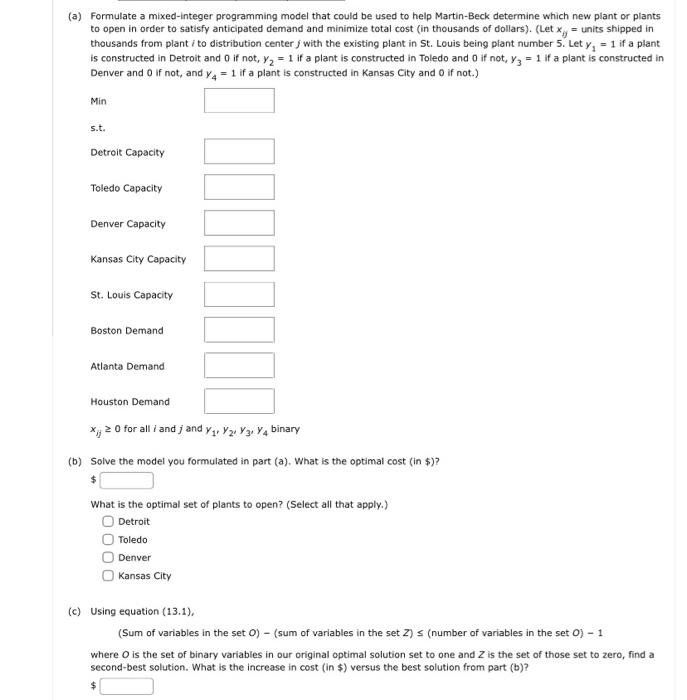

The Martin-Beck Company operates a plant in St. Louis with an annual capacity of 30,000 units. Product is shipped to regional distribution centers located in Boston, Atlanta, and Houston. Because of an anticipated increase in demand, Martin-Beck plans to increase capacity by constructing a new plant in one or more of the following cities: Detroit, Toledo, Denver, or Kansas City. The estimated annual fixed cost and the annual capacity for the four proposed plants are as follows: The company's long-range planning group developed forecasts of the anticipated annual demand at the distribution centers as follows. The shipping cost per unit from each plant to each distribution center is as follows. (a) Formulate a mixed-integer programming model that could be used to help Martin-Beck determine which new plant or plants to open in order to satisfy anticipated demand and minimize total cost (in thousands of dollars). (Let xij= units shipped in thousands from plant i to distribution center j with the existing plant in St. Louis being plant number 5 . Let y1=1 if a plant is constructed in Detroit and 0 if not, y2=1 if a plant is constructed in Toledo and 0 if not, y3=1 if a plant is constructed in Denver and 0 if not, and y4=1 if a plant is constructed in Kansas City and 0 if not.) xij0 for all i and j and y1,y2,y3,y4 binary (b) Solve the model you formulated in part (a). What is the optimal cost (in \$)? $ What is the optimal set of plants to open? (Select all that apply.) Detroit Toledo Denver Kansas City (c) Using equation (13.1) (Sum of variables in the set O) - (sum of variables in the set Z) (number of variables in the set O ) - 1 where O is the set of binary variables in our original optimal solution set to one and Z is the set of those set to zero, find a second-best solution. What is the increase in cost (in $ ) versus the best solution from part (b)? The Martin-Beck Company operates a plant in St. Louis with an annual capacity of 30,000 units. Product is shipped to regional distribution centers located in Boston, Atlanta, and Houston. Because of an anticipated increase in demand, Martin-Beck plans to increase capacity by constructing a new plant in one or more of the following cities: Detroit, Toledo, Denver, or Kansas City. The estimated annual fixed cost and the annual capacity for the four proposed plants are as follows: The company's long-range planning group developed forecasts of the anticipated annual demand at the distribution centers as follows. The shipping cost per unit from each plant to each distribution center is as follows. (a) Formulate a mixed-integer programming model that could be used to help Martin-Beck determine which new plant or plants to open in order to satisfy anticipated demand and minimize total cost (in thousands of dollars). (Let xij= units shipped in thousands from plant i to distribution center j with the existing plant in St. Louis being plant number 5 . Let y1=1 if a plant is constructed in Detroit and 0 if not, y2=1 if a plant is constructed in Toledo and 0 if not, y3=1 if a plant is constructed in Denver and 0 if not, and y4=1 if a plant is constructed in Kansas City and 0 if not.) xij0 for all i and j and y1,y2,y3,y4 binary (b) Solve the model you formulated in part (a). What is the optimal cost (in \$)? $ What is the optimal set of plants to open? (Select all that apply.) Detroit Toledo Denver Kansas City (c) Using equation (13.1) (Sum of variables in the set O) - (sum of variables in the set Z) (number of variables in the set O ) - 1 where O is the set of binary variables in our original optimal solution set to one and Z is the set of those set to zero, find a second-best solution. What is the increase in cost (in $ ) versus the best solution from part (b)