Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C Pte Ltd (CPL) is a company incorporated and resident in Singapore. It has two wholly- owned subsidiaries - D Pte Ltd (DPL) in

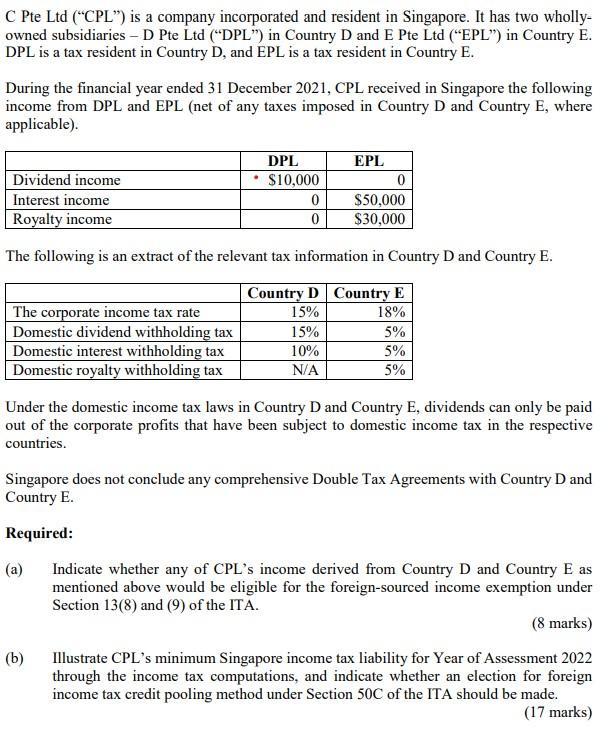

C Pte Ltd ("CPL") is a company incorporated and resident in Singapore. It has two wholly- owned subsidiaries - D Pte Ltd ("DPL") in Country D and E Pte Ltd ("EPL") in Country E. DPL is a tax resident in Country D, and EPL is a tax resident in Country E. During the financial year ended 31 December 2021, CPL received in Singapore the following income from DPL and EPL (net of any taxes imposed in Country D and Country E, where applicable). Dividend income Interest income Royalty income The corporate income tax rate Domestic dividend withholding tax Domestic interest withholding tax Domestic royalty withholding tax . DPL $10,000 0 0 (b) The following is an extract of the relevant tax information in Country D and Country E. Country D Country E 15% 18% EPL 15% 10% N/A 0 $50,000 $30,000 5% 5% 5% Under the domestic income tax laws in Country D and Country E, dividends can only be paid out of the corporate profits that have been subject to domestic income tax in the respective countries. Singapore does not conclude any comprehensive Double Tax Agreements with Country D and Country E. Required: (a) Indicate whether any of CPL's income derived from Country D and Country E as mentioned above would be eligible for the foreign-sourced income exemption under Section 13(8) and (9) of the ITA. (8 marks) Illustrate CPL's minimum Singapore income tax liability for Year of Assessment 2022 through the income tax computations, and indicate whether an election for foreign income tax credit pooling method under Section 50C of the ITA should be made. (17 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The income derived from DPL would not be eligible for the foreignsourced income exemption under Se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started