Answered step by step

Verified Expert Solution

Question

1 Approved Answer

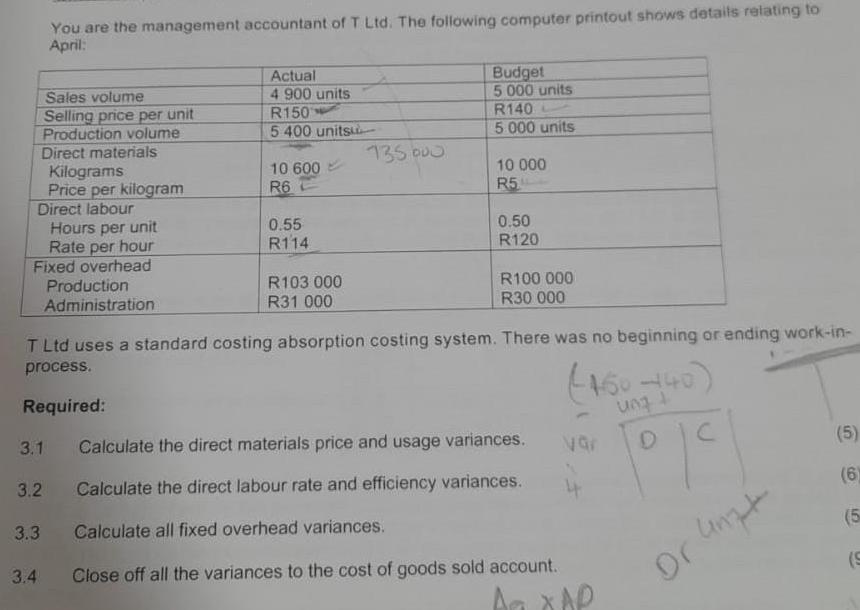

You are the management accountant of T Ltd. The following computer printout shows details relating to April: Sales volume Selling price per unit Production

You are the management accountant of T Ltd. The following computer printout shows details relating to April: Sales volume Selling price per unit Production volume Direct materials Kilograms Price per kilogram Direct labour Hours per unit Rate per hour Fixed overhead 3.1 3.2 3.3 3.4 Production Administration Actual 4 900 units R150 5 400 units 10 600 R6 0.55 R114 R103 000 R31 000 735000 Budget 5 000 units R140 5.000 units 10 000 R5 0.50 R120 T Ltd uses a standard costing absorption costing system. There was no beginning or ending work-in- process. Required: R100 000 R30 000 Calculate the direct materials price and usage variances. Calculate the direct labour rate and efficiency variances. Calculate all fixed overhead variances. (160-40) ung t D var Close off all the variances to the cost of goods sold account. Aa XAP C or anyt (5) (6) (5 (S

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

31 Direct materials price variance 10000 x 5 10600 x 55 500000 58500 441500 Direct materials usage v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started