Answered step by step

Verified Expert Solution

Question

1 Approved Answer

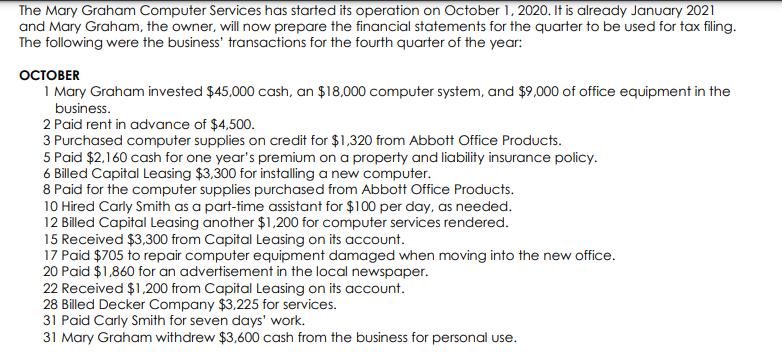

The Mary Graham Computer Services has started its operation on October 1, 2020. It is already January 2021 and Mary Graham, the owner, will

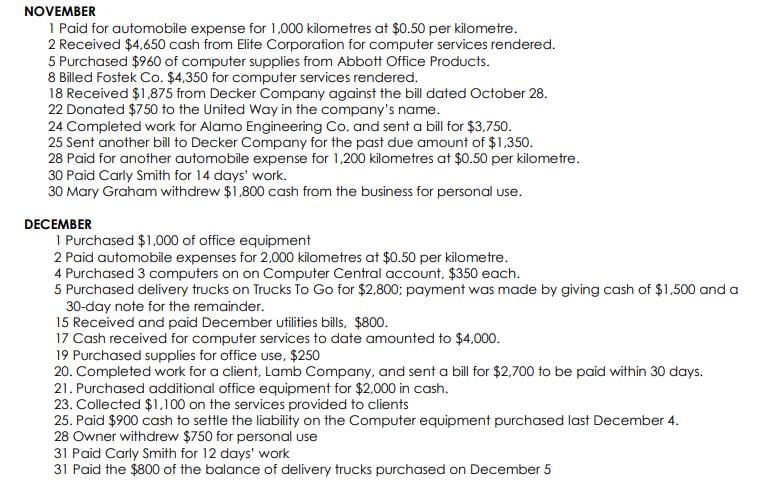

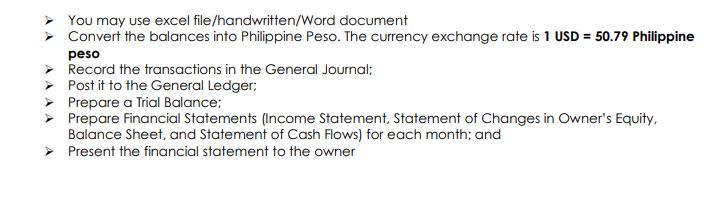

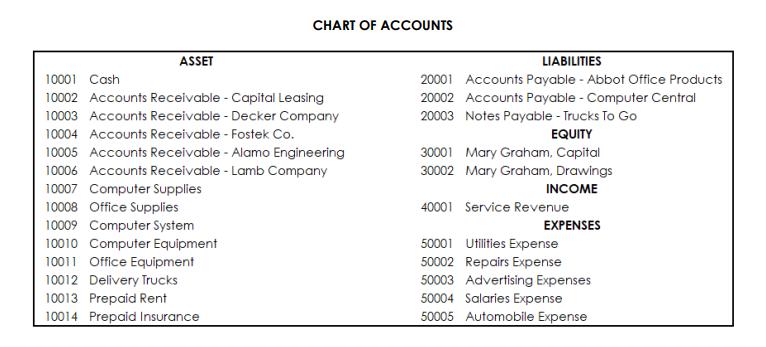

The Mary Graham Computer Services has started its operation on October 1, 2020. It is already January 2021 and Mary Graham, the owner, will now prepare the financial statements for the quarter to be used for tax filing. The following were the business' transactions for the fourth quarter of the year: OCTOBER 1 Mary Graham invested $45,000 cash, an $18,000 computer system, and $9,000 of office equipment in the business. 2 Paid rent in advance of $4,500. 3 Purchased computer supplies on credit for $1,320 from Abbott Office Products. 5 Paid $2,160 cash for one year's premium on a property and liability insurance policy. 6 Billed Capital Leasing $3,300 for installing a new computer. 8 Paid for the computer supplies purchased from Abbott Office Products. 10 Hired Carly Smith as a part-time assistant for $100 per day, as needed. 12 Billed Capital Leasing another $1,200 for computer services rendered. 15 Received $3,300 from Capital Leasing on its account. 17 Paid $705 to repair computer equipment damaged when moving into the new office. 20 Paid $1,860 for an advertisement in the local newspaper. 22 Received $1,200 from Capital Leasing on its account. 28 Billed Decker Company $3,225 for services. 31 Paid Carly Smith for seven days' work. 31 Mary Graham withdrew $3,600 cash from the business for personal use. NOVEMBER 1 Paid for automobile expense for 1,000 kilometres at $0.50 per kilometre. 2 Received $4,650 cash from Elite Corporation for computer services rendered. 5 Purchased $960 of computer supplies from Abbott Office Products. 8 Billed Fostek Co. $4,350 for computer services rendered. 18 Received $1,875 from Decker Company against the bill dated October 28. 22 Donated $750 to the United Way in the company's name. 24 Completed work for Alamo Engineering Co. and sent a bill for $3,750. 25 Sent another bill to Decker Company for the past due amount of $1,350. 28 Paid for another automobile expense for 1,200 kilometres at $0.50 per kilometre. 30 Paid Carly Smith for 14 days' work. 30 Mary Graham withdrew $1,800 cash from the business for personal use. DECEMBER 1 Purchased $1,000 of office equipment 2 Paid automobile expenses for 2,000 kilometres at $0.50 per kilometre. 4 Purchased 3 computers on on Computer Central account, $350 each. 5 Purchased delivery trucks on Trucks To Go for $2,800; payment was made by giving cash of $1,500 and a 30-day note for the remainder. 15 Received and paid December utilities bills, $800. 17 Cash received for computer services to date amounted to $4,000. 19 Purchased supplies for office use, $250 20. Completed work for a client, Lamb Company, and sent a bill for $2,700 to be paid within 30 days. 21. Purchased additional office equipment for $2,000 in cash. 23. Collected $1,100 on the services provided to clients 25. Paid $900 cash to settle the liability on the Computer equipment purchased last December 4. 28 Owner withdrew $750 for personal use 31 Paid Carly Smith for 12 days' work 31 Paid the $800 of the balance of delivery trucks purchased on December 5 > > You may use excel file/handwritten/Word document Convert the balances into Philippine Peso. The currency exchange rate is 1 USD = 50.79 Philippine peso Record the transactions in the General Journal; Post it to the General Ledger; Prepare a Trial Balance; Prepare Financial Statements (Income Statement, Statement of Changes in Owner's Equity, Balance Sheet, and Statement of Cash Flows) for each month; and >Present the financial statement to the owner ASSET CHART OF ACCOUNTS 10001 Cash 10002 Accounts Receivable - Capital Leasing 10003 Accounts Receivable - Decker Company 10004 Accounts Receivable - Fostek Co. 10005 Accounts Receivable - Alamo Engineering 10006 Accounts Receivable - Lamb Company 10007 Computer Supplies 10008 Office Supplies 10009 Computer System 10010 Computer Equipment 10011 Office Equipment 10012 Delivery Trucks 10013 Prepaid Rent 10014 Prepaid Insurance LIABILITIES 20001 Accounts Payable - Abbot Office Products 20002 Accounts Payable - Computer Central 20003 Notes Payable - Trucks To Go EQUITY 30001 Mary Graham, Capital 30002 Mary Graham, Drawings INCOME 40001 Service Revenue 50001 Utilities Expense 50002 Repairs Expense 50003 Advertising Expenses 50004 Salaries Expense 50005 Automobile Expense EXPENSES

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To provide you with the workings for the transactions I will present a summary of the transactions and their effects on the accounts Please note that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started