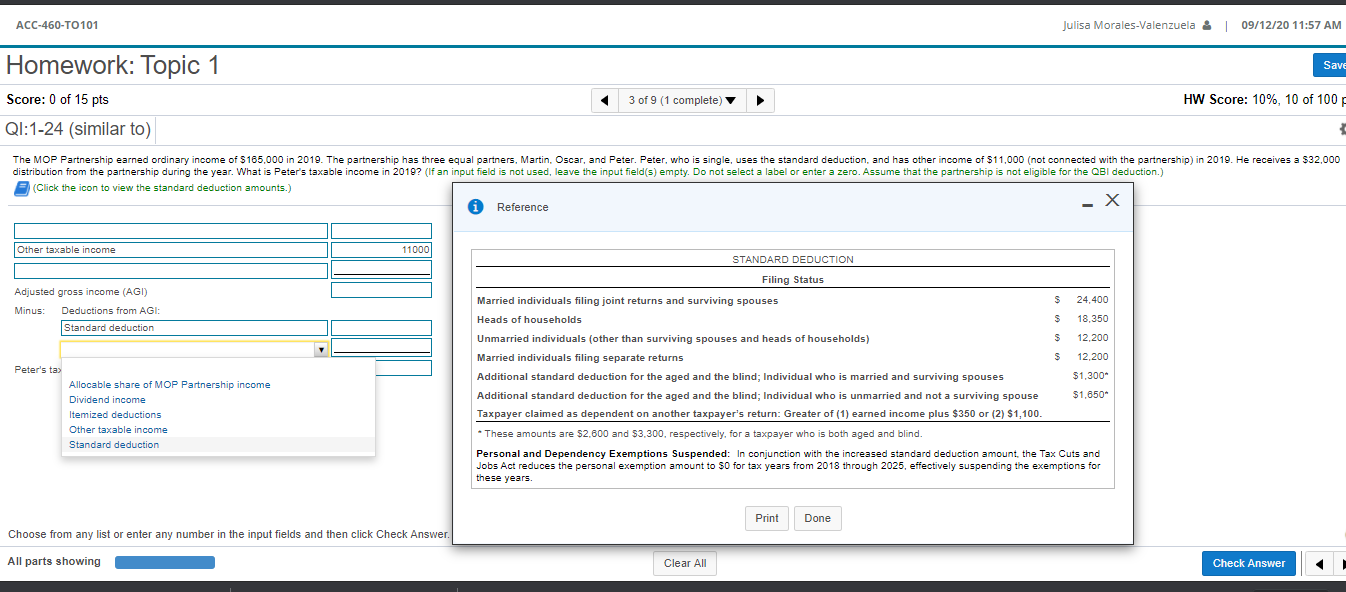

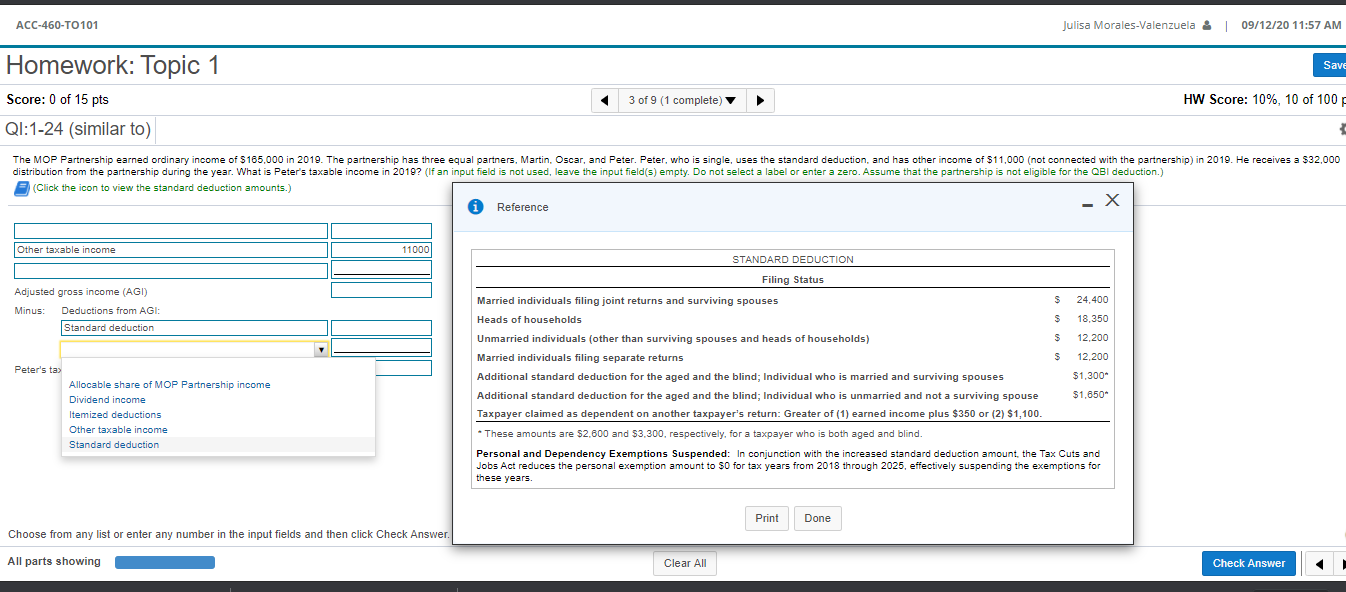

The MOP Partnership earned ordinary income of $165,000 in 2019. The partnership has three equal partners, Martin, Oscar, and Peter. Peter, who is single, uses the standard deduction, and has other income of $11,000 (not connected with the partnership) in 2019. He receives a $32000 distribution from the partnership during the year. What is Peters taxable income in 2019? (If an input field is not used, leave the input field(s) empty. Do not select a label or enter a zero. Assume that the partnership is not eligible for the QBI deduction.) Please show your work. Thank you.

ACC-460-TO 101 Julisa Morales-Valenzuela : | 09/12/20 11:57 AM Save Homework: Topic 1 Score: 0 of 15 pts QI:1-24 (similar to) 3 of 9 (1 complete) HW Score: 10%, 10 of 100 The MOP Partnership earned ordinary income of $ 165,000 in 2019. The partnership has three equal partners, Martin. Oscar, and Peter. Peter, who is single, uses the standard deduction, and has other income of $11,000 (not connected with the partnership) in 2019. He receives a $32,000 distribution from the partnership during the year. What is Peter's taxable income in 2019? (If an input field is not used, leave the input field(s) empty. Do not select a label or enter a zero. Assume that the partnership is not eligible for the QBI deduction) (Click the icon to view the standard deduction amounts.) * Reference Other taxable income 11000) STANDARD DEDUCTION Adjusted gross income (AGI) Minus: Deductions from AGI: Standard deduction Peter's tas Allocable share of MOP Partnership income Dividend income Itemized deductions Other taxable income Standard deduction Filing Status Married individuals filing joint returns and surviving spouses $ 24,400 Heads of households $ 18,350 Unmarried individuals (other than surviving spouses and heads of households) $ 12,200 Married individuals filing separate returns $ 12,200 Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses $1,300* Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse $1,650 Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2.800 and $3.300, respectively, for a taxpayer who is both aged and blind. Personal and Dependency Exemptions Suspended: In conjunction with the increased standard deduction amount the Tax Cuts and Jobs Act reduces the personal exemption amount to $0 for tax years from 2018 through 2025, effectively suspending the exemptions for these years. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All Check