Question: Prepare the Hong Kong joint personal assessment tax computation for David and Katherine for the year of assessment 2020/21, using the most advantageous method

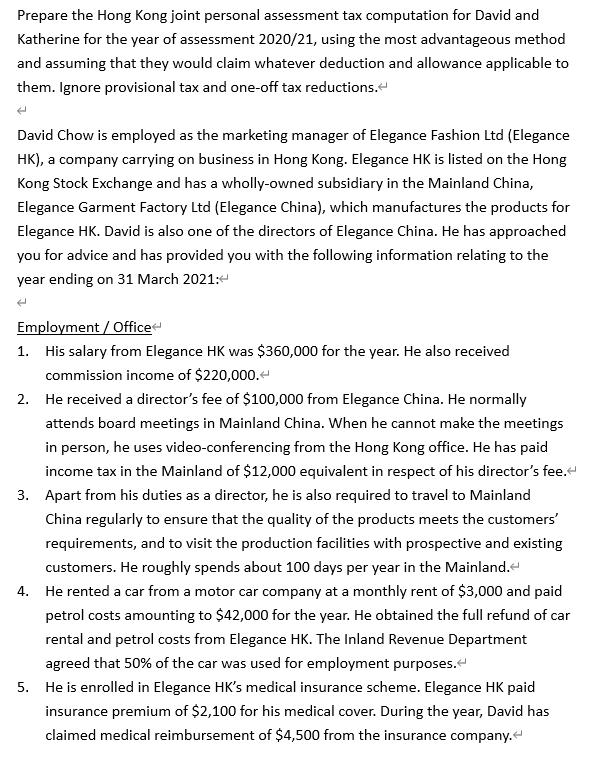

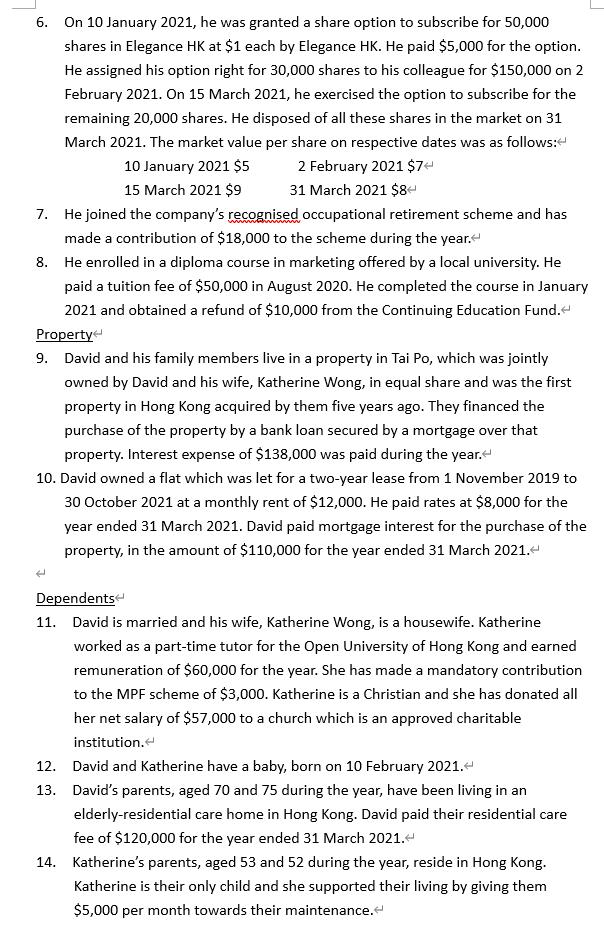

Prepare the Hong Kong joint personal assessment tax computation for David and Katherine for the year of assessment 2020/21, using the most advantageous method and assuming that they would claim whatever deduction and allowance applicable to them. Ignore provisional tax and one-off tax reductions. < David Chow is employed as the marketing manager of Elegance Fashion Ltd (Elegance HK), a company carrying on business in Hong Kong. Elegance HK is listed on the Hong Kong Stock Exchange and has a wholly-owned subsidiary in the Mainland China, Elegance Garment Factory Ltd (Elegance China), which manufactures the products for Elegance HK. David is also one of the directors of Elegance China. He has approached you for advice and has provided you with the following information relating to the year ending on 31 March 2021: Employment / Office 1. His salary from Elegance HK was $360,000 for the year. He also received commission income of $220,000. < 2. He received a director's fee of $100,000 from Elegance China. He normally attends board meetings in Mainland China. When he cannot make the meetings in person, he uses video-conferencing from the Hong Kong office. He has paid income tax in the Mainland of $12,000 equivalent in respect of his director's fee. < 3. Apart from his duties as a director, he is also required to travel to Mainland China regularly to ensure that the quality of the products meets the customers' requirements, and to visit the production facilities with prospective and existing customers. He roughly spends about 100 days per year in the Mainland. 4. He rented a car from a motor car company at a monthly rent of $3,000 and paid petrol costs amounting to $42,000 for the year. He obtained the full refund of car rental and petrol costs from Elegance HK. The Inland Revenue Department agreed that 50% of the car was used for employment purposes. < 5. He is enrolled in Elegance HK's medical insurance scheme. Elegance HK paid insurance premium of $2,100 for his medical cover. During the year, David has claimed medical reimbursement of $4,500 from the insurance company. 6. On 10 January 2021, he was granted a share option to subscribe for 50,000 shares in Elegance HK at $1 each by Elegance HK. He paid $5,000 for the option. He assigned his option right for 30,000 shares to his colleague for $150,000 on 2 February 2021. On 15 March 2021, he exercised the option to subscribe for the remaining 20,000 shares. He disposed of all these shares in the market on 31 March 2021. The market value per share on respective dates was as follows: 10 January 2021 $5 2 February 2021 $74 15 March 2021 $9 31 March 2021 $84 7. He joined the company's recognised occupational retirement scheme and has made a contribution of $18,000 to the scheme during the year. 8. He enrolled in a diploma course in marketing offered by a local university. He paid a tuition fee of $50,000 in August 2020. He completed the course in January 2021 and obtained a refund of $10,000 from the Continuing Education Fund. Property 9. David and his family members live in a property in Tai Po, which was jointly owned by David and his wife, Katherine Wong, in equal share and was the first property in Hong Kong acquired by them five years ago. They financed the purchase of the property by a bank loan secured by a mortgage over that property. Interest expense of $138,000 was paid during the year. 10. David owned a flat which was let for a two-year lease from 1 November 2019 to 30 October 2021 at a monthly rent of $12,000. He paid rates at $8,000 for the year ended 31 March 2021. David paid mortgage interest for the purchase of the property, in the amount of $110,000 for the year ended 31 March 2021. < Dependents 11. David is married and his wife, Katherine Wong, is a housewife. Katherine worked as a part-time tutor for the Open University of Hong Kong and earned remuneration of $60,000 for the year. She has made a mandatory contribution to the MPF scheme of $3,000. Katherine is a Christian and she has donated all her net salary of $57,000 to a church which is an approved charitable institution. 12. David and Katherine have a baby, born on 10 February 2021. < 13. David's parents, aged 70 and 75 during the year, have been living in an elderly-residential care home in Hong Kong. David paid their residential care fee of $120,000 for the year ended 31 March 2021. < 14. Katherine's parents, aged 53 and 52 during the year, reside in Hong Kong. Katherine is their only child and she supported their living by giving them $5,000 per month towards their maintenance.

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Ans a Mr and Mrs Chow Salaries tax computation joint assessment Year of Assessment 201112 Salary Com... View full answer

Get step-by-step solutions from verified subject matter experts