Question

The managers of Cherry Bank ask for a performance/risk analysis, and ask you to answer the following questions. A. What is the banks 1-year income

The managers of Cherry Bank ask for a performance/risk analysis, and ask you

to answer the following questions.

A. What is the banks 1-year income (funding) gap (Rate Sensitive Assets (RSA) for 1 year

Rate Sensitive Liabilities (RSL) for 1 year? Funding Gap ____________

B. Given this funding gap if rates go up by 1%, what is the expected change in the banks

NII $? [Hint: Change NII $ = Funding Gap x Change Rate]

Expected Change in NII _______________

C. What is the Banks Duration gap (D-Gap)?

D-GAP = Duration of Assets {[Total Liabs./Total Assets] x Duration Liabs.}

Hint: Duration of Assets = Sum {[Each type of asset / Total Assets] x its Duration}

Duration of Liabilities = Sum {[Each type of Liability / Total Liabs.] x its Duration}

Duration of Assets __________

Duration of Liabilities ______________ Duration Gap _____________

D. What is the expected % change in the value of equity with a rise in rates of 1%?

Expected Change in Value of Equity = - D-GAP x {[(Chg rate / (1+ Ave loan rate)]

***(Use 5% as the average loan rate).

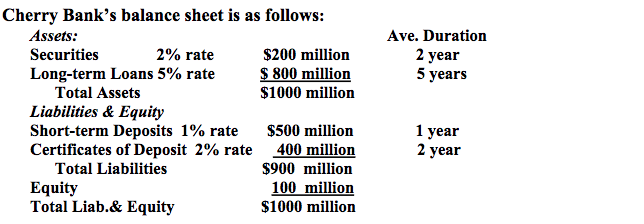

Ave. Duration 2 year 5 years Cherry Bank's balance sheet is as follows: Assets: Securities 2% rate $200 million Long-term Loans 5% rate $ 800 million Total Assets $1000 million Liabilities & Equity Short-term Deposits 1% rate $500 million Certificates of Deposit 2% rate 400 million Total Liabilities $900 million Equity 100 million Total Liab.& Equity $1000 million 1 year 2 year Ave. Duration 2 year 5 years Cherry Bank's balance sheet is as follows: Assets: Securities 2% rate $200 million Long-term Loans 5% rate $ 800 million Total Assets $1000 million Liabilities & Equity Short-term Deposits 1% rate $500 million Certificates of Deposit 2% rate 400 million Total Liabilities $900 million Equity 100 million Total Liab.& Equity $1000 million 1 year 2 year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started