Answered step by step

Verified Expert Solution

Question

1 Approved Answer

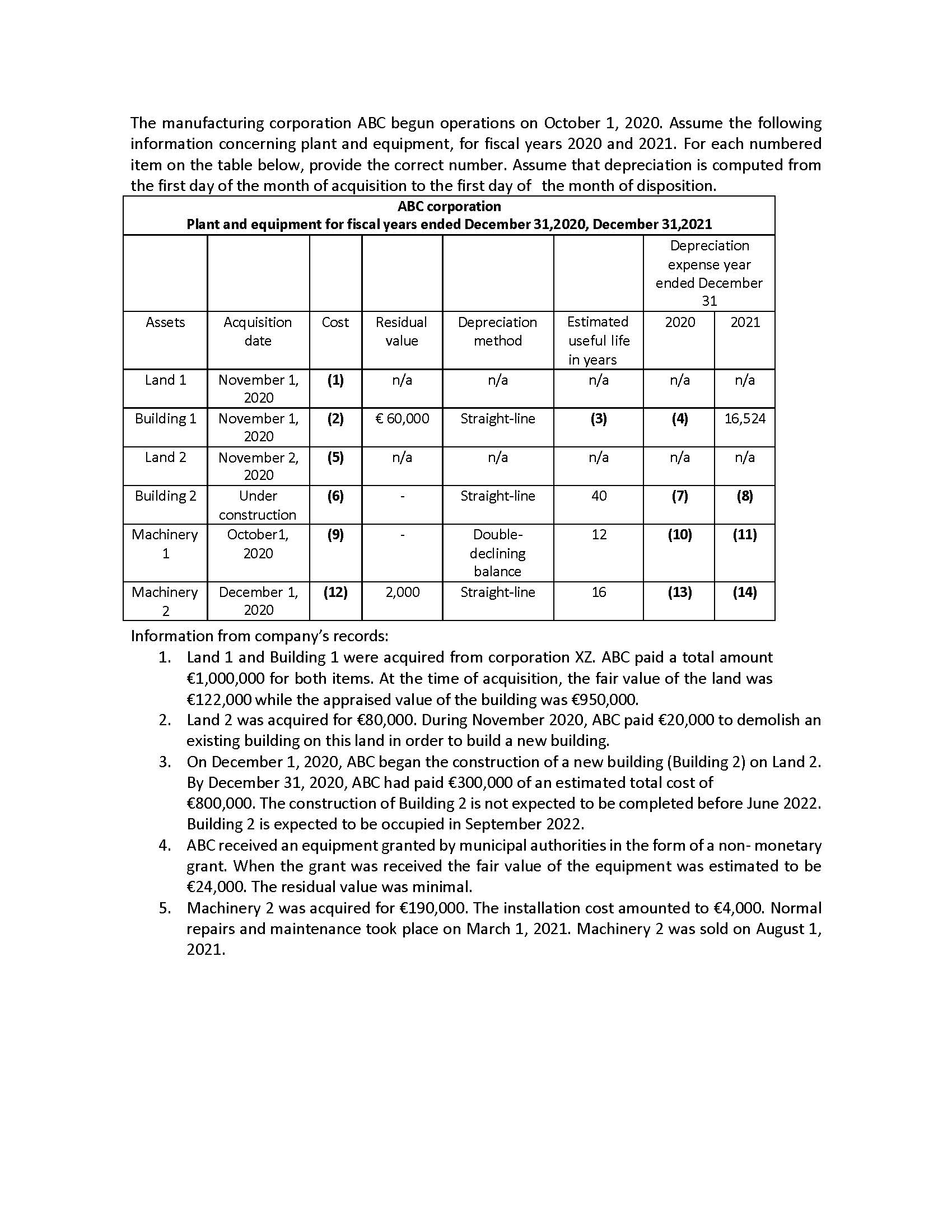

The manufacturing corporation ABC begun operations on October 1, 2020. Assume the following information concerning plant and equipment, for fiscal years 2020 and 2021.

The manufacturing corporation ABC begun operations on October 1, 2020. Assume the following information concerning plant and equipment, for fiscal years 2020 and 2021. For each numbered item on the table below, provide the correct number. Assume that depreciation is computed from the first day of the month of acquisition to the first day of the month of disposition. ABC corporation Plant and equipment for fiscal years ended December 31,2020, December 31,2021 Depreciation expense year ended December 31 Assets Acquisition Cost date Residual Depreciation value Estimated 2020 2021 method useful life in years Land 1 Building 1 Land 2 November 1, 2020 November 1, (2) 2020 November 2, (5) (1) n/a n/a n/a n/a n/a 60,000 Straight-line (3) (4) 16,524 n/a n/a n/a n/a n/a 2020 Building 2 Under (6) Straight-line 40 (7) (8) construction Machinery 1 Double- 12 (10) (11) declining balance 2,000 Straight-line 16 (13) (14) October 1, (9) 2020 Machinery December 1, (12) 2 2020 Information from company's records: 1. Land 1 and Building 1 were acquired from corporation XZ. ABC paid a total amount 1,000,000 for both items. At the time of acquisition, the fair value of the land was 122,000 while the appraised value of the building was 950,000. 2. Land 2 was acquired for 80,000. During November 2020, ABC paid 20,000 to demolish an existing building on this land in order to build a new building. 3. On December 1, 2020, ABC began the construction of a new building (Building 2) on Land 2. By December 31, 2020, ABC had paid 300,000 of an estimated total cost of 800,000. The construction of Building 2 is not expected to be completed before June 2022. Building 2 is expected to be occupied in September 2022. 4. ABC received an equipment granted by municipal authorities in the form of a non- monetary grant. When the grant was received the fair value of the equipment was estimated to be 24,000. The residual value was minimal. 5. Machinery 2 was acquired for 190,000. The installation cost amounted to 4,000. Normal repairs and maintenance took place on March 1, 2021. Machinery 2 was sold on August 1, 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started