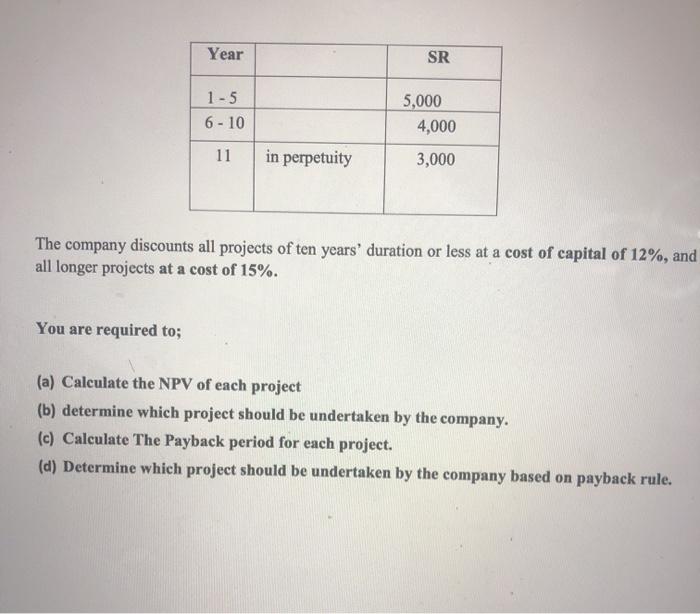

The management of Matrix Stores Sdn. Bhd. are in the process of exploring the company's investment opportunities. There are six opportunities, the details and relevant information for which is as follows: Project A would cost SR 29 000 now, and would generate the following cash flows: Year 1 2 3 4 The equipment included in the cost of the investment could be resold for SR 5,000 at the start of year 5. The profits from the project would be as follows: Project B would involve a current outlay of SR 44,000 on capital equipment and SR 20,000 on working capital. 1 2 3 SR Fixed Year Sales Variable Contribution cost Costs SR 8,000 12,000 10,000 6,000 1 75,000 50,000 90,000 60,000 42,000 28,000 SR SR 25,000 30,000 14,000 SR Profit SR 10,000 15,000 10,000 20,000 8,000 6,000 Fixed costs include an annual charge of SR 4,000 for depreciation; all the other fixed costs are avoidable. At the end of year 3 the working capital investment would be recovered and the equipment would be sold for SR 5,000. Project C would involve a current outlay of RM50,000 on equipment and SR 15,000 on working capital. The investment in working capital would be increased to SR 21,000 at the end of the first year. Annual cash profits would be SR 18,000 per annum for five years, at the end of which the investment in working capital would be recovered. Project D is a long-term project involving an immediate outlay of SR 32,000 and annual cash profits of SR 4,500 per annum in perpetuity. Project E is another long-term project, involving an immediate outlay of SR 20,000 and annual cash profits as follows: Year You are required to; 1-5 6-10 11 in perpetuity SR 5,000 4,000 3,000 The company discounts all projects of ten years' duration or less at a cost of capital of 12%, and all longer projects at a cost of 15%. (a) Calculate the NPV of each project (b) determine which project should be undertaken by the company. (c) Calculate The Payback period for each project. (d) Determine which project should be undertaken by the company based on payback rule.

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of NPV for each project Project A NPV 29000 8000112 120001122 100001123 60001124 50001...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started