Answered step by step

Verified Expert Solution

Question

1 Approved Answer

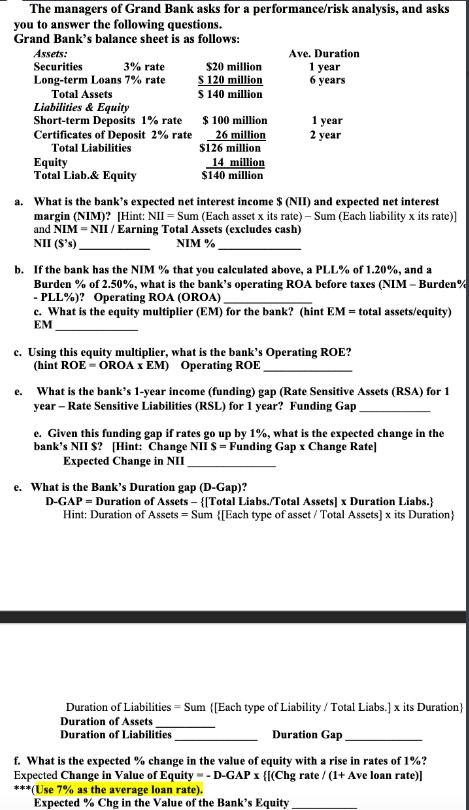

The managers of Grand Bank asks for a performance/risk analysis, and asks you to answer the following questions. Grand Bank's balance sheet is as

The managers of Grand Bank asks for a performance/risk analysis, and asks you to answer the following questions. Grand Bank's balance sheet is as follows: Assets: Securities 3% rate Long-term Loans 7% rate Total Assets Liabilities & Equity Short-term Deposits 1% rate Certificates of Deposit 2% rate Total Liabilities e. Equity Total Liab.& Equity $20 million $ 120 million S 140 million $ 100 million 26 million $126 million 14 million $140 million Ave. Duration 1 year 6 years 1 year 2 year a. What is the bank's expected net interest income $ (NII) and expected net interest margin (NIM)? [Hint: NII = Sum (Each asset x its rate) - Sum (Each liability x its rate)] and NIM = NII / Earning Total Assets (excludes cash) NII (S's) NIM % b. If the bank has the NIM % that you calculated above, a PLL% of 1.20%, and a Burden % of 2.50%, what is the bank's operating ROA before taxes (NIM- Burden% - PLL%)? Operating ROA (OROA) c. What is the equity multiplier (EM) for the bank? (hint EM= total assets/equity) EM c. Using this equity multiplier, what is the bank's Operating ROE? (hint ROE = OROA x EM) Operating ROE What is the bank's 1-year income (funding) gap (Rate Sensitive Assets (RSA) for 1 year-Rate Sensitive Liabilities (RSL) for 1 year? Funding Gap e. Given this funding gap if rates go up by 1%, what is the expected change in the bank's NII S? [Hint: Change NII S-Funding Gap x Change Rate] Expected Change in NII e. What is the Bank's Duration gap (D-Gap)? D-GAP = Duration of Assets - {[Total Liabs./Total Assets] x Duration Liabs.} Hint: Duration of Assets = Sum {[Each type of asset/Total Assets] x its Duration} Duration of Liabilities - Sum ([Each type of Liability/Total Liabs.] x its Duration) Duration of Assets Duration of Liabilities Duration Gap f. What is the expected % change in the value of equity with a rise in rates of 1%? Expected Change in Value of Equity--D-GAP x {[(Chg rate / (1+ Ave loan rate)] *** (Use 7% as the average loan rate). Expected % Chg in the Value of the Bank's Equity

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a The banks expected net interest income NII can be calculated as follows NII 003 x 20 million 007 x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started