Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The management of Rajpur Garments and Textiles Limited, a closely-held company, was reviewing the first-ever unfavourable financial performance of the company. In its recently

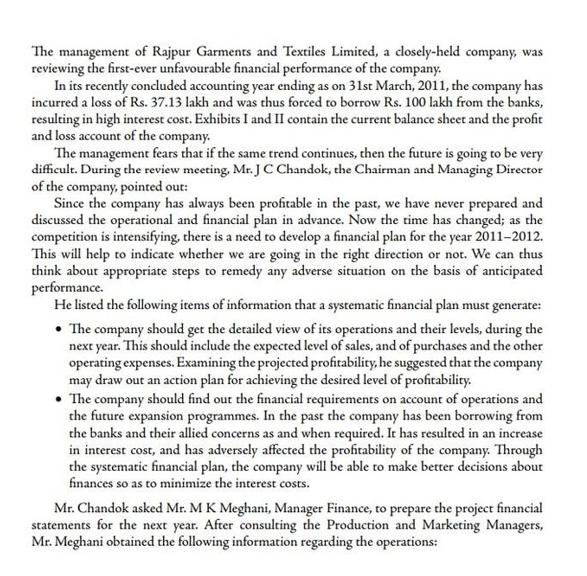

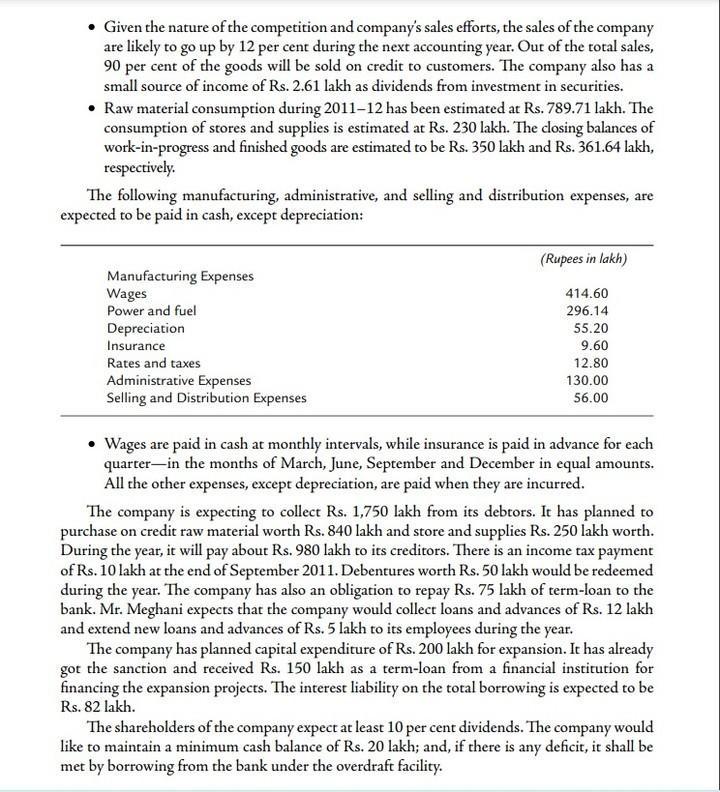

The management of Rajpur Garments and Textiles Limited, a closely-held company, was reviewing the first-ever unfavourable financial performance of the company. In its recently concluded accounting year ending as on 31st March, 2011, the company has incurred a loss of Rs. 37.13 lakh and was thus forced to borrow Rs. 100 lakh from the banks, resulting in high interest cost. Exhibits I and II contain the current balance sheet and the profit and loss account of the company. The management fears that if the same trend continues, then the future is going to be very difficult. During the review meeting, Mr. JC Chandok, the Chairman and Managing Director of the company, pointed out: Since the company has always been profitable in the past, we have never prepared and discussed the operational and financial plan in advance. Now the time has changed; as the competition is intensifying, there is a need to develop a financial plan for the year 2011-2012. This will help to indicate whether we are going in the right direction or not. We can thus think about appropriate steps to remedy any adverse situation on the basis of anticipated performance. He listed the following items of information that a systematic financial plan must generate: The company should get the detailed view of its operations and their levels, during the next year. This should include the expected level of sales, and of purchases and the other operating expenses. Examining the projected profitability, he suggested that the company may draw out an action plan for achieving the desired level of profitability. The company should find out the financial requirements on account of operations and the future expansion programmes. In the past the company has been borrowing from the banks and their allied concerns as and when required. It has resulted in an increase in interest cost, and has adversely affected the profitability of the company. Through the systematic financial plan, the company will be able to make better decisions about finances so as to minimize the interest costs. Mr. Chandok asked Mr. M K Meghani, Manager Finance, to prepare the project financial statements for the next year. After consulting the Production and Marketing Managers, Mr. Meghani obtained the following information regarding the operations: Given the nature of the competition and company's sales efforts, the sales of the company are likely to go up by 12 per cent during the next accounting year. Out of the total sales, 90 per cent of the goods will be sold on credit to customers. The company also has a small source of income of Rs. 2.61 lakh as dividends from investment in securities. Raw material consumption during 2011-12 has been estimated at Rs. 789.71 lakh. The consumption of stores and supplies is estimated at Rs. 230 lakh. The closing balances of work-in-progress and finished goods are estimated to be Rs. 350 lakh and Rs. 361.64 lakh, respectively. The following manufacturing, administrative, and selling and distribution expenses, are expected to be paid in cash, except depreciation: Manufacturing Expenses Wages Power and fuel Depreciation Insurance Rates and taxes Administrative Expenses Selling and Distribution Expenses (Rupees in lakh) 414.60 296.14 55.20 9.60 12.80 130.00 56.00 Wages are paid in cash at monthly intervals, while insurance is paid in advance for each quarter in the months of March, June, September and December in equal amounts. All the other expenses, except depreciation, are paid when they are incurred. The company is expecting to collect Rs. 1,750 lakh from its debtors. It has planned to purchase on credit raw material worth Rs. 840 lakh and store and supplies Rs. 250 lakh worth. During the year, it will pay about Rs. 980 lakh to its creditors. There is an income tax payment of Rs. 10 lakh at the end of September 2011. Debentures worth Rs. 50 lakh would be redeemed during the year. The company has also an obligation to repay Rs. 75 lakh of term-loan to the bank. Mr. Meghani expects that the company would collect loans and advances of Rs. 12 lakh and extend new loans and advances of Rs. 5 lakh to its employees during the year. The company has planned capital expenditure of Rs. 200 lakh for expansion. It has already got the sanction and received Rs. 150 lakh as a term-loan from a financial institution for financing the expansion projects. The interest liability on the total borrowing is expected to be Rs. 82 lakh. The shareholders of the company expect at least 10 per cent dividends. The company would like to maintain a minimum cash balance of Rs. 20 lakh; and, if there is any deficit, it shall be met by borrowing from the bank under the overdraft facility. RAJPUR GARMENTS AND TEXTILES LIMITED 5 DISCUSSION QUESTIONS 1. Prepare pro-forma profit and loss account and balance sheet for the year 2011-12. 2. Discuss various adjustments that were required to arrive at pro-forma profit and loss account and balance sheet. Why were these adjustments necessary? 3. Determine the financial requirements for the year 2011-12 justifying your calculations. 4. Based on above statements what is your assessment of the financial strength of this company? Do you think bank will consider the request of the company to meet its financial requirements? Should the company review its requirements before approaching to the bank?

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Step 1 of 2 Balance Sheet of Rajpur Garments and Textile Limited for the year ended 2011 Rajpur Garments and Textile Limited Balance Sheet as o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started