Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The McCaffrey's want to mainitain the levels of their current consumption. To obtain this, Jim needs to know the annual inflation rate expected in the

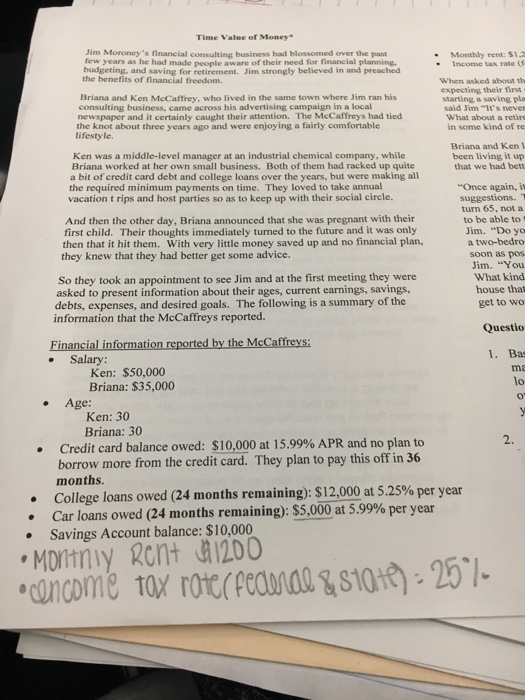

The McCaffrey's want to mainitain the levels of their current consumption. To obtain this, Jim needs to know the annual inflation rate expected in the future. Assume that average annual inflation rate is 3% per year for the whole terms, if the McCaffreys want to have as much of an after-tax income when they retire as they currently have, and assuming they live until they are 80 years old, how much money should they have in their retirement account at the age of 65? (the investment return is 7%)

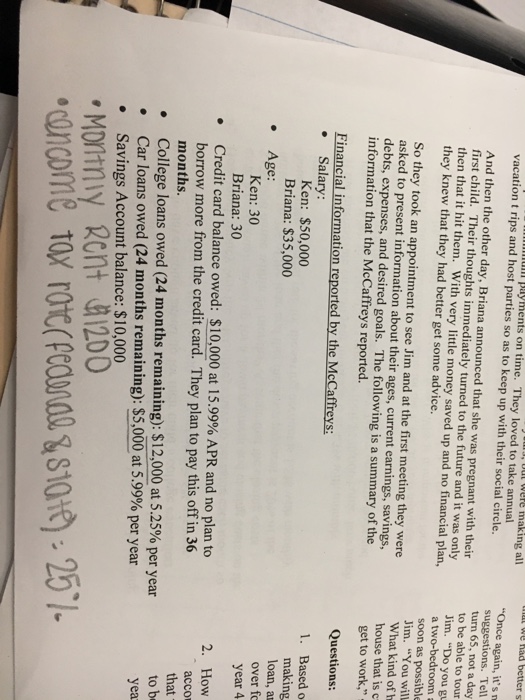

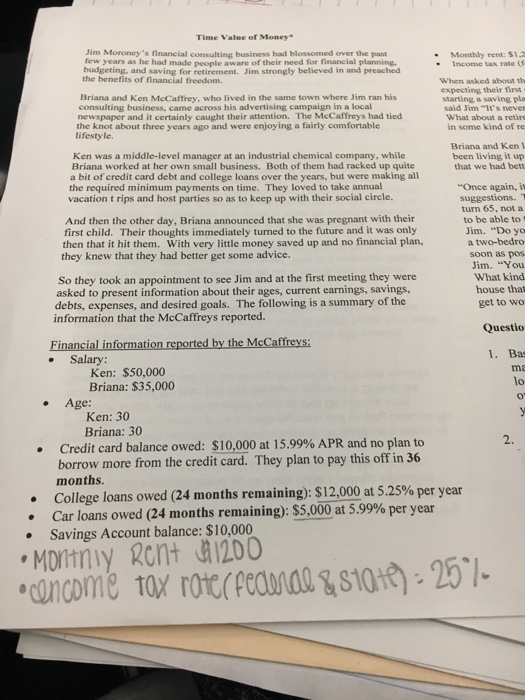

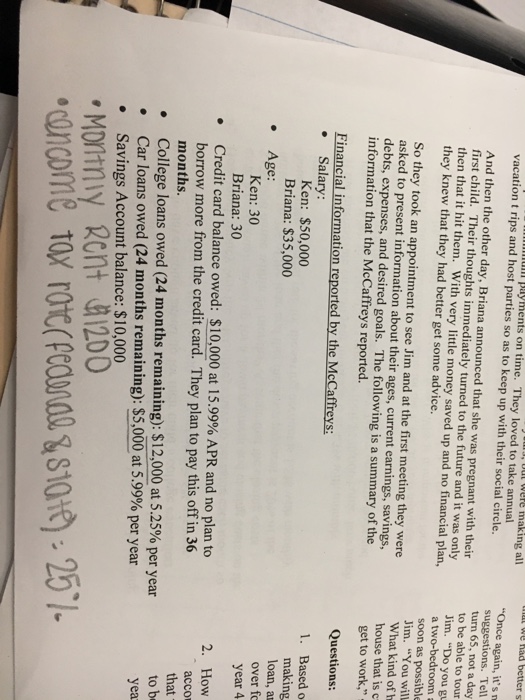

payments on time. They loved to take annual parties so as to keep up with their social circle. we nad better s all "Once again, it's n suggestions. Tell And then the other day, Briana announced that she was pregnant with their first child. Their thoughts immediately turned to the future and it was only then that it hit them. With very little money saved up and no financial plan, they knew that they had better get some advice. 65, not a day to be able to tour Jim "Do you gu a two-bedroom a soon as possible So they took an appointment to see Jim and at the first meeting they were asked to present information about their ages, current earnings, savings, debts, expenses, and desired goals. The following is a summary of the information that the McCaffreys reported. Jim. "You will What kind of h house that is c get to work." Financial information reported by the McCaffreys: Salary Questions: Ken: $50,000 1. Based o Briana: $35,000 making Age loan, at Ken: 30 over fo year 4 Briana: 30 Credit card balance owed: $10,000 at 15.99% APR and no plan to 2. How borrow more from the credit card. They plan to pay this off in 36 w months acco that College loans owed (24 months remaining): $12,000 at 5.25% per year to be Car loans owed (24 months remaining): $5,000 at 5.99% per year yea Savings Account balance: $10,000 Monthly Rent 200 payments on time. They loved to take annual parties so as to keep up with their social circle. we nad better s all "Once again, it's n suggestions. Tell And then the other day, Briana announced that she was pregnant with their first child. Their thoughts immediately turned to the future and it was only then that it hit them. With very little money saved up and no financial plan, they knew that they had better get some advice. 65, not a day to be able to tour Jim "Do you gu a two-bedroom a soon as possible So they took an appointment to see Jim and at the first meeting they were asked to present information about their ages, current earnings, savings, debts, expenses, and desired goals. The following is a summary of the information that the McCaffreys reported. Jim. "You will What kind of h house that is c get to work." Financial information reported by the McCaffreys: Salary Questions: Ken: $50,000 1. Based o Briana: $35,000 making Age loan, at Ken: 30 over fo year 4 Briana: 30 Credit card balance owed: $10,000 at 15.99% APR and no plan to 2. How borrow more from the credit card. They plan to pay this off in 36 w months acco that College loans owed (24 months remaining): $12,000 at 5.25% per year to be Car loans owed (24 months remaining): $5,000 at 5.99% per year yea Savings Account balance: $10,000 Monthly Rent 200 How much they should set aside each month starting at the end of the month so they have enough money accumulated in their retirement next egg (previous question)? Assume that the investment rate is 8% per year before retirement.

(Information is attached)

(please put inputs to help me follow along like N(periods) i/y, PV, and FV)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started