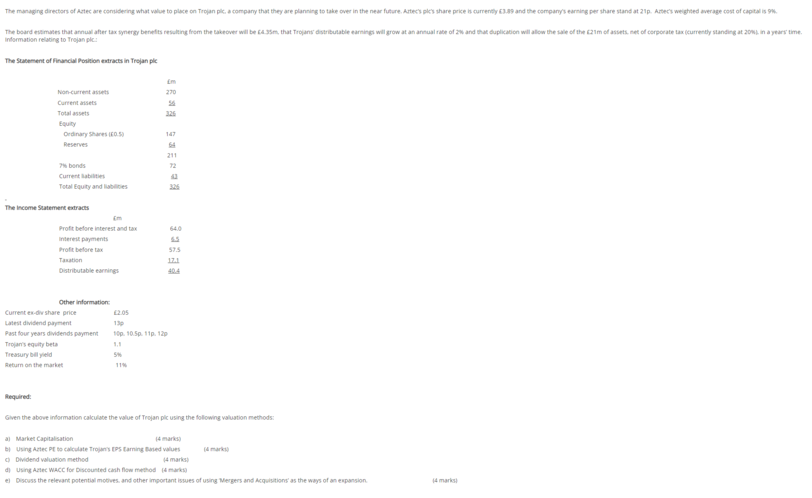

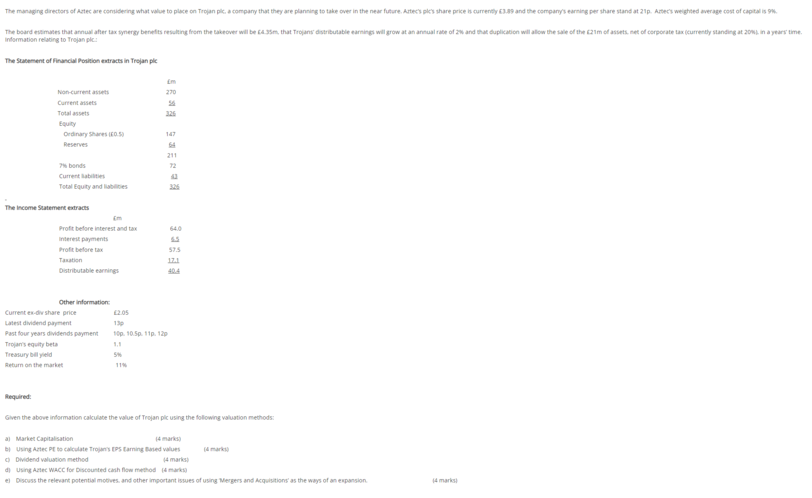

The managing directors of Aztec are considering what value to place on Trojan pic. a company that they are planning to take over in the near future. Antec's ples share price is currently 3.89 and the company's earning per share stand at 2p. Astecs weighted average cost of capitals The board enmates that arnalater tax synergy bereits resulting from the takeover will be 235m, that Trojans darbutable earnings will grow at an annual rate of u and the duplication wil allow the state of the most set of corporate tax (currently standing at 2001, in a years time, Information or to Trap The Statement of Financial Position tracts in Trojan 270 326 Non-current assets Current assets Total assets Equity Ordinary Shares Reserves 211 7 bonds Current Total Equity and be The Income Statement extracts Profit before interest and tax Interest payments Profit before tax Tastin Distributable earnings 525 1721 404 Other information: Current ex-div share price 20 Latest dividend payment Past four years dividend payment Op. 10.5p. 11. 120 Trojan's equity beta Treasury belyield 5 Return on the market Required Given the above information calculate the value of Trojan ple using the following valuation methods: al Market Capitalisation Using Artec Pt to calculate Transparing tased values Dividend valuation method 14 mars d) Using Ate WACC for Discounted cash flow method marks Discuss the relevant potential motives and other important issues of using Mergers and Acquisitions as the ways of an expansion market The managing directors of Aztec are considering what value to place on Trojan pic. a company that they are planning to take over in the near future. Antec's ples share price is currently 3.89 and the company's earning per share stand at 2p. Astecs weighted average cost of capitals The board enmates that arnalater tax synergy bereits resulting from the takeover will be 235m, that Trojans darbutable earnings will grow at an annual rate of u and the duplication wil allow the state of the most set of corporate tax (currently standing at 2001, in a years time, Information or to Trap The Statement of Financial Position tracts in Trojan 270 326 Non-current assets Current assets Total assets Equity Ordinary Shares Reserves 211 7 bonds Current Total Equity and be The Income Statement extracts Profit before interest and tax Interest payments Profit before tax Tastin Distributable earnings 525 1721 404 Other information: Current ex-div share price 20 Latest dividend payment Past four years dividend payment Op. 10.5p. 11. 120 Trojan's equity beta Treasury belyield 5 Return on the market Required Given the above information calculate the value of Trojan ple using the following valuation methods: al Market Capitalisation Using Artec Pt to calculate Transparing tased values Dividend valuation method 14 mars d) Using Ate WACC for Discounted cash flow method marks Discuss the relevant potential motives and other important issues of using Mergers and Acquisitions as the ways of an expansion market