Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Model Company is to begin operations in April. It has budgeted April sales of $58,000. May sales of $62,000, June sales of $68,000,

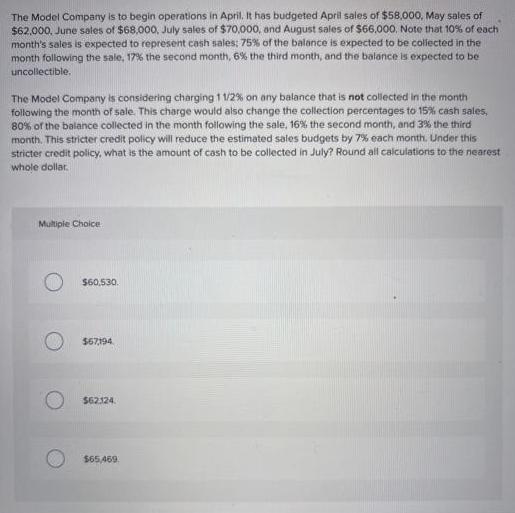

The Model Company is to begin operations in April. It has budgeted April sales of $58,000. May sales of $62,000, June sales of $68,000, July sales of $70,000, and August sales of $66,000, Note that 10% of each month's sales is expected to represent cash sales: 75% of the balance is expected to be collected in the month following the sale, 17% the second month, 6% the third month, and the balance is expected to be uncollectible. The Model Company is considering charging 1 1/2 % on any balance that is not collected in the month following the month of sale. This charge would also change the collection percentages to 15% cash sales, 80% of the balance collected in the month following the sale, 16% the second month, and 3% the third month. This stricter credit policy will reduce the estimated sales budgets by 7% each month. Under this stricter credit policy, what is the amount of cash to be collected in July? Round all calculations to the nearest whole dollar. Multiple Choice $60,530. $67,194 $62.124 $65,469

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started