Answered step by step

Verified Expert Solution

Question

1 Approved Answer

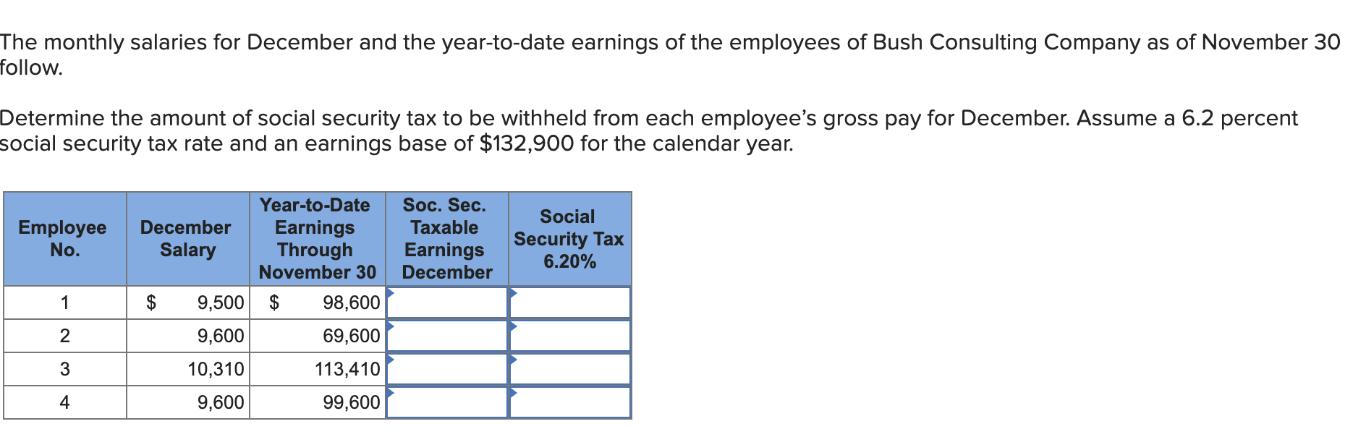

The monthly salaries for December and the year-to-date earnings of the employees of Bush Consulting Company as of November 30 follow. Determine the amount

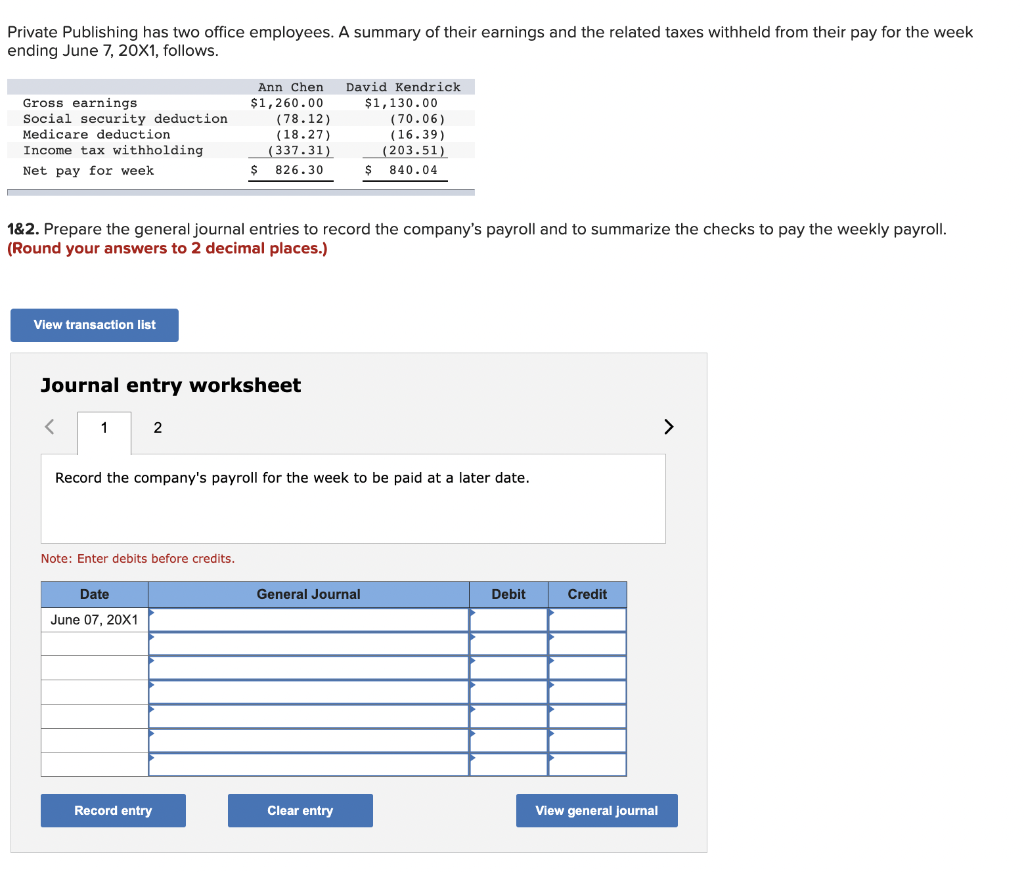

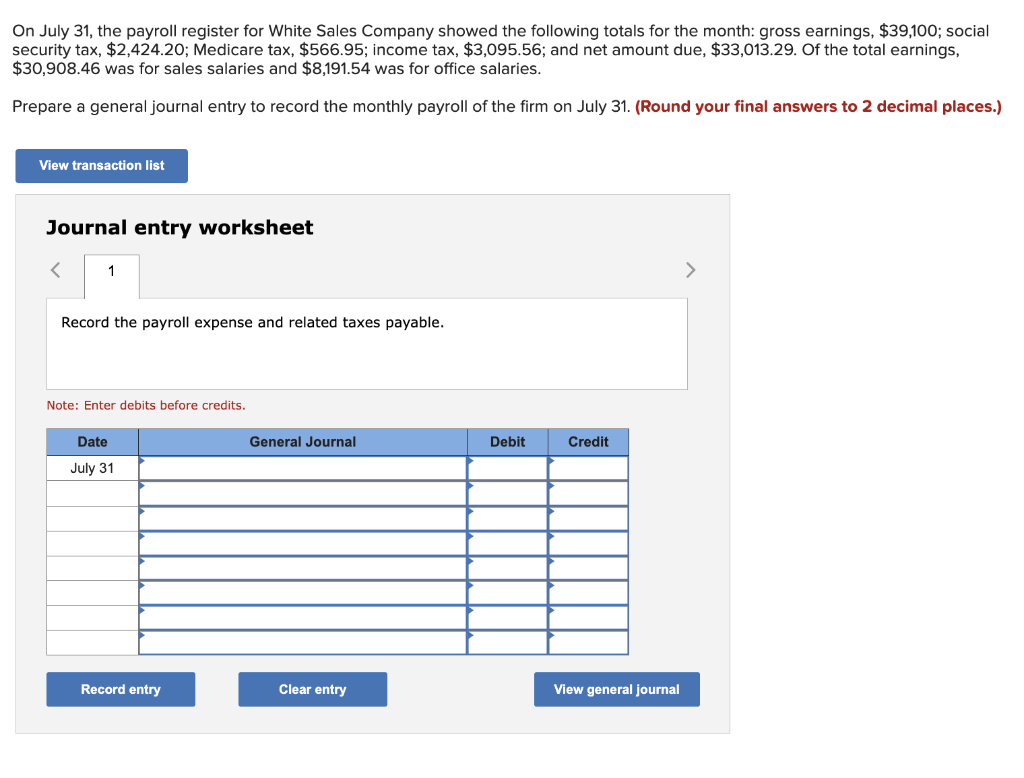

The monthly salaries for December and the year-to-date earnings of the employees of Bush Consulting Company as of November 30 follow. Determine the amount of social security tax to be withheld from each employee's gross pay for December. Assume a 6.2 percent social security tax rate and an earnings base of $132,900 for the calendar year. Employee December No. Salary 1 234 Year-to-Date Earnings Through Soc. Sec. Taxable Earnings November 30 December 98,600 69,600 113,410 99,600 $ 9,500 $ 9,600 10,310 9,600 Social Security Tax 6.20% Private Publishing has two office employees. A summary of their earnings and the related taxes withheld from their pay for the week ending June 7, 20X1, follows. Gross earnings Social security deduction Medicare deduction Income tax withholding Net pay for week View transaction list < 1&2. Prepare the general journal entries to record the company's payroll and to summarize the checks to pay the weekly payroll. (Round your answers to 2 decimal places.) Journal entry worksheet 1 2 Ann Chen $1,260.00 (78.12) (18.27) (337.31) Note: Enter debits before credits. Date June 07, 20X1 $ 826.30 Record entry Record the company's payroll for the week to be paid at a later date. David Kendrick $1,130.00 (70.06) (16.39) (203.51) $ 840.04 General Journal Clear entry Debit Credit View general journal > On July 31, the payroll register for White Sales Company showed the following totals for the month: gross earnings, $39,100; social security tax, $2,424.20; Medicare tax, $566.95; income tax, $3,095.56; and net amount due, $33,013.29. Of the total earnings, $30,908.46 was for sales salaries and $8,191.54 was for office salaries. Prepare a general journal entry to record the monthly payroll of the firm on July 31. (Round your final answers to 2 decimal places.) View transaction list Journal entry worksheet < 1 Record the payroll expense and related taxes payable. Note: Enter debits before credits. Date July 31 Record entry General Journal Clear entry Debit Credit View general journal >

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Q 1 Social Security Tax Employee No December Salary Year to date Earningsthrough November 30 Soc Sec ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started