Answered step by step

Verified Expert Solution

Question

1 Approved Answer

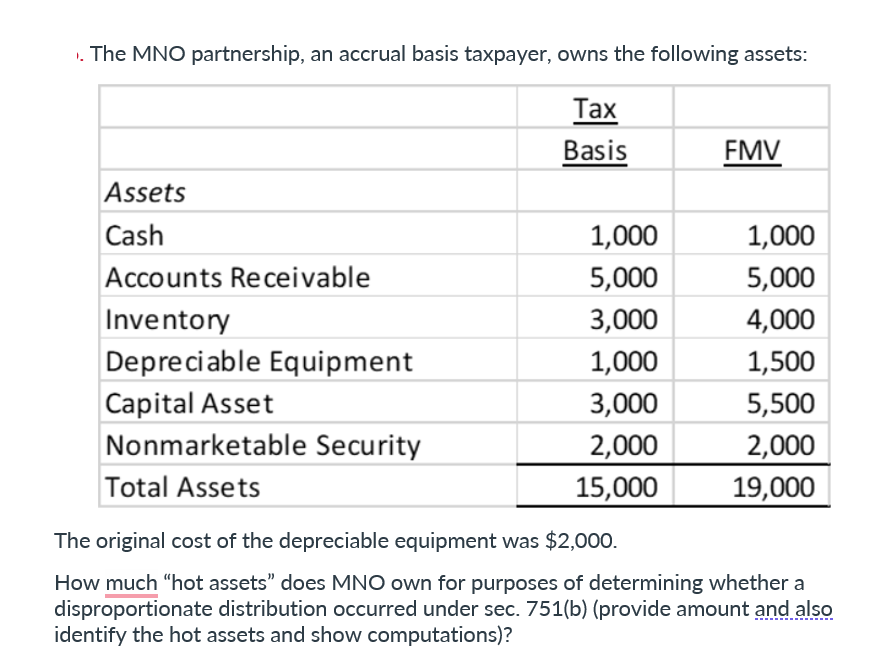

. The MNO partnership, an accrual basis taxpayer, owns the following assets: Tax Basis FMV Assets Cash 1,000 1,000 Accounts Receivable 5,000 5,000 Inventory

. The MNO partnership, an accrual basis taxpayer, owns the following assets: Tax Basis FMV Assets Cash 1,000 1,000 Accounts Receivable 5,000 5,000 Inventory 3,000 4,000 Depreciable Equipment 1,000 1,500 Capital Asset 3,000 5,500 Nonmarketable Security 2,000 2,000 Total Assets 15,000 19,000 The original cost of the depreciable equipment was $2,000. How much "hot assets" does MNO own for purposes of determining whether a disproportionate distribution occurred under sec. 751(b) (provide amount and also identify the hot assets and show computations)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Identify Hot Assets Hot assets are those that can potentially cause a disproportionate distribution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started