Question

The managing director of a family-owned business, Cando Franchise Ltd, believes that the business could earn an additional $800,000 in profit before interest and taxes

The managing director of a family-owned business, Cando Franchise Ltd, believes that the business could earn an additional $800,000 in profit before interest and taxes each year by expanding its range of products. However, the business needs an extra $4 million for growth and this amount cannot be raised by the family. The managing director wishes to retain family control of the firm, but with no choice, he has to consider issuing securities to outsiders. He is considering three alternative financing plans.

• Plan A is to borrow at 11% over five years.

• Plan B is to issue 100,000 ordinary shares at $40 each.

• Plan C is to issue 40,000 non-voting preference shares at $100 each, with each share entitled to an annual preference dividend of $8.80.

Cando Franchise Ltd has 500,000 ordinary shares issued. All three plans will raise the required amount, $4 million. * The income tax rate is 30%.

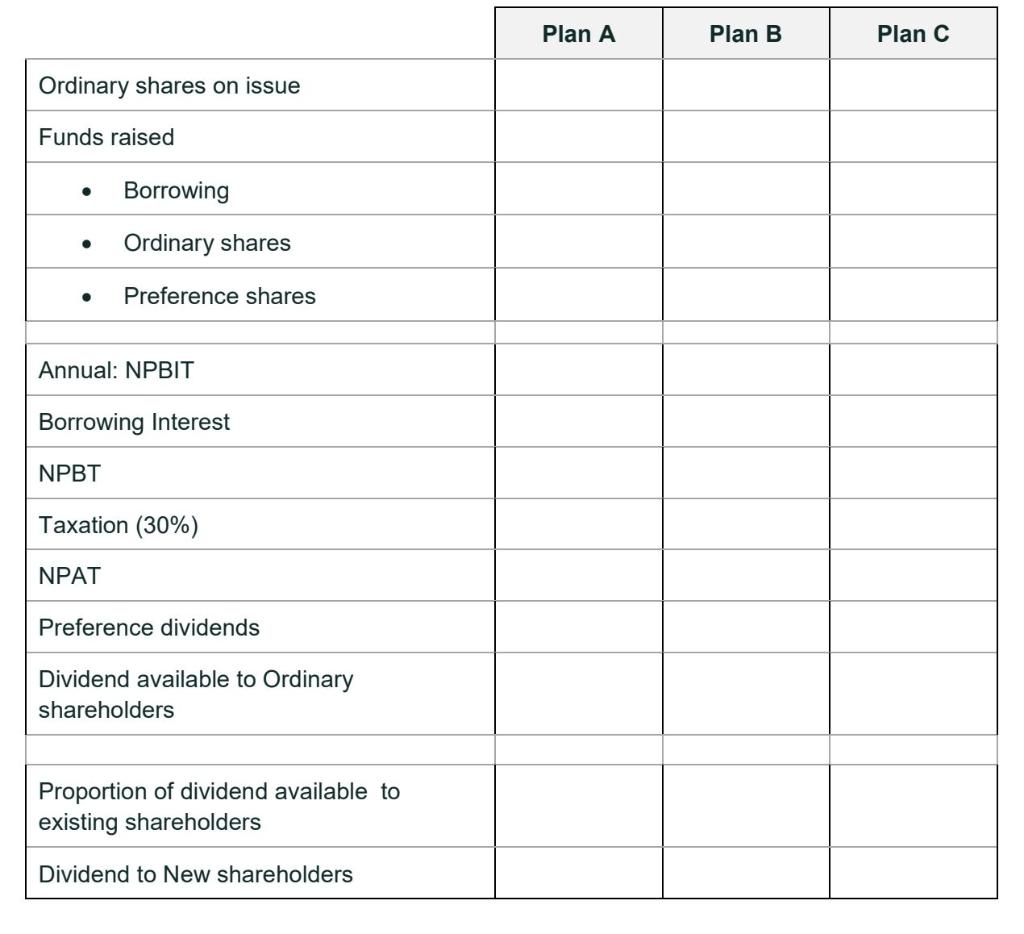

a) As the financial manager of Cando Franchise Ltd, you have been asked to prepare an analysis of the three alternatives for the board members to consider using the following format:

b) As a financial manager, you are also expected to give your comments on the above three alternatives.

Ordinary shares on issue Funds raised Borrowing Ordinary shares Preference shares Annual: NPBIT Borrowing Interest NPBT Taxation (30%) NPAT Preference dividends Dividend available to Ordinary shareholders Proportion of dividend available to existing shareholders Dividend to New shareholders Plan A Plan B Plan C

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started