Question

The Managing Director of Wraymand plc has asked you to prepare the statement of comprehensive income for the group. The company has one subsidiary undertaking,

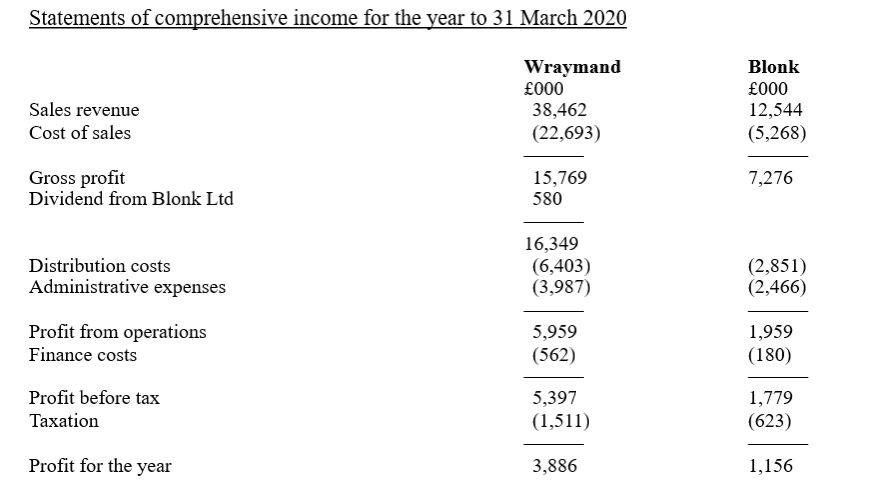

The Managing Director of Wraymand plc has asked you to prepare the statement of comprehensive income for the group. The company has one subsidiary undertaking, Blonk Ltd. The statements of comprehensive income of the two companies for the year ended 31 March 2020 are set out below.Further information:(i) Wraymand plc acquired 75% of the ordinary share capital of Blonk Ltd on 1 April 2019.(ii) During the year, Blonk Ltd sold goods which had cost 1,100,000 to Wraymand plc for 1,600,000. All of the goods had been sold by Wraymand plc by the end of the year

.

Taking in consideration the income statement of companies Wraymand and Blonk, the amount of "sales revenue" at the Consolidated statement of comprehensive income for the year to 31 March 2020 is:

Taking in consideration the income statement of companies Wraymand and Blonk, the amount of "cost of sales" at the Consolidated statement of comprehensive income for the year to 31 March 2020 is:

Taking in consideration the income statement of companies Wraymand and Blonk, the amount of profit attributable to the non-controlling interest at the Consolidated statement of comprehensive income for the year to 31 March 2020 is:

Taking in consideration the income statement of companies Wraymand and Blonk, the amount of profit attributable to the group at the Consolidated statement of comprehensive income for the year to 31 March 2020 is:

Statements of comprehensive income for the year to 31 March 2020 Sales revenue Cost of sales Wraymand 000 38,462 (22,693) Blonk 000 12,544 (5,268) Gross profit Dividend from Blonk Ltd 15,769 580 7,276 Distribution costs Administrative expenses 16,349 (6,403) (3,987) (2,851) (2,466) Profit from operations Finance costs 5,959 (562) 1,959 (180) Profit before tax Taxation 5,397 (1,511) 1,779 (623) Profit for the year 3,886 1,156

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started