Question

The management of Skysong Inc., a small private company that uses the cost recovery impairment model, was discussing whether certain equipment should be written down

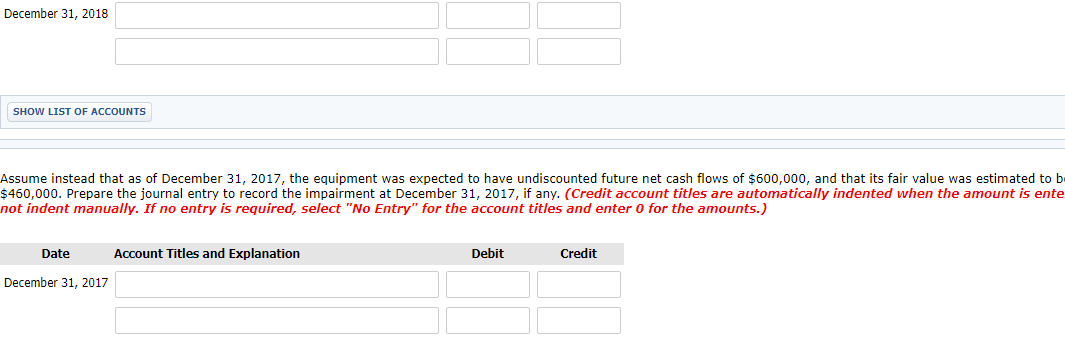

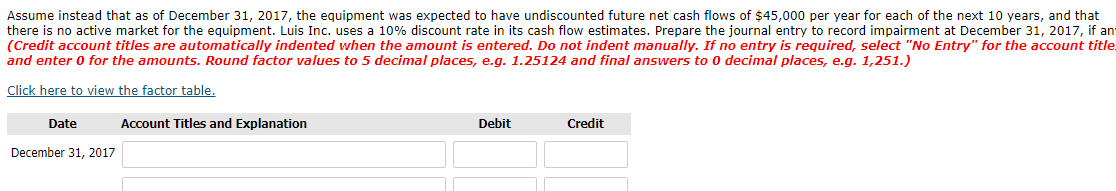

The management of Skysong Inc., a small private company that uses the cost recovery impairment model, was discussing whether certain equipment should be written down as a charge to current operations because of obsolescence. The assets had a cost of $900,000, and depreciation of $350,000 had been taken to December 31, 2017. On December 31, 2017, management projected the undiscounted future net cash flows from this equipment to be $340,000, and its fair value to be $200,000. The company intends to use this equipment in the future.

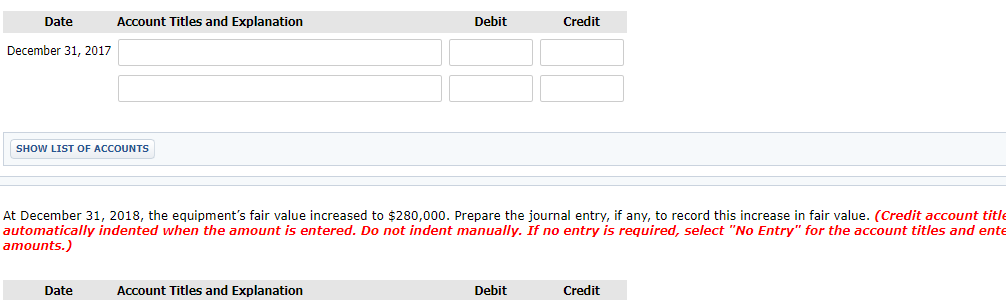

Prepare the journal entry, if any, to record the impairment at December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started