Answered step by step

Verified Expert Solution

Question

1 Approved Answer

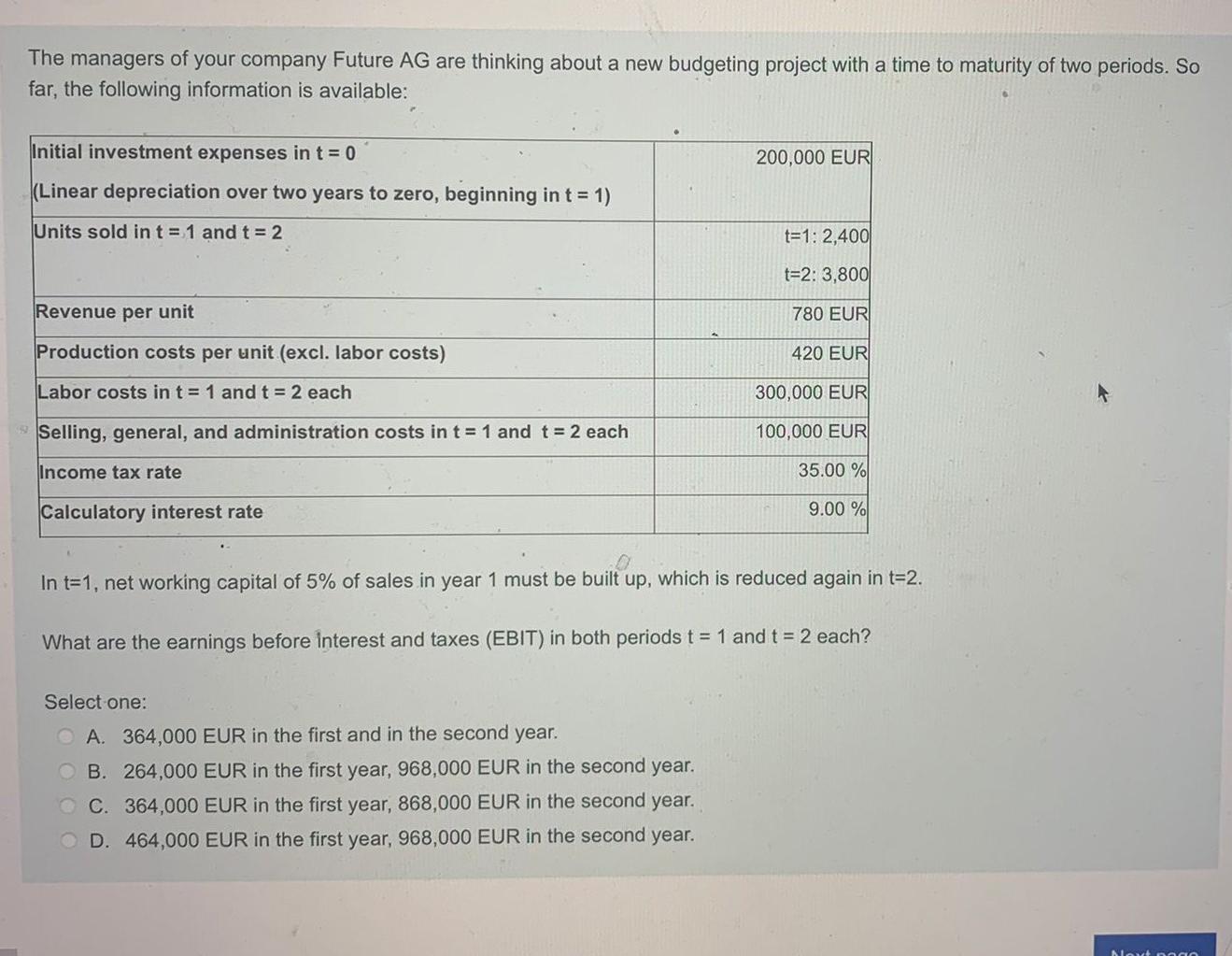

The managers of your company Future AG are thinking about a new budgeting project with a time to maturity of two periods. So far,

The managers of your company Future AG are thinking about a new budgeting project with a time to maturity of two periods. So far, the following information is available: Initial investment expenses in t = 0 200,000 EUR (Linear depreciation over two years to zero, beginning in t = 1) Units sold in t = 1 and t = 2 t=1: 2,400 t=2: 3,800 Revenue per unit 780 EUR Production costs per unit (excl. labor costs) 420 EUR Labor costs in t = 1 and t = 2 each 300,000 EUR Selling, general, and administration costs in t = 1 and t = 2 each 100,000 EUR Income tax rate 35.00 % Calculatory interest rate 9.00 % 0 In t=1, net working capital of 5% of sales in year 1 must be built up, which is reduced again in t=2. What are the earnings before interest and taxes (EBIT) in both periods t = 1 and t = 2 each? Select one: OA. 364,000 EUR in the first and in the second year. B. 264,000 EUR in the first year, 968,000 EUR in the second year. C. 364,000 EUR in the first year, 868,000 EUR in the second year. OD. 464,000 EUR in the first year, 968,000 EUR in the second year. Next pago

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

B E First Year Second Year 2400 1872000 3800 2964000 1008000 1596000 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started