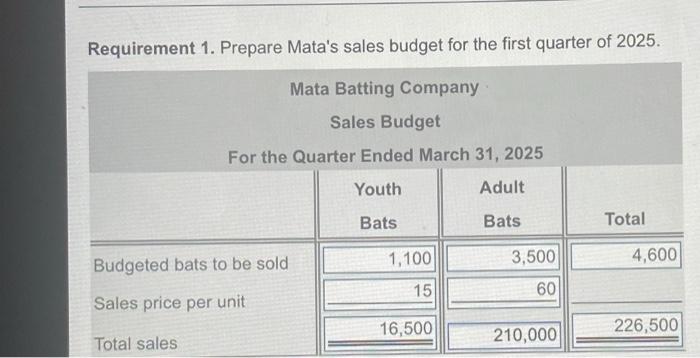

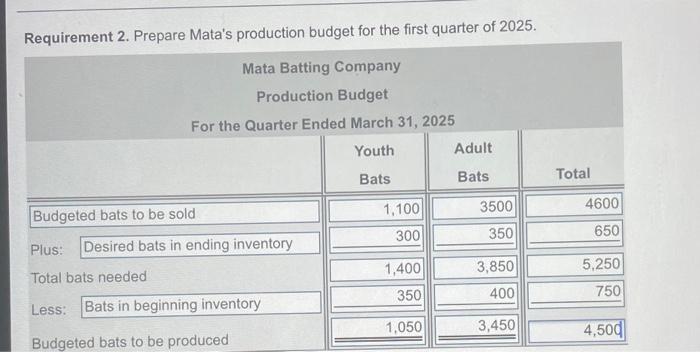

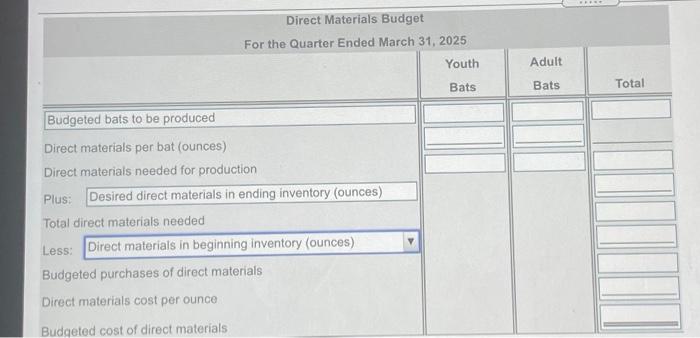

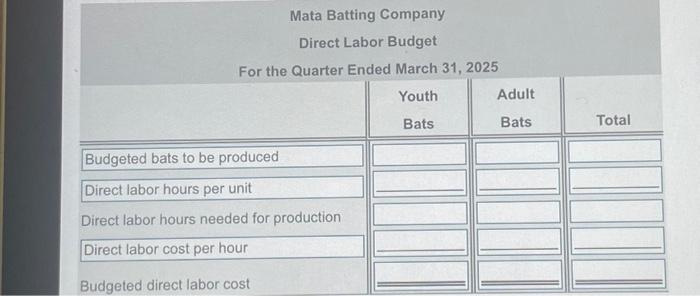

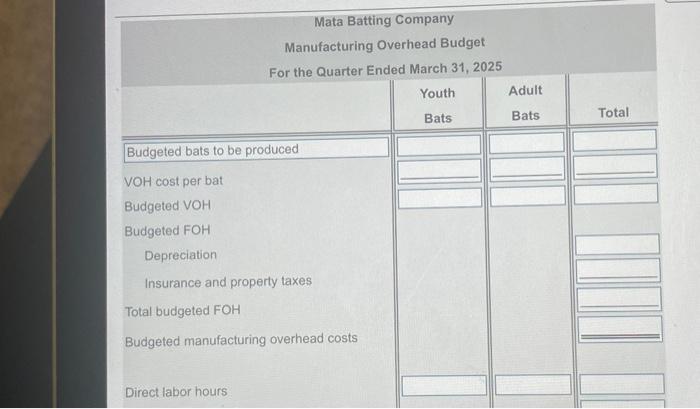

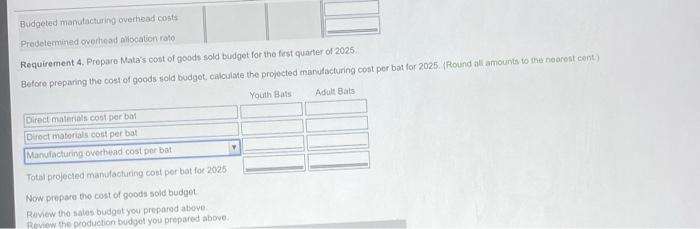

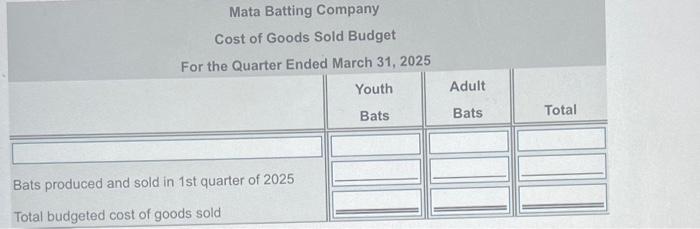

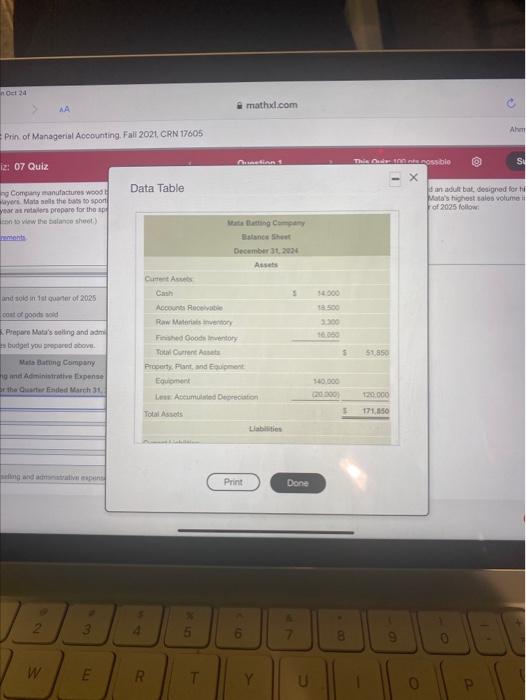

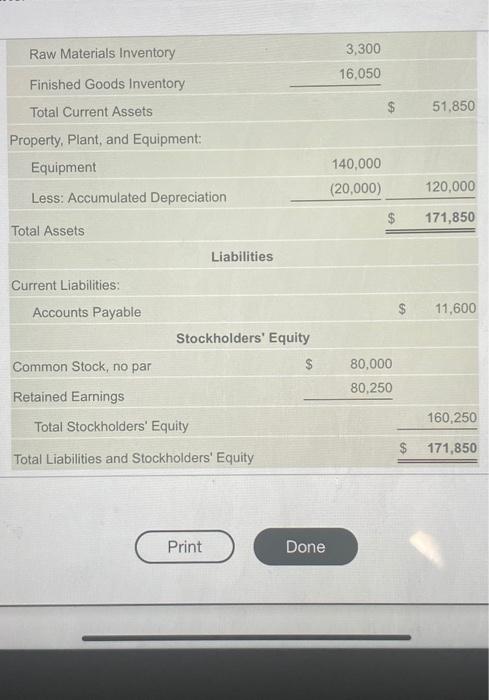

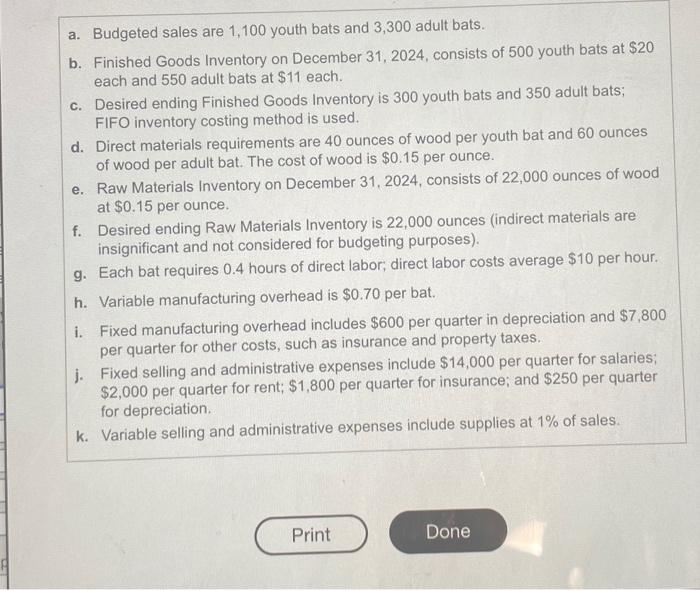

The Mata Batting Company manufacture wood baseballat Mata's two primary product you bat designed for children and young teens, and an adult bat, designed for high school and college aged players Matstheats to sporting goods stores and sales are an account the youth bat sofort ut botol for Soo Mata's highest sales volumes in the first months of the year as los prepare for the spring baseban Mata's balance sheet for December 31 2034, and other data for the first of 2025 che con to view the balance sheet Choke on to the other data Read the Requirement 1. Prepare Mata's sales budget for the first quarter of 2025. Mata Batting Company Sales Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be sold 1,100 3,500 4,600 15 60 Sales price per unit 16,500 226,500 Total sales 210,000 Requirement 2. Prepare Mata's production budget for the first quarter of 2025. Mata Batting Company Production Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total 3500 4600 1,100 Budgeted bats to be sold 300 350 650 Plus: Desired bats in ending inventory 1,400 3,850 5,250 Total bats needed 350 400 750 Less: Bats in beginning inventory 1,050 3,450 4,500 Budgeted bats to be produced Direct Materials Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be produced Direct materials per bat (ounces) Direct materials needed for production Plus Desired direct materials in ending inventory (ounces) Total direct materials needed Less: Direct materials in beginning inventory (ounces) Budgeted purchases of direct materials Direct materials cost per ounce Budgeted cost of direct materials Mata Batting Company Direct Labor Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be produced Direct labor hours per unit Direct labor hours needed for production Direct labor cost per hour Budgeted direct labor cost Mata Batting Company Manufacturing Overhead Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be produced VOH cost per bat Budgeted VOH Budgeted FOH Depreciation Insurance and property taxes Total budgeted FOH Budgeted manufacturing overhead costs Direct labor hours Budgeted manufacturing overhead costs Predetermined overhead allocation rato Requirement 4. Prepare Mata's cost of goods sold budget for the first quarter of 2025 Before preparing the cost of goods sold budget calculate the projected manufacturing cost per bot for 2025. (Round all amounts to the nearest cont) Youth Bats Adult Bats Direct materials cost per a Direct materials cost per bal Manufacturing overhead cost per bat Total projected manufacturing cost per bat for 2025 Now prepare the cost of goods sold budget Review the sales budget you prepared above Review the production budget you prepared above Mata Batting Company Cost of Goods Sold Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Bats produced and sold in 1st quarter of 2025 Total budgeted cost of goods sold Requirement 5. Prepare Mata's selling and administrative expense budget for the first quarter of 20 Review the sales budget you prepared above. Mata Batting Company Selling and Administrative Expense Budget For the Quarter Ended March 31, 2025 Oct 24 matha.com Ah Prin of Managerial Accounting. Fall 2021, CRN 17605 This dossible SI iz: 07 Quiz Data Table Company manufactures wood wor Mats the best son year as prepare for the en vw the dance sheet) sundu bat designed for Mat's highest sales volume of 2035 follow SLOO and sold in 1st quarter of 2025 Wat C Distance Show December 31, 2014 Assets Cuneta Cash Account Recova Raw Mate Fished Goodwory Torrent Protant, and more Equipment Acum Decation Total Assets Liabilities cost of goods sold Prepare Mata's wing and admi budget you prepared above Mata Bating Company Administrative pense the Grinded March 31 3.300 $ 51350 2000 120.000 1 171.450 ng and main Print Done 3 B W E R. T Y U O Raw Materials Inventory 3,300 16,050 51,850 Finished Goods Inventory Total Current Assets Property, Plant, and Equipment: Equipment 140,000 (20,000) 120,000 Less: Accumulated Depreciation $ 171,850 Total Assets Liabilities Current Liabilities: Accounts Payable 11,600 Stockholders' Equity $ Common Stock, no par 80,000 80,250 Retained Earnings Total Stockholders' Equity 160,250 171,850 Total Liabilities and Stockholders' Equity Print Done a. Budgeted sales are 1,100 youth bats and 3,300 adult bats. b. Finished Goods Inventory on December 31, 2024, consists of 500 youth bats at $20 each and 550 adult bats at $11 each. C. Desired ending Finished Goods Inventory is 300 youth bats and 350 adult bats; FIFO inventory costing method is used. d. Direct materials requirements are 40 ounces of wood per youth bat and 60 ounces of wood per adult bat. The cost of wood is $0.15 per ounce. e. Raw Materials Inventory on December 31, 2024, consists of 22,000 ounces of wood at $0.15 per ounce. f. Desired ending Raw Materials Inventory is 22,000 ounces (indirect materials are insignificant and not considered for budgeting purposes). g. Each bat requires 0.4 hours of direct labor, direct labor costs average $10 per hour. h. Variable manufacturing overhead is $0.70 per bat. i. Fixed manufacturing overhead includes $600 per quarter in depreciation and $7,800 per quarter for other costs, such as insurance and property taxes. j. Fixed selling and administrative expenses include $14,000 per quarter for salaries; $2,000 per quarter for rent: $1,800 per quarter for insurance; and $250 per quarter for depreciation k. Variable selling and administrative expenses include supplies at 1% of sales. Print Done The Mata Batting Company manufacture wood baseballat Mata's two primary product you bat designed for children and young teens, and an adult bat, designed for high school and college aged players Matstheats to sporting goods stores and sales are an account the youth bat sofort ut botol for Soo Mata's highest sales volumes in the first months of the year as los prepare for the spring baseban Mata's balance sheet for December 31 2034, and other data for the first of 2025 che con to view the balance sheet Choke on to the other data Read the Requirement 1. Prepare Mata's sales budget for the first quarter of 2025. Mata Batting Company Sales Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be sold 1,100 3,500 4,600 15 60 Sales price per unit 16,500 226,500 Total sales 210,000 Requirement 2. Prepare Mata's production budget for the first quarter of 2025. Mata Batting Company Production Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total 3500 4600 1,100 Budgeted bats to be sold 300 350 650 Plus: Desired bats in ending inventory 1,400 3,850 5,250 Total bats needed 350 400 750 Less: Bats in beginning inventory 1,050 3,450 4,500 Budgeted bats to be produced Direct Materials Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be produced Direct materials per bat (ounces) Direct materials needed for production Plus Desired direct materials in ending inventory (ounces) Total direct materials needed Less: Direct materials in beginning inventory (ounces) Budgeted purchases of direct materials Direct materials cost per ounce Budgeted cost of direct materials Mata Batting Company Direct Labor Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be produced Direct labor hours per unit Direct labor hours needed for production Direct labor cost per hour Budgeted direct labor cost Mata Batting Company Manufacturing Overhead Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Budgeted bats to be produced VOH cost per bat Budgeted VOH Budgeted FOH Depreciation Insurance and property taxes Total budgeted FOH Budgeted manufacturing overhead costs Direct labor hours Budgeted manufacturing overhead costs Predetermined overhead allocation rato Requirement 4. Prepare Mata's cost of goods sold budget for the first quarter of 2025 Before preparing the cost of goods sold budget calculate the projected manufacturing cost per bot for 2025. (Round all amounts to the nearest cont) Youth Bats Adult Bats Direct materials cost per a Direct materials cost per bal Manufacturing overhead cost per bat Total projected manufacturing cost per bat for 2025 Now prepare the cost of goods sold budget Review the sales budget you prepared above Review the production budget you prepared above Mata Batting Company Cost of Goods Sold Budget For the Quarter Ended March 31, 2025 Youth Adult Bats Bats Total Bats produced and sold in 1st quarter of 2025 Total budgeted cost of goods sold Requirement 5. Prepare Mata's selling and administrative expense budget for the first quarter of 20 Review the sales budget you prepared above. Mata Batting Company Selling and Administrative Expense Budget For the Quarter Ended March 31, 2025 Oct 24 matha.com Ah Prin of Managerial Accounting. Fall 2021, CRN 17605 This dossible SI iz: 07 Quiz Data Table Company manufactures wood wor Mats the best son year as prepare for the en vw the dance sheet) sundu bat designed for Mat's highest sales volume of 2035 follow SLOO and sold in 1st quarter of 2025 Wat C Distance Show December 31, 2014 Assets Cuneta Cash Account Recova Raw Mate Fished Goodwory Torrent Protant, and more Equipment Acum Decation Total Assets Liabilities cost of goods sold Prepare Mata's wing and admi budget you prepared above Mata Bating Company Administrative pense the Grinded March 31 3.300 $ 51350 2000 120.000 1 171.450 ng and main Print Done 3 B W E R. T Y U O Raw Materials Inventory 3,300 16,050 51,850 Finished Goods Inventory Total Current Assets Property, Plant, and Equipment: Equipment 140,000 (20,000) 120,000 Less: Accumulated Depreciation $ 171,850 Total Assets Liabilities Current Liabilities: Accounts Payable 11,600 Stockholders' Equity $ Common Stock, no par 80,000 80,250 Retained Earnings Total Stockholders' Equity 160,250 171,850 Total Liabilities and Stockholders' Equity Print Done a. Budgeted sales are 1,100 youth bats and 3,300 adult bats. b. Finished Goods Inventory on December 31, 2024, consists of 500 youth bats at $20 each and 550 adult bats at $11 each. C. Desired ending Finished Goods Inventory is 300 youth bats and 350 adult bats; FIFO inventory costing method is used. d. Direct materials requirements are 40 ounces of wood per youth bat and 60 ounces of wood per adult bat. The cost of wood is $0.15 per ounce. e. Raw Materials Inventory on December 31, 2024, consists of 22,000 ounces of wood at $0.15 per ounce. f. Desired ending Raw Materials Inventory is 22,000 ounces (indirect materials are insignificant and not considered for budgeting purposes). g. Each bat requires 0.4 hours of direct labor, direct labor costs average $10 per hour. h. Variable manufacturing overhead is $0.70 per bat. i. Fixed manufacturing overhead includes $600 per quarter in depreciation and $7,800 per quarter for other costs, such as insurance and property taxes. j. Fixed selling and administrative expenses include $14,000 per quarter for salaries; $2,000 per quarter for rent: $1,800 per quarter for insurance; and $250 per quarter for depreciation k. Variable selling and administrative expenses include supplies at 1% of sales. Print Done