Answered step by step

Verified Expert Solution

Question

1 Approved Answer

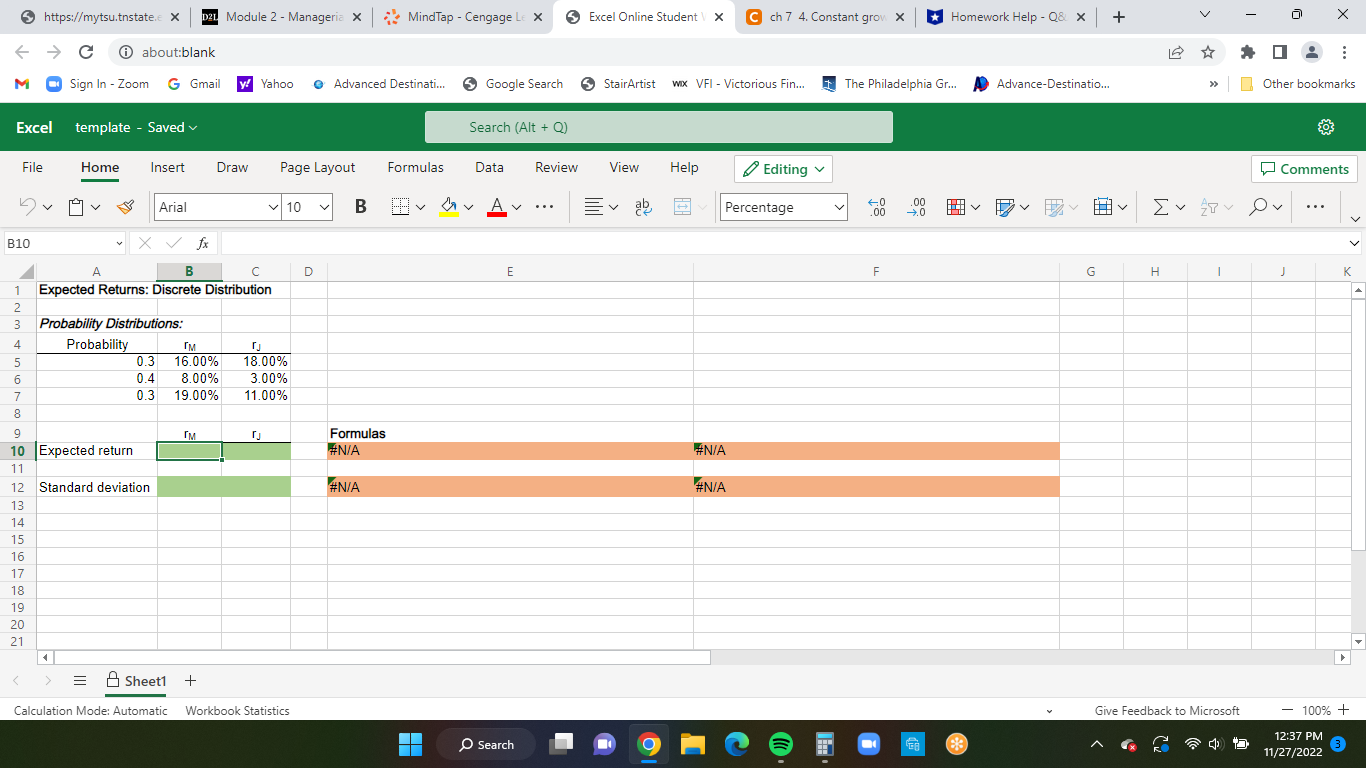

The market and Stock J have the following probability distributions: Probability r M r J 0.3 16.00 % 18.00 % 0.4 8.00 3.00 0.3 19.00

The market and Stock J have the following probability distributions:

| Probability | rM | rJ | ||

| 0.3 | 16.00 | % | 18.00 | % |

| 0.4 | 8.00 | 3.00 | ||

| 0.3 | 19.00 | 11.00 |

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

C about:blank M Excel template - Saved File https://mytsu.tnstate. X D21 Module 2 - Manageria X Dv B10 6 7 8 Sign In -Zoom G Gmail y! Yahoo Home Insert 4 B 1 Expected Returns: Discrete Distribution 2 3 Probability Distributions: 4 Probability 5 A Arial X fx 9 10 Expected return 11 12 Standard deviation 13 14 15 16 17 18 19 20 21 = 0.3 16.00% 0.4 8.00% 0.3 19.00% Draw Page Layout M 10 rj 18.00% 3.00% 11.00% rj Sheet1 + Calculation Mode: Automatic Workbook Statistics D Advanced Destinati... B Formulas #N/A MindTap - Cengage Le X #N/A Formulas Google Search Search (Alt + Q) Data E O Search Review ... Excel Online Student X StairArtist wix VFI - Victorious Fin... View Ev ab Help #N/A C ch 7 4. Constant grow X #N/A Editing The Philadelphia Gr... Percentage .0 .00 F .00 .0 Homework Help - Q8 + GER 3 Advance-Destinatio... G H I * TV Ov Give Feedback to Microsoft Other bookmarks x Comments J : 12:37 PM 11/27/2022 K - 100% +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 What is the expected return of the market rM To calculate the expected return of the market rM we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started