Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The MAVI Company is considering investing in a new machine for one of its factories. The company can choose either MAchine A or Machine

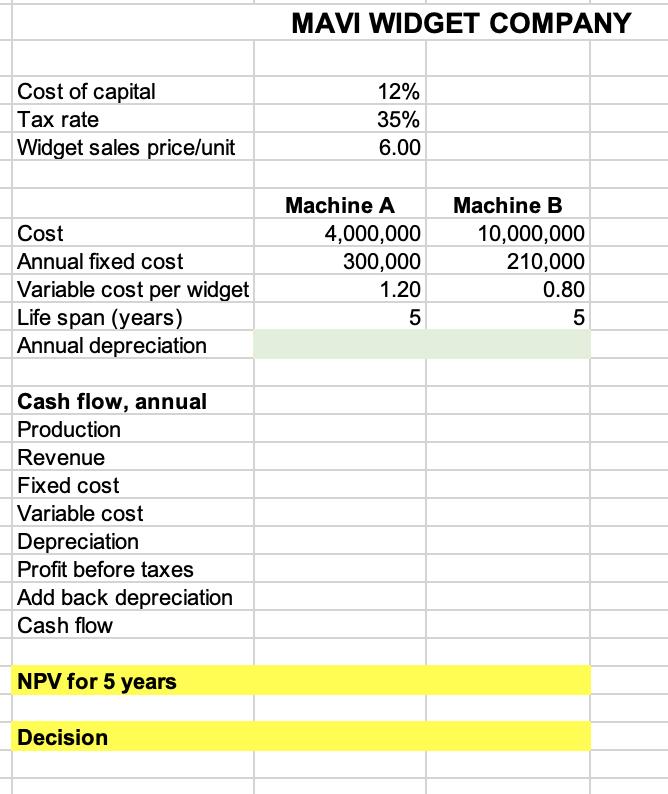

The MAVI Company is considering investing in a new machine for one of its factories. The company can choose either MAchine A or Machine B. The life span for each machine is 5 years, and depreciation is straight-line to zero salvage value. The widgets produced by the machines are sold for $6 each. The company has a cost of capital of 12%, and its tax rate is 35%. PART A. If the company manufactures 1,000,000 units per year, which machine should it buy? Cost of capital Tax rate Widget sales price/unit Cost Annual fixed cost Variable cost per widget Life span (years) Annual depreciation Cash flow, annual Production Revenue Fixed cost Variable cost Depreciation Profit before taxes Add back depreciation Cash flow NPV for 5 years Decision MAVI WIDGET COMPANY 12% 35% 6.00 Machine A 4,000,000 300,000 1.20 5 Machine B 10,000,000 210,000 0.80 5

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Revenue earned no of units produced x selling price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started