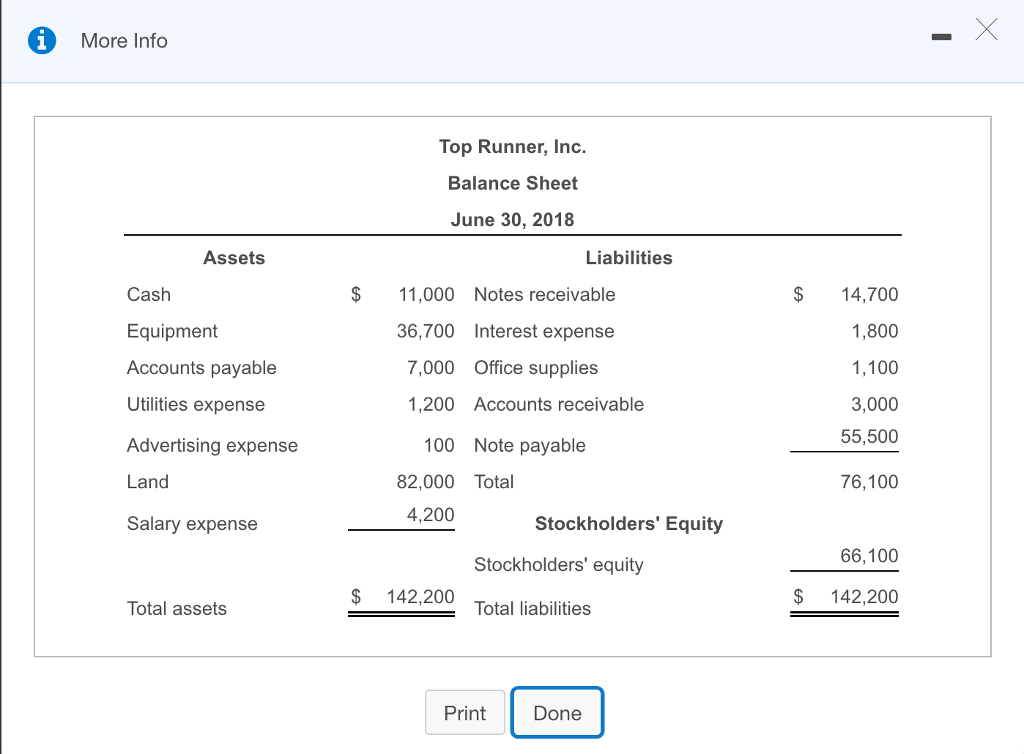

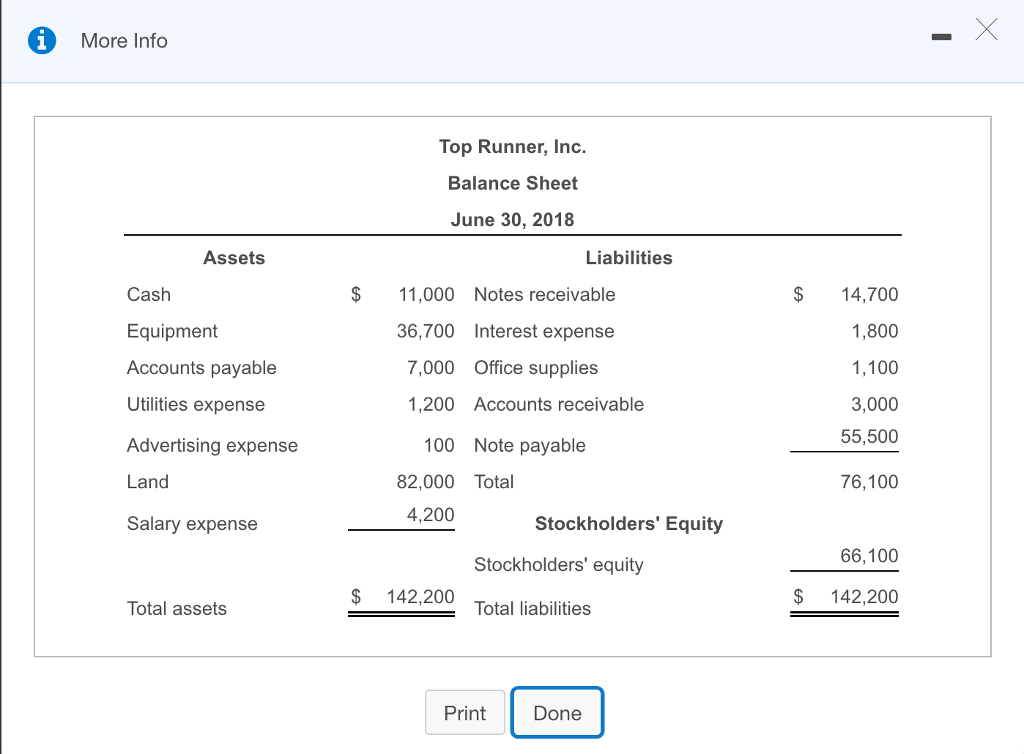

The manager of Top Runner, Inc., prepared the company's balance sheet as of June 30, 2018, while the company's accountant was ill. The balance sheet contains numerous errors. In particular, the manager knew that the balance sheet should balance, so she plugged in the stockholders' equity amount needed to achieve this balance. The stockholders' equity amount is not correct. All other amounts are accurate. (Click the icon to view the manager's balance sheet.) Read the requirements. Requirement 1. Prepare the correct balance sheet and date it properly. Compute total assets, total labilities, and stockholders' equity. (Do not classify the balance sheet into current and long-term sections. In the first part complete the assets section of the balance sheet. In the second part complete the liabilities and stockholders' equity section of the balance sheet. If a box is not used in the balance sheet, leave the box empty; do not select a label or enter a zero.) Assets Liabilities Total liabilities Total liabilities Stockholders' Equity Total assets Total liabilities and stockholders' equity Requirement 2. Is Top Runner actually in better (or worse) financial position than the erroneous balance sheet reports? Give the reason for your answe. Top Runner is in liabilities have Requirement 3. Identify the accounts listed on the incorrect balance sheet that should not be reported on the balance sheet. State why you excluded financial position because stockholders' equity has by $ by $ , and them from the correct balance sheet you prepared for Requirement 1. On which financial statement should these accounts appear? The accounts that are not on the balance sheet are: More Info Top Runner, Inc. Balance Sheet June 30, 2018 Assets Liabilities Cash Equipment Accounts payable Utilities expense Advertising expense Land Salary expense $11,000 Notes receivable $14,700 1,800 1,100 3,000 55,500 76,100 36,700 Interest expense 7,000 Office supplies 1,200 Accounts receivable 100 Note payable 82,000 Total 4,200 Stockholders' Equity 66,100 Stockholders' equity $ 142,200 $ 142,200 Total assets Total liabilities Print Done