Answered step by step

Verified Expert Solution

Question

1 Approved Answer

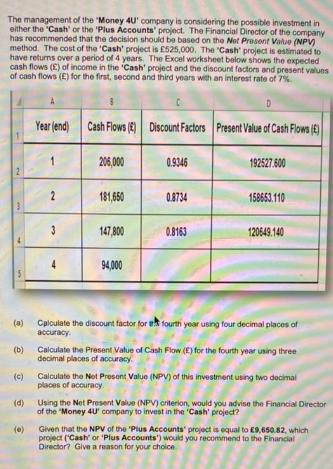

The management of the Money 4U' company is considering the possible investment in either the 'Cash' or the 'Plus Accounts' project. The Financial Director

The management of the "Money 4U' company is considering the possible investment in either the 'Cash' or the 'Plus Accounts' project. The Financial Director of the company has recommended that the decision should be based on the Net Present Value (NPV) method. The cost of the 'Cash' project is 525,000. The "Cash' project is estimated to have returns over a period of 4 years. The Excel worksheet below shows the expected cash flows (2) of income in the 'Cash' project and the discount factors and present values of cash flows (E) for the first, second and third years with an interest rate of 7% 5 Year (end) 2 3 4 Cash Flows (E) Discount Factors Present Value of Cash Flows (E) 206,000 181,650 147,800 94,000 0.9346 0.8734 0.8163 192527.600 158653.110 120649.140 Calculate the discount factor for a fourth year using four decimal places of accuracy. (a) (b) (c) (d) Using the Net Present Value (NPV) criterion, would you advise the Financial Director of the "Money 4U company to invest in the 'Cash' project? Calculate the Present Value of Cash Flow (E) for the fourth year using three decimal places of accuracy. Calculate the Not Present Value (NPV) of this investment using two decimal places of accuracy. (e) Given that the NPV of the "Plus Accounts' project is equal to 9,650.82, which project (Cash' or 'Plus Accounts') would you recommend to the Financial Director? Give a reason for your choice

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve each of these step by step a Calculate the discount factor for the fourth year The discount factor is typically calculated using the formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started