Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Marmoset Company offers the service of transport consultations. Its accounting year ends on 31 December each year and it is currently preparing half-yearly

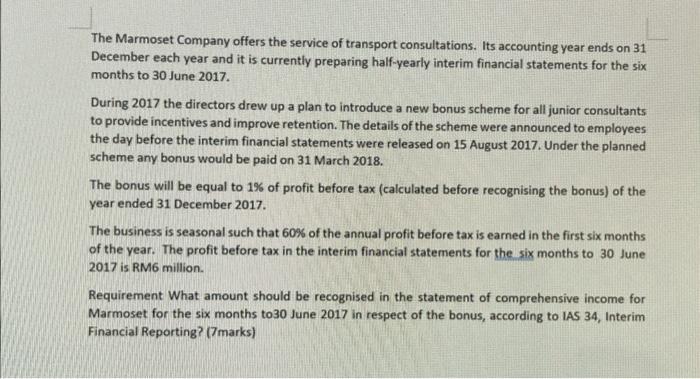

The Marmoset Company offers the service of transport consultations. Its accounting year ends on 31 December each year and it is currently preparing half-yearly interim financial statements for the six months to 30 June 2017. During 2017 the directors drew up a plan to introduce a new bonus scheme for all junior consultants to provide incentives and improve retention. The details of the scheme were announced to employees the day before the interim financial statements were released on 15 August 2017. Under the planned scheme any bonus would be paid on 31 March 2018. The bonus will be equal to 1% of profit before tax (calculated before recognising the bonus) of the year ended 31 December 2017. The business is seasonal such that 60% of the annual profit before tax is earned in the first six months of the year. The profit before tax in the interim financial statements for the six months to 30 June 2017 is RM6 million. Requirement What amount should be recognised in the statement of comprehensive income for Marmoset for the six months to30 June 2017 in respect of the bonus, according to IAS 34, Interim Financial Reporting? (7marks) 2006

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

According to IAS 34 Interim Financial Reporting bonuses are recognized as an expense in the interim ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started