Question

The Merrill Winch Company received $200,000 from one of its clients, Abe Smith, to invest in 3 funds: stock fund, bond fund and money market

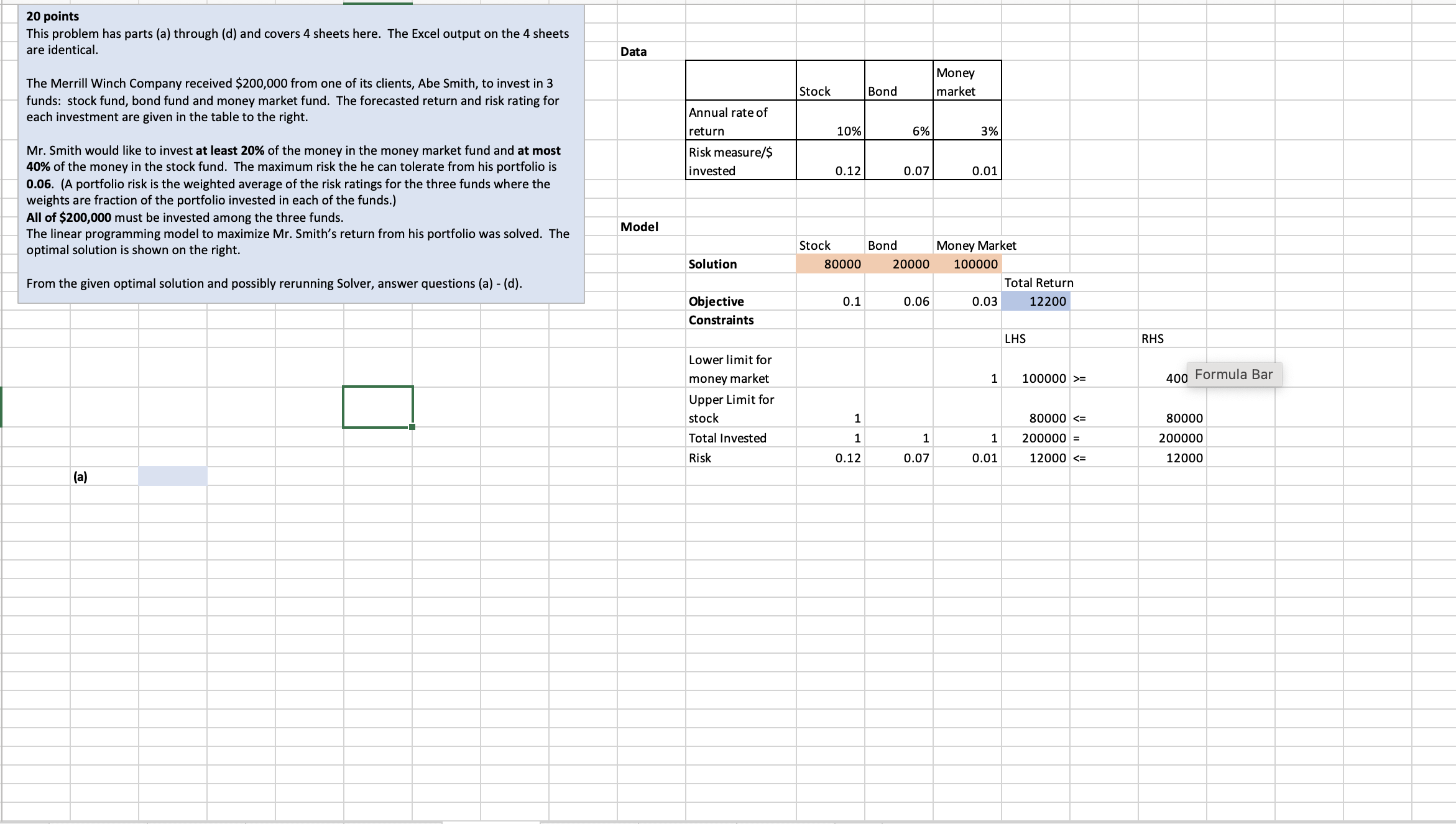

The Merrill Winch Company received $200,000 from one of its clients, Abe Smith, to invest in 3 funds: stock fund, bond fund and money market fund. The forecasted return and risk rating for each investment are given in the table to the right.

Mr. Smith would like to invest at least 20% of the money in the money market fund and at most 40% of the money in the stock fund. The maximum risk the he can tolerate from his portfolio is 0.06. (A portfolio risk is the weighted average of the risk ratings for the three funds where the weights are fraction of the portfolio invested in each of the funds.)

All of $200,000 must be invested among the three funds.

The linear programming model to maximize Mr. Smith's return from his portfolio was solved. The optimal solution is shown on the right.

(a) What is the % return from this portfolio?

(b) Suppose the rate of return for the stock fund is actually 8%, not 10%. What is the the new optimal solution, i.e., how much to invest in each fund?

(c) Refer to the original problem here (without the change made in (b)). Suppose Mr. Smith decides he is willing to accept risk level up to 0.07. Make the appropriate change and run Solver. Does the total return increase or decrease? By how much?

(d) Refer to the original problem here (without the change made in (b) or (c)). Suppose Mr. Smith says he wants the amount in the bond fund to be at least 40% as much as the amount in the stock fund. Add a new constraint for this and solve. State the new optimal solution.

20 points This problem has parts (a) through (d) and covers 4 sheets here. The Excel output on the 4 sheets are identical. The Merrill Winch Company received $200,000 from one of its clients, Abe Smith, to invest in 3 funds: stock fund, bond fund and money market fund. The forecasted return and risk rating for each investment are given in the table to the right. Mr. Smith would like to invest at least 20% of the money in the money market fund and at most 40% of the money in the stock fund. The maximum risk the he can tolerate from his portfolio is 0.06. (A portfolio risk is the weighted average of the risk ratings for the three funds where the weights are fraction of the portfolio invested in each of the funds.) All of $200,000 must be invested among the three funds. The linear programming model to maximize Mr. Smith's return from his portfolio was solved. The optimal solution is shown on the right. From the given optimal solution and possibly rerunning Solver, answer questions (a) - (d). Data Model (a) Money Stock Bond market Annual rate of return 10% 6% 3% Risk measure/$ invested 0.12 0.07 0.01 Stock Bond Money Market Solution 80000 20000 100000 Total Return Objective 0.1 0.06 0.03 12200 Constraints Lower limit for money market Upper Limit for stock Total Invested Risk 1 1 0.12 LHS 1 100000 >= RHS 400 Formula Bar 1 1 80000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started