Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The manager of Pharmacorp needs to find a source of funding for a new drug testing facility. He is considering one of the following

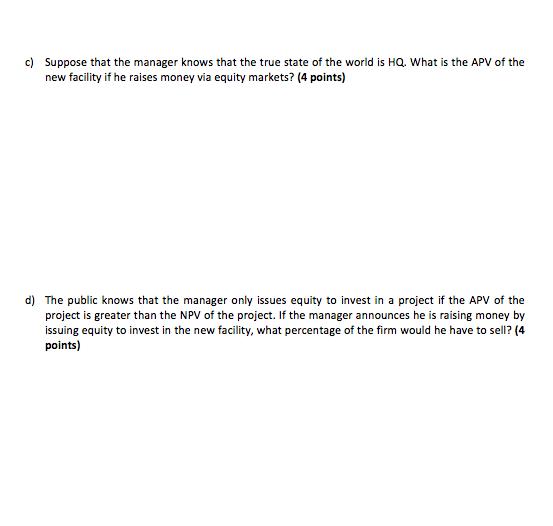

The manager of Pharmacorp needs to find a source of funding for a new drug testing facility. He is considering one of the following choices: (1) raise the cash via equity markets, or (2) raise the cash via debt markets. Assume that Pharmacorp is currently an all-equity firm. The public believes that Pharmacorp is either a low-quality (LQ) or high-quality (HQ) firm and assigns a 50 percent probability to each state. The manager is privately informed about the true state of the existing assets of Pharmacorp and the new facility. The public does not know this private information, but knows that the manager knows this private information. The numbers in the table below are public information. Probability Value of assets in place Value of new facility NPV of new facility Total value State LQ 50% $5,000M $2,000M $1,000M $7,000M State HQ 50% $9,000M $4,000M $3,000M $13,000M a) The new facility costs $1,000M. Absent signaling effects, if the manager raised this money via equity markets, what percentage of the firm would he have to sell? (4 points) b) Suppose that the manager knows that the true state of the world is LQ. What is the APV of the new facility if he raises money via equity markets? (Reminder: the value of mispricing equals the money you receive from the equity issuance minus the value of the portion of the firm given to the new equity investors in that state.) (4 points) c) Suppose that the manager knows that the true state of the world is HQ. What is the APV of the new facility if he raises money via equity markets? (4 points) d) The public knows that the manager only issues equity to invest in a project if the APV of the project is greater than the NPV of the project. If the manager announces he is raising money by issuing equity to invest in the new facility, what percentage of the firm would he have to sell? (4 points)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a If the manager raised the 1000M needed for the new facility via equity markets the percentage of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started