Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The manager of Rosfeld Fund Co. is evaluating three different bonds. Both the face value of bond A and B are $1000 and mature

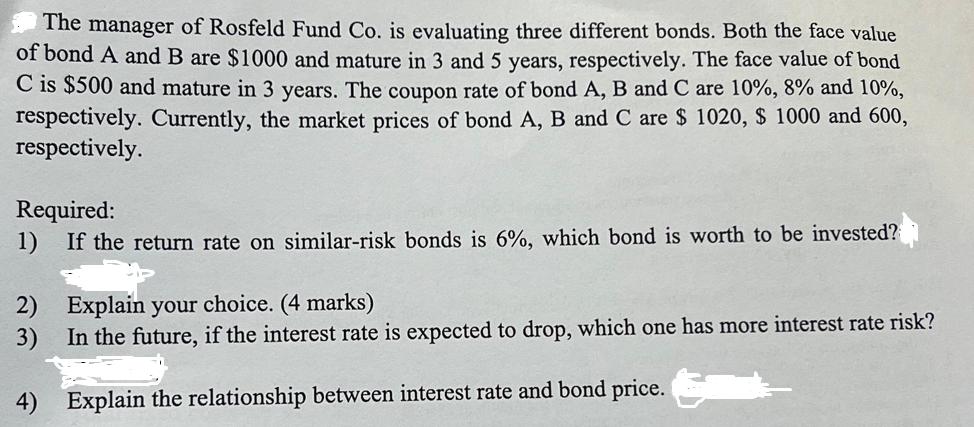

The manager of Rosfeld Fund Co. is evaluating three different bonds. Both the face value of bond A and B are $1000 and mature in 3 and 5 years, respectively. The face value of bond C is $500 and mature in 3 years. The coupon rate of bond A, B and C are 10%, 8% and 10%, respectively. Currently, the market prices of bond A, B and C are $ 1020, $ 1000 and 600, respectively. Required: 1) If the return rate on similar-risk bonds is 6%, which bond is worth to be invested? 2) Explain your choice. (4 marks) 3) In the future, if the interest rate is expected to drop, which one has more interest rate risk? 4) Explain the relationship between interest rate and bond price.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Bond C is worth investing 2 Bond C has the highest expected return Bond A Current price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started