Answered step by step

Verified Expert Solution

Question

1 Approved Answer

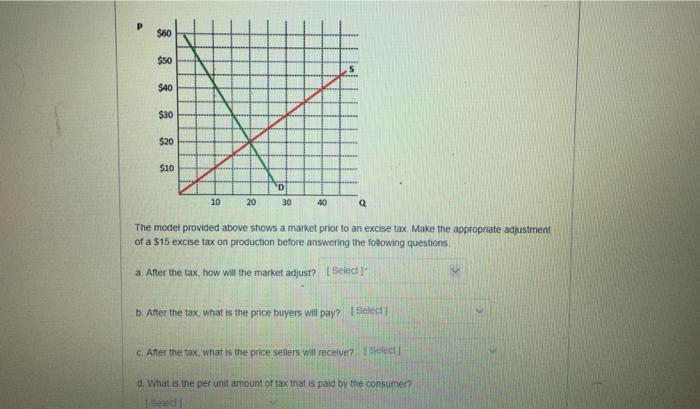

$60 $50 $40 $30 $20 $10 10 20 D 30 40 S Q The model provided above shows a market prior to an excise

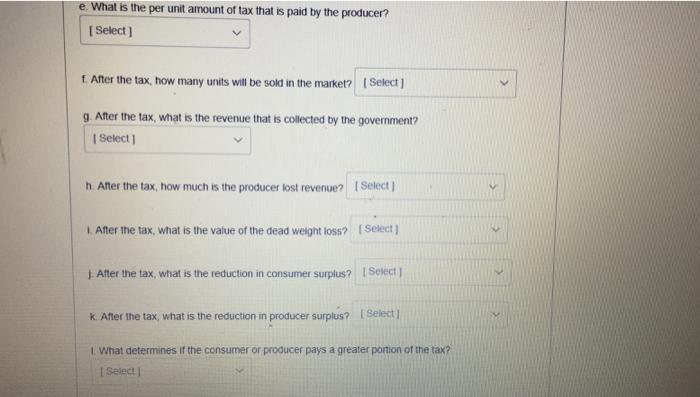

$60 $50 $40 $30 $20 $10 10 20 D 30 40 S Q The model provided above shows a market prior to an excise tax. Make the appropriate adjustment of a $15 excise tax on production before answering the following questions a. After the tax, how will the market adjust? [Select b. After the tax, what is the price buyers will pay? [Select c. After the tax, what is the price sellers will receive? Select] d. What is the per unit amount of tax that is paid by the consumer? Select e. What is the per unit amount of tax that is paid by the producer? [Select] f. After the tax, how many units will be sold in the market? [Select] g. After the tax, what is the revenue that is collected by the government? [ Select] h. After the tax, how much is the producer lost revenue? [Select] 1. After the tax, what is the value of the dead weight loss? [Select] j. After the tax, what is the reduction in consumer surplus? [Select] k. After the tax, what is the reduction in producer surplus? [Select] 1. What determines if the consumer or producer pays a greater portion of the tax? [Select]

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

A Reduction in quantity Reason Due to tax supply curve shi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e3e262747e_183064.pdf

180 KBs PDF File

635e3e262747e_183064.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started