Answered step by step

Verified Expert Solution

Question

1 Approved Answer

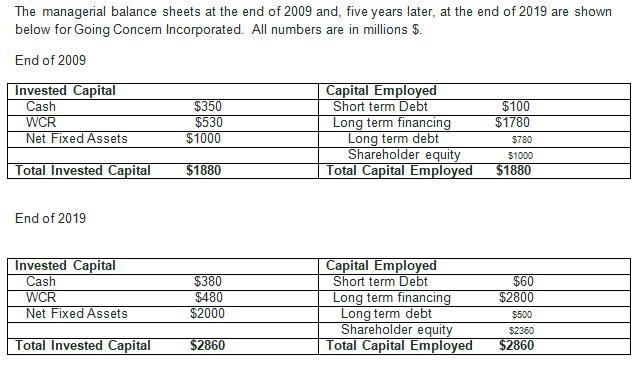

The managerial balance sheets at the end of 2009 and, five years later, at the end of 2019 are shown below for Going Concern

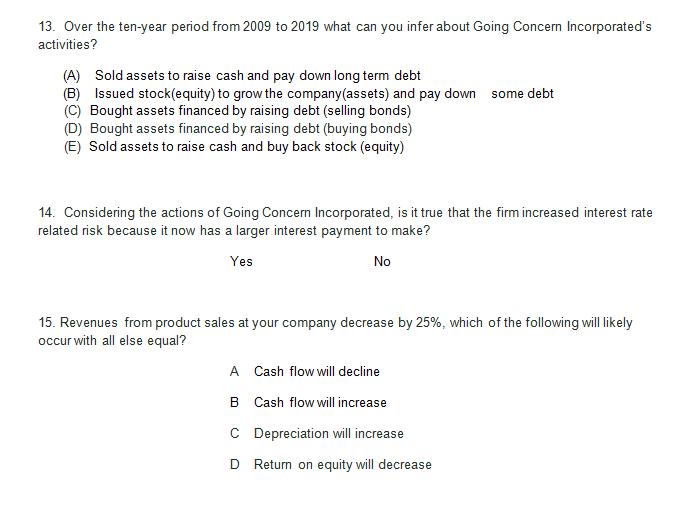

The managerial balance sheets at the end of 2009 and, five years later, at the end of 2019 are shown below for Going Concern Incorporated. All numbers are in millions $. End of 2009 Invested Capital Cash WCR Net Fixed Assets Total Invested Capital End of 2019 Invested Capital Cash WCR Net Fixed Assets Total Invested Capital $350 $530 $1000 $1880 $380 $480 $2000 $2860 Capital Employed Short term Debt Long term financing Long term debt Shareholder equity Total Capital Employed Capital Employed Short term Debt Long term financing Long term debt Shareholder equity Total Capital Employed $100 $1780 $780 $1000 $1880 $60 $2800 $500 $2360 $2860 13. Over the ten-year period from 2009 to 2019 what can you infer about Going Concern Incorporated's activities? (A) Sold assets to raise cash and pay down long term debt (B) Issued stock(equity) to grow the company(assets) and pay down some debt (C) Bought assets financed by raising debt (selling bonds) (D) Bought assets financed by raising debt (buying bonds) (E) Sold assets to raise cash and buy back stock (equity) 14. Considering the actions of Going Concern Incorporated, is it true that the firm increased interest rate related risk because it now has a larger interest payment to make? Yes No 15. Revenues from product sales at your company decrease by 25%, which of the following will likely occur with all else equal? A Cash flow will decline B Cash flow will increase C Depreciation will increase D Return on equity will decrease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided we can infer that Going Concern Incorporateds activities over the tenyear period from 2009 to 2019 were primarily fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started