Answered step by step

Verified Expert Solution

Question

1 Approved Answer

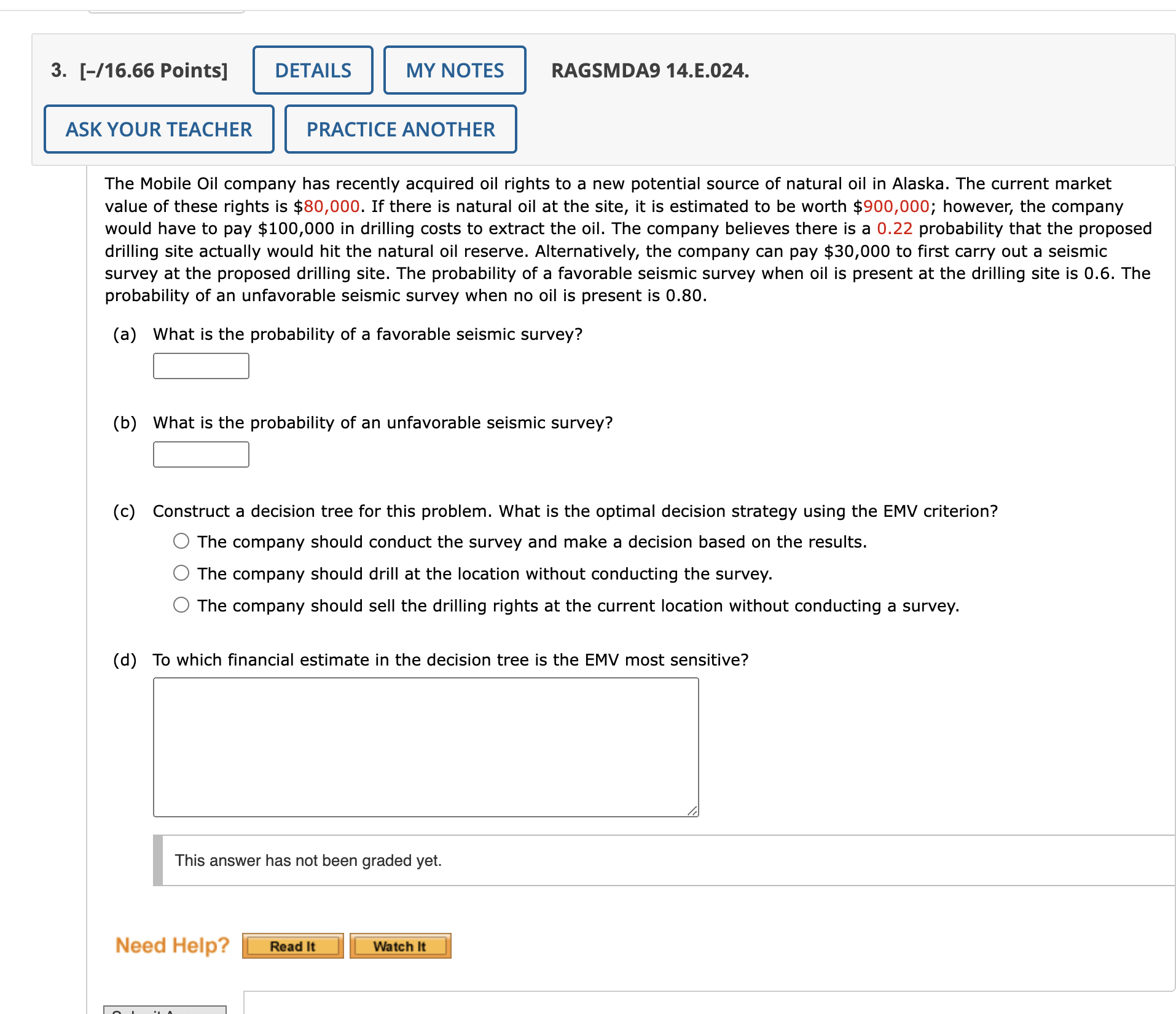

The Mobile Oil company has recently acquired oil rights to a new potential source of natural oil in Alaska. The current market value of these

The Mobile Oil company has recently acquired oil rights to a new potential source of natural oil in Alaska. The current market

value of these rights is $ If there is natural oil at the site, it is estimated to be worth $; however, the company

would have to pay $ in drilling costs to extract the oil. The company believes there is a probability that the proposed

drilling site actually would hit the natural oil reserve. Alternatively, the company can pay $ to first carry out a seismic

survey at the proposed drilling site. The probability of a favorable seismic survey when oil is present at the drilling site is The

probability of an unfavorable seismic survey when no oil is present is

a What is the probability of a favorable seismic survey?

b What is the probability of an unfavorable seismic survey?

c Construct a decision tree for this problem. What is the optimal decision strategy using the EMV criterion?

The company should conduct the survey and make a decision based on the results.

The company should drill at the location without conducting the survey.

The company should sell the drilling rights at the current location without conducting a survey.

d To which financial estimate in the decision tree is the EMV most sensitive

This answer has not been graded yet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started