Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The manager of Arbor, inc. is considering raising its current price of $50 per unit by 10%. If she does so, she estimates that demand

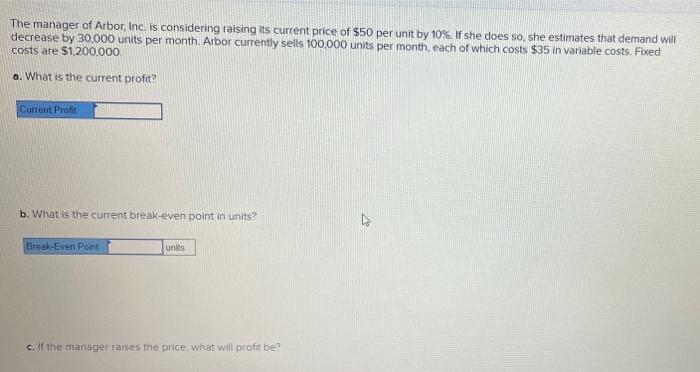

The manager of Arbor, inc. is considering raising its current price of $50 per unit by 10%. If she does so, she estimates that demand will decrease by 30,000 units per month. Arbor currently sells 100,000 units per month, each of which costs $35 in variable costs. Fixed costs are $1,200,000.

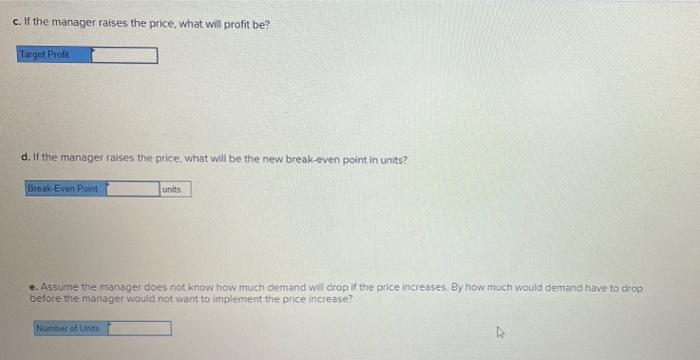

The manager of Arbor, Inc. is considering raising its current price of $50 per unit by 10%. If she does so, she estimates that demand will decrease by 30.000 units per month. Arbor currently sells 100,000 units per month, each of which costs $35 in variable costs. Fixed costs are $1,200,000. a. What is the current profit? Current Profit b. What is the current break-even point in units? Break-Even Point units c. If the manager raises the price, what will profit be? c. If the manager raises the price, what will profit be? Target Profit d. If the manager raises the price, what will be the new break-even point in units? Break-Even Point units e. Assume the manager does not know how much demand will drop if the price increases. By how much would demand have to drop before the manager would not want to implement the price increase? Number of Units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started