Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Millers have three children, Denny age 3, Caitlyn age 5, and Hunter age 8. Both Scott and Amy struggled financially to get through college

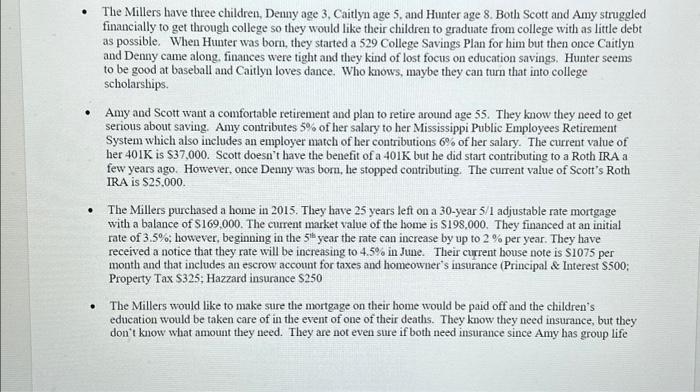

The Millers have three children, Denny age 3, Caitlyn age 5, and Hunter age 8. Both Scott and Amy struggled financially to get through college so they would like their children to graduate from college with as little debt as possible. When Hunter was born, they started a 529 College Savings Plan for him but then once Caitlyn and Denny came along, finances were tight and they kind of lost focus on education savings. Hunter seems to be good at baseball and Caitlyn loves dance. Who knows, maybe they can turn that into college scholarships. Amy and Scott want a comfortable retirement and plan to retire around age 55. They know they need to get serious about saving. Amy contributes 5% of her salary to her Mississippi Public Employees Retirement System which also includes an employer match of her contributions 6% of her salary. The current value of her 401K is $37,000. Scott doesn't have the benefit of a 401K but he did start contributing to a Roth IRA a few years ago. However, once Denny was born, he stopped contributing. The current value of Scott's Roth IRA is $25,000. The Millers purchased a home in 2015. They have 25 years left on a 30-year 5/1 adjustable rate mortgage with a balance of $169,000. The current market value of the home is $198.000. They financed at an initial rate of 3.5%; however, beginning in the 5th year the rate can increase by up to 2% per year. They have received a notice that they rate will be increasing to 4.5% in June. Their current house note is $1075 per month and that includes an escrow account for taxes and homeowner's insurance (Principal & Interest $500; Property Tax $325; Hazzard insurance $250 The Millers would like to make sure the mortgage on their home would be paid off and the children's education would be taken care of in the event of one of their deaths. They know they need insurance, but they don't know what amount they need. They are not even sure if both need insurance since Amy has group life

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started