Answered step by step

Verified Expert Solution

Question

1 Approved Answer

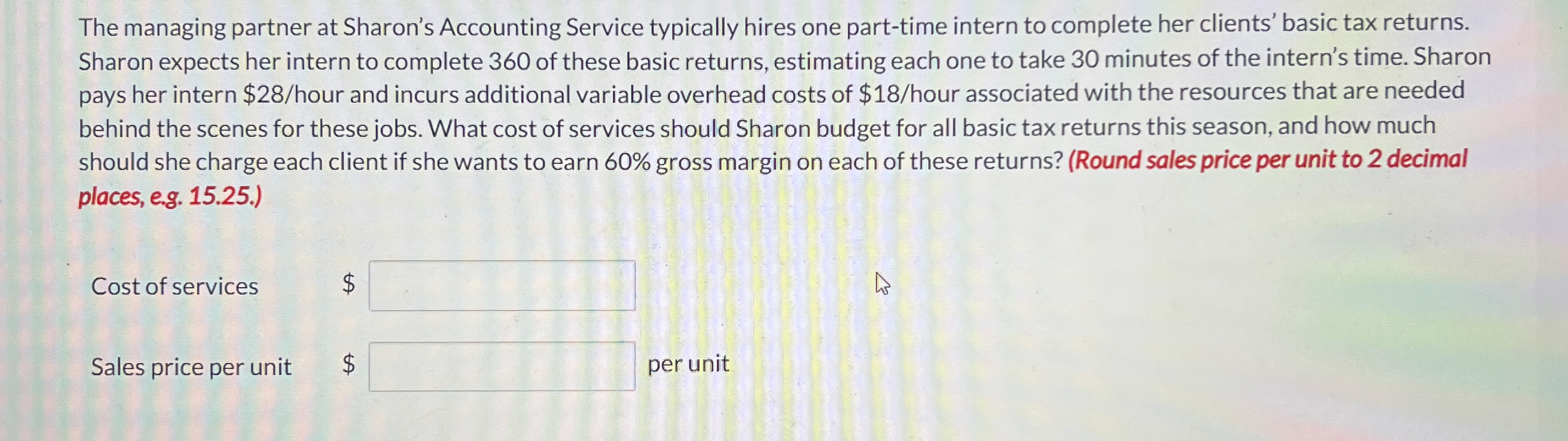

The managing partner at Sharon's Accounting Service typically hires one part - time intern to complete her clients' basic tax returns. Sharon expects her intern

The managing partner at Sharon's Accounting Service typically hires one parttime intern to complete her clients' basic tax returns.

Sharon expects her intern to complete of these basic returns, estimating each one to take minutes of the intern's time. Sharon

pays her intern $ hour and incurs additional variable overhead costs of $ hour associated with the resources that are needed

behind the scenes for these jobs. What cost of services should Sharon budget for all basic tax returns this season, and how much

should she charge each client if she wants to earn gross margin on each of these returns? Round sales price per unit to decimal

places, eg

Cost of services $

Sales price per unit

$

per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started