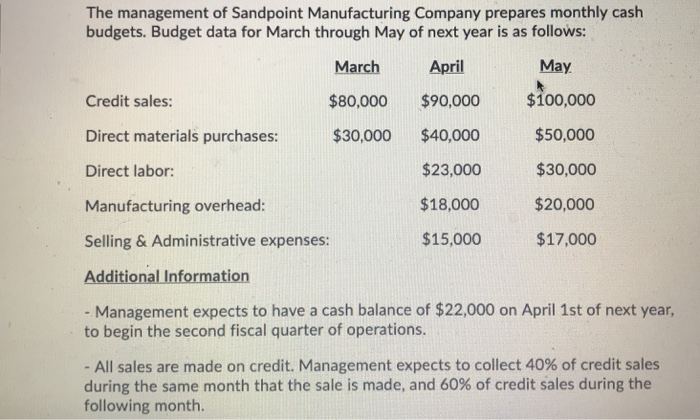

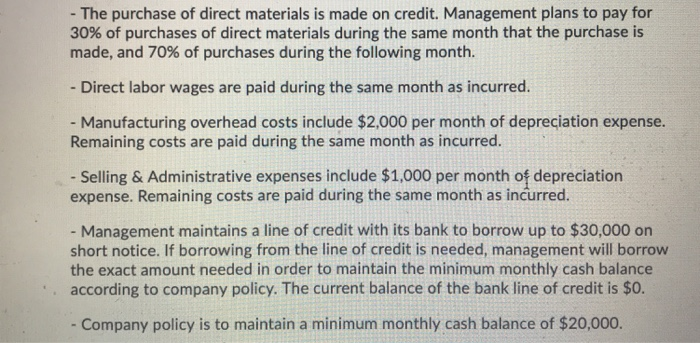

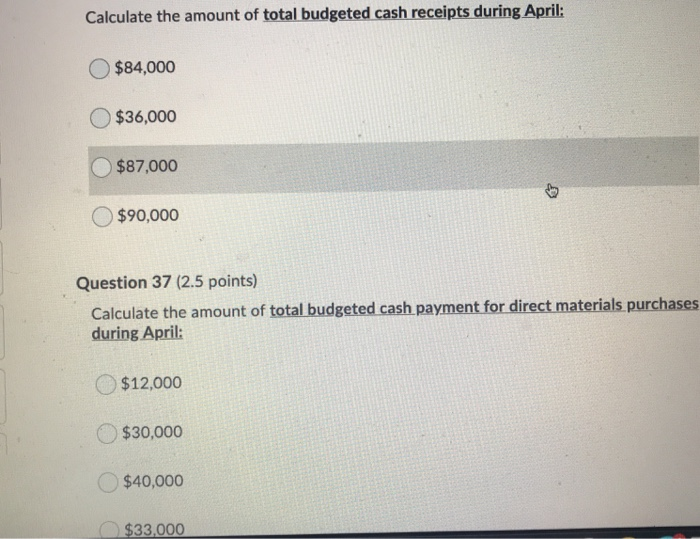

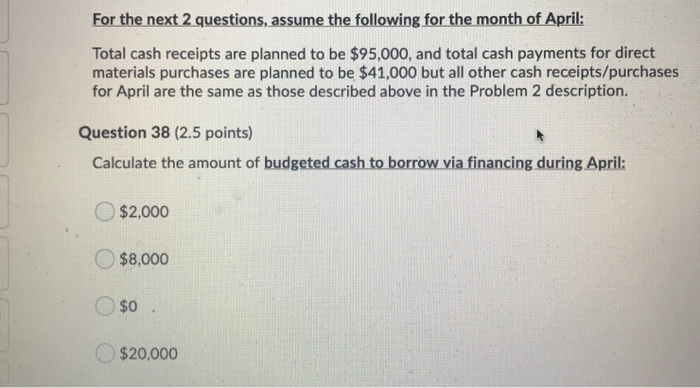

The management of Sandpoint Manufacturing Company prepares monthly cash budgets. Budget data for March through May of next year is as follows: March April May $100,000 Credit sales: $80,000 Direct materials purchases: $30,000 Direct labor: Manufacturing overhead: Selling & Administrative expenses: $90,000 $40,000 $23,000 $50,000 $30,000 $18,000 $20,000 $15,000 $17,000 Additional Information - Management expects to have a cash balance of $22,000 on April 1st of next year, to begin the second fiscal quarter of operations. - All sales are made on credit. Management expects to collect 40% of credit sales during the same month that the sale is made, and 60% of credit sales during the following month - The purchase of direct materials is made on credit. Management plans to pay for 30% of purchases of direct materials during the same month that the purchase is made, and 70% of purchases during the following month. - Direct labor wages are paid during the same month as incurred. - Manufacturing overhead costs include $2.000 per month of depreciation expense. Remaining costs are paid during the same month as incurred. - Selling & Administrative expenses include $1,000 per month of depreciation expense. Remaining costs are paid during the same month as incurred. - Management maintains a line of credit with its bank to borrow up to $30,000 on short notice. If borrowing from the line of credit is needed, management will borrow the exact amount needed in order to maintain the minimum monthly cash balance according to company policy. The current balance of the bank line of credit is $0. - Company policy is to maintain a minimum monthly cash balance of $20,000. Calculate the amount of total budgeted cash receipts during April: $84,000 $36,000 $87,000 $90,000 Question 37 (2.5 points) Calculate the amount of total budgeted cash payment for direct materials purchases during April: $12,000 $30,000 $40,000 $33,000 For the next 2 questions, assume the following for the month of April: Total cash receipts are planned to be $95,000, and total cash payments for direct materials purchases are planned to be $41,000 but all other cash receipts/purchases for April are the same as those described above in the Problem 2 description. Question 38 (2.5 points) Calculate the amount of budgeted cash to borrow via financing during April: $2,000 $8,000 $0 $20,000 Calculate the budgeted ending cash balance on April 30th: $22,000 $20,000 $23,000 $25,000 Question 40 (2.5 points) Assuming a cash balance of $20,500 on April 30th, calculate the amount of budgeted cash to borrow via financing during May: $0 $20,000 $12,500 $9.500