Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The semi-strong form of the efficient market hypothesis asserts that all publicly available information is rapidly and correctly reflected in stock prices. This implies

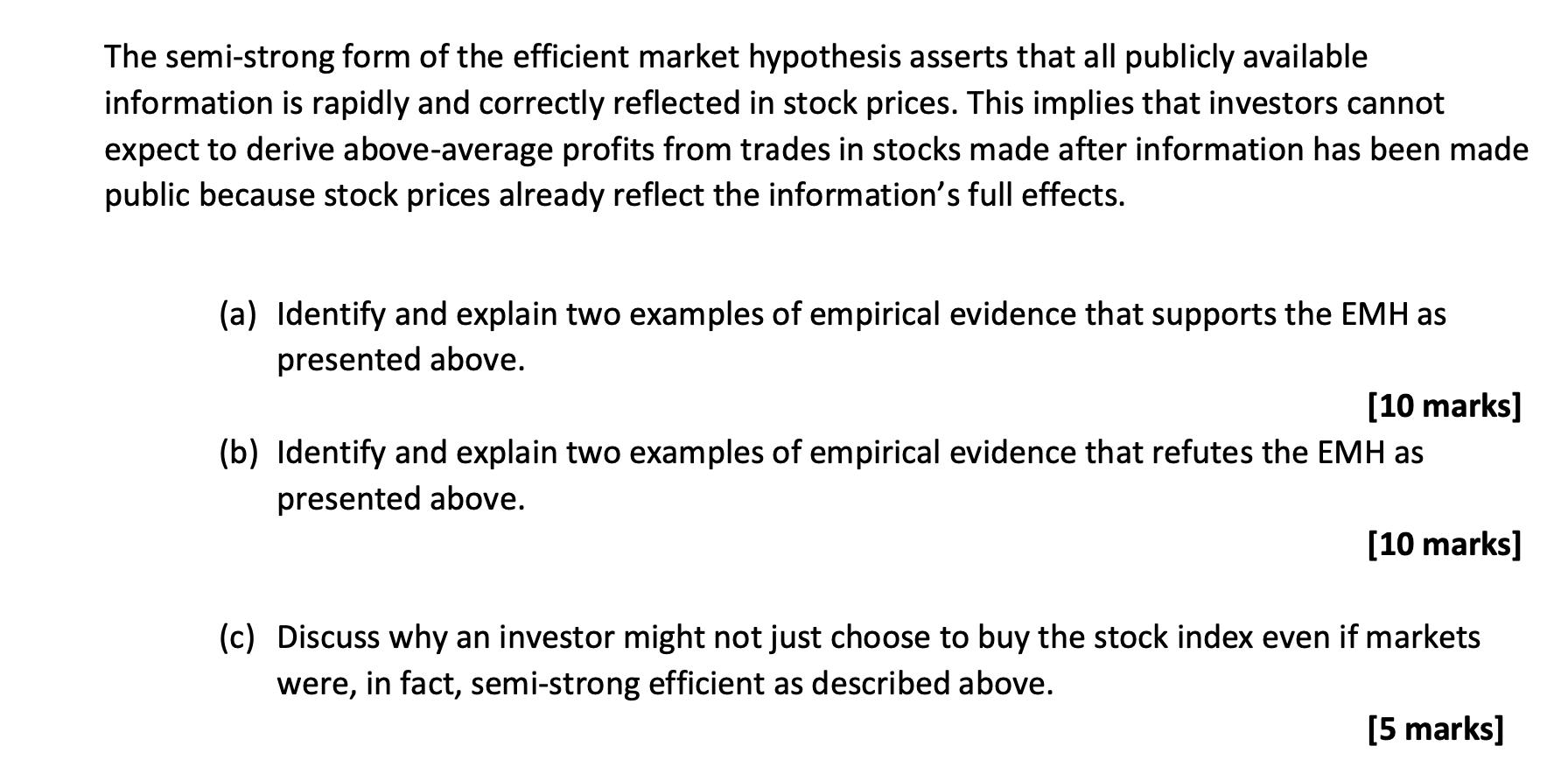

The semi-strong form of the efficient market hypothesis asserts that all publicly available information is rapidly and correctly reflected in stock prices. This implies that investors cannot expect to derive above-average profits from trades in stocks made after information has been made public because stock prices already reflect the information's full effects. (a) Identify and explain two examples of empirical evidence that supports the EMH as presented above. [10 marks] (b) Identify and explain two examples of empirical evidence that refutes the EMH as presented above. [10 marks] (c) Discuss why an investor might not just choose to buy the stock index even if markets were, in fact, semi-strong efficient as described above. [5 marks]

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The Efficient Market Hypothesis Evidence and Limitations a Evidence Supporting the SemiStrong EMH 1 Event Studies These studies examine the impact of unexpected public news on stock prices If the EMH ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started