Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Milton Teapot Company (MTC) is beginning its capital budgeting process for the year. The first step in this process is to find the firm's

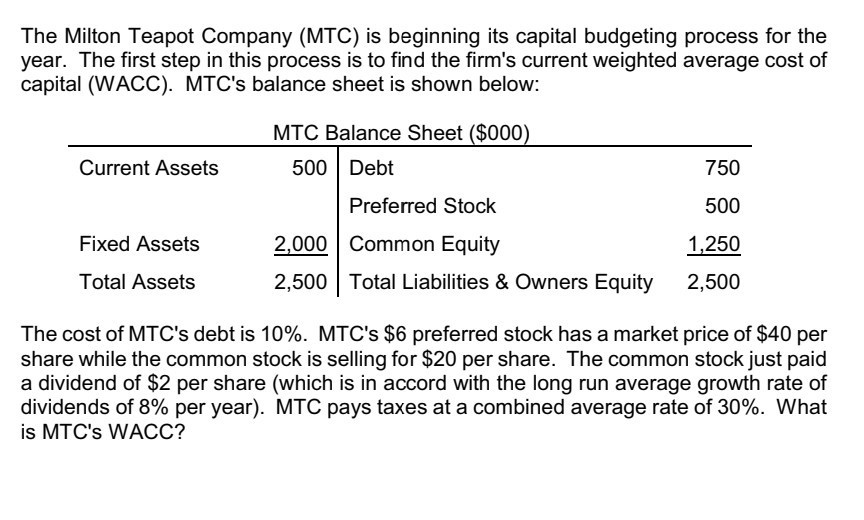

The Milton Teapot Company (MTC) is beginning its capital budgeting process for the year. The first step in this process is to find the firm's current weighted average cost of capital (WACC). MTC's balance sheet is shown below: Current Assets MTC Balance Sheet ($000) 500 Debt Preferred Stock 2,000 Common Equity 2,500 Total Liabilities & Owners Equity 750 500 1,250 2,500 Fixed Assets Total Assets The cost of MTC's debt is 10%. MTC's $6 preferred stock has a market price of $40 per share while the common stock is selling for $20 per share. The common stock just paid a dividend of $2 per share (which is in accord with the long run average growth rate of dividends of 8% per year). MTC pays taxes at a combined average rate of 30%. What is MTC's WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started