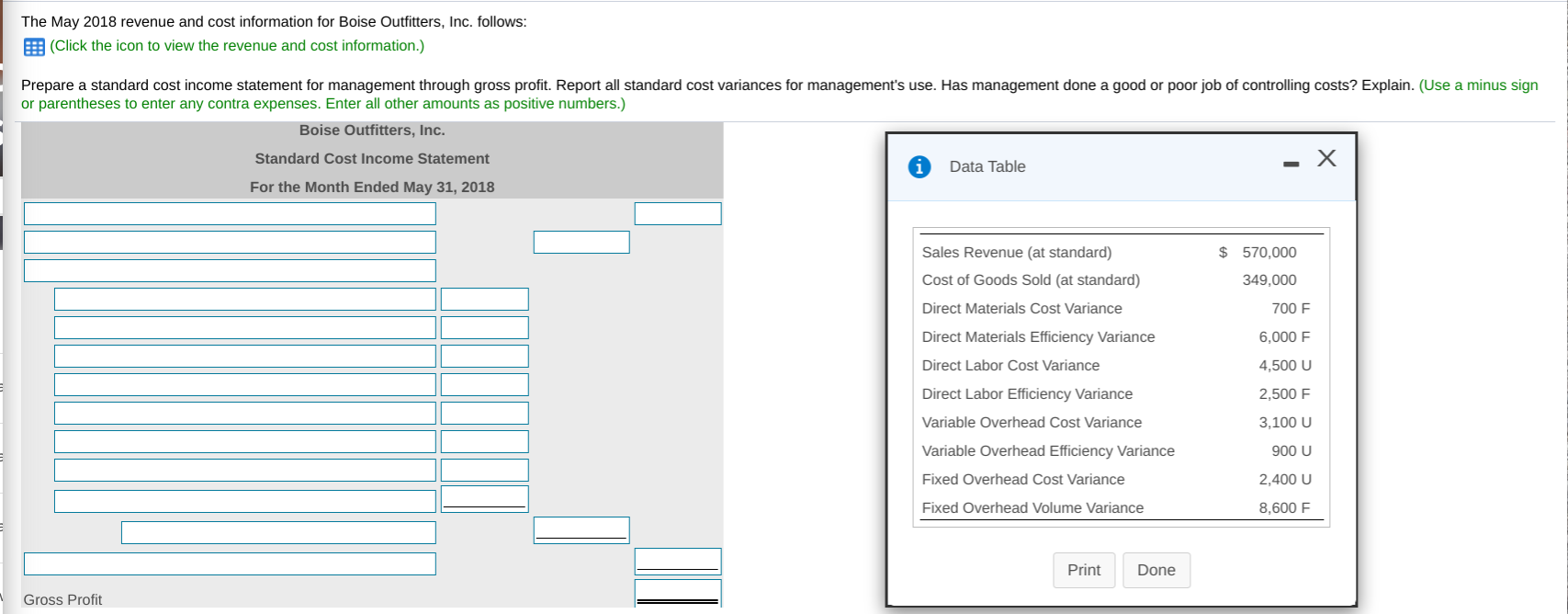

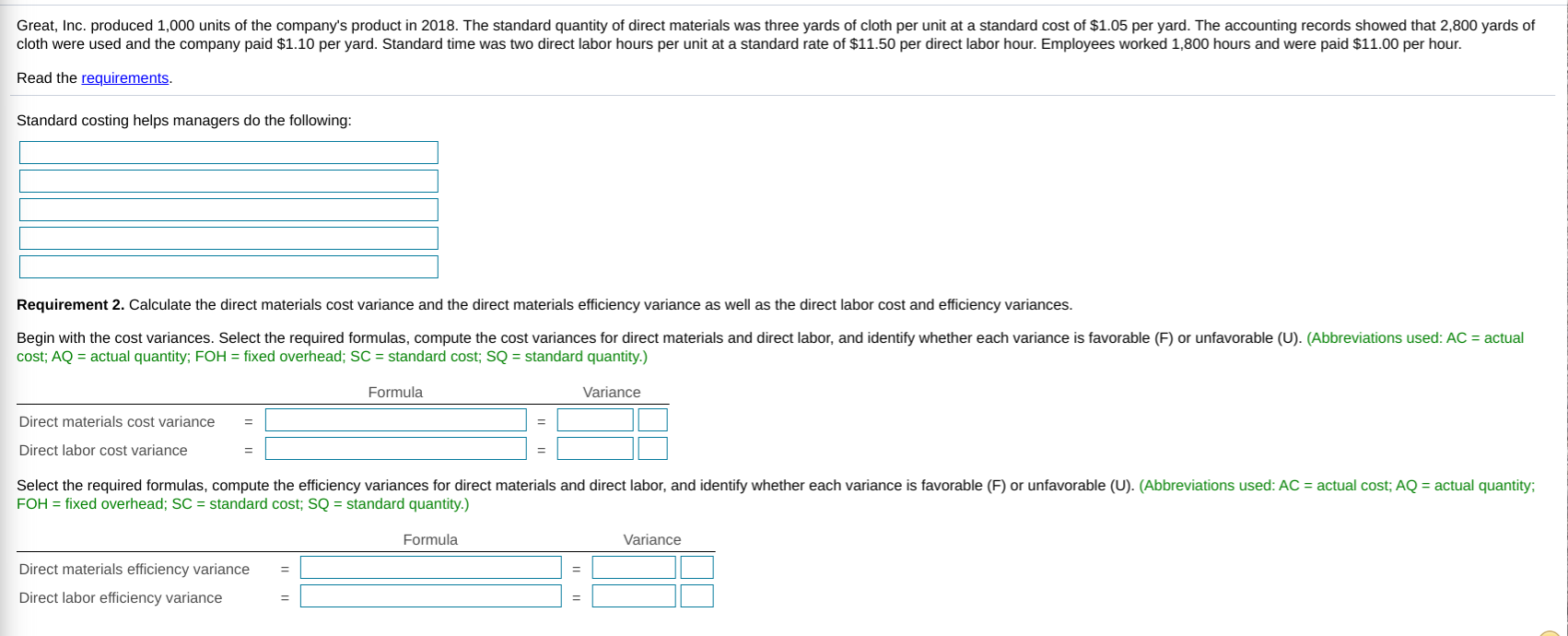

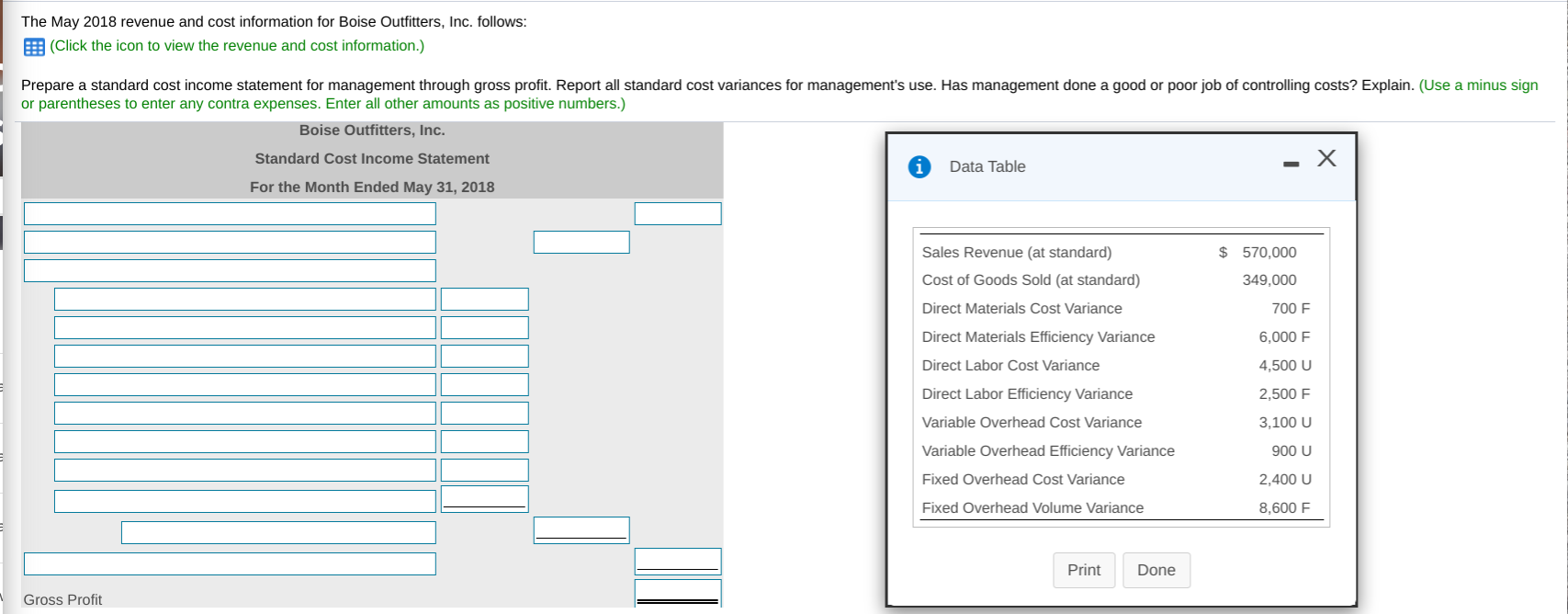

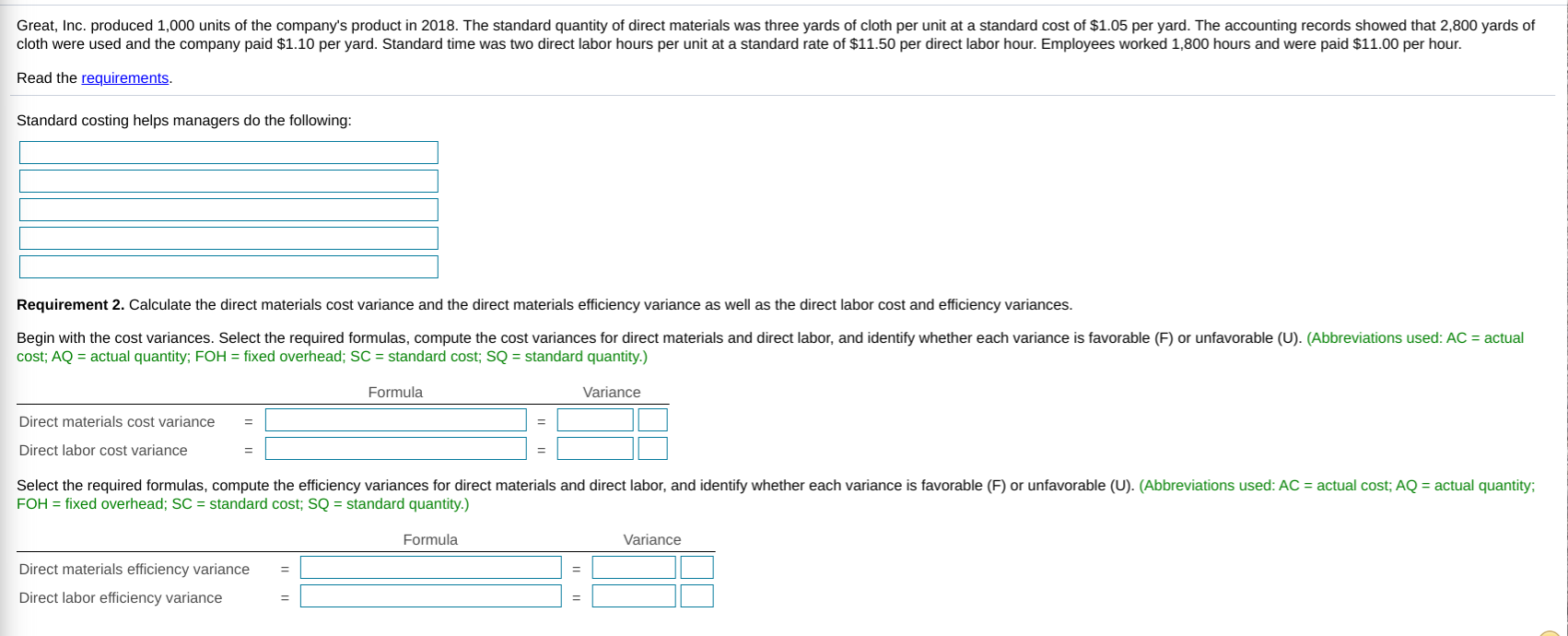

The May 2018 revenue and cost information for Boise Outfitters, Inc. follows: (Click the icon to view the revenue and cost information.) Prepare a standard cost income statement for management through gross profit. Report all standard cost variances for management's use. Has management done a good or poor job of controlling costs? Explain. (Use a minus sign or parentheses to enter any contra expenses. Enter all other amounts as positive numbers.) Boise Outfitters, Inc. Standard Cost Income Statement Data Table For the Month Ended May 31, 2018 Sales Revenue (at standard) 570,000 Cost of Goods Sold (at standard) 349,000 Direct Materials Cost Variance 700 F Direct Materials Efficiency Variance 6,000 F Direct Labor Cost Variance 4,500 U Direct Labor Efficiency Variance 2,500 F Variable Overhead Cost Variance 3,100 U Variable Overhead Efficiency Variance 900 U Fixed Overhead Cost Variance 2,400 U Fixed Overhead Volume Variance 8,600 F Print Done Gross Profit Great, Inc. produced 1,000 units of the company's product in 2018. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.05 per yard. The accounting records showed that 2,800 yards of cloth were used and the company paid $1.10 per yard. Standard time was two direct labor hours per unit at a standard rate of $11.50 per direct labor hour.. Employees worked 1,800 hours and were paid $11.00 per hour. Read the requirements. Standard costing helps managers do the following: Requirement 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ actual quantity; FOH = fixed overhead; SC standard cost; SQ standard quantity.) Formula Variance Direct materials cost variance Direct labor cost variance Select the required formulas, compute the efficiency variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH =fixed overhead; SC = standard cost; SQ standard quantity.) Formula Variance Direct materials efficiency variance Direct labor efficiency variance