the more you can help me out the better!

due at 11 pm central time and am struggling, plz help!! Thx

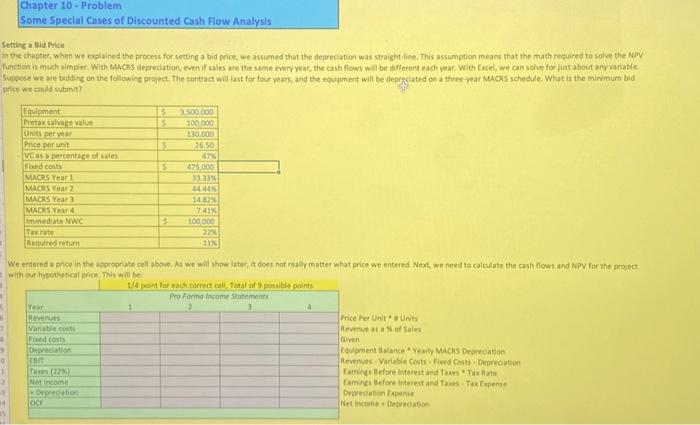

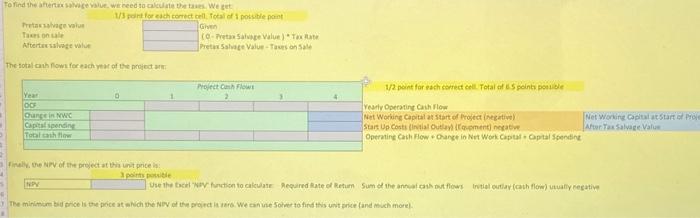

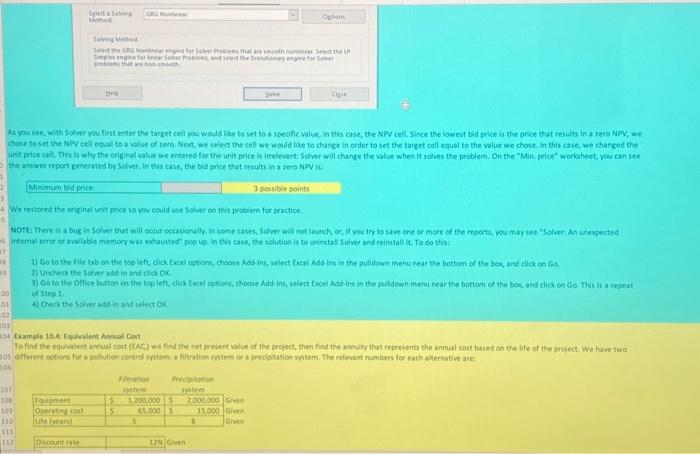

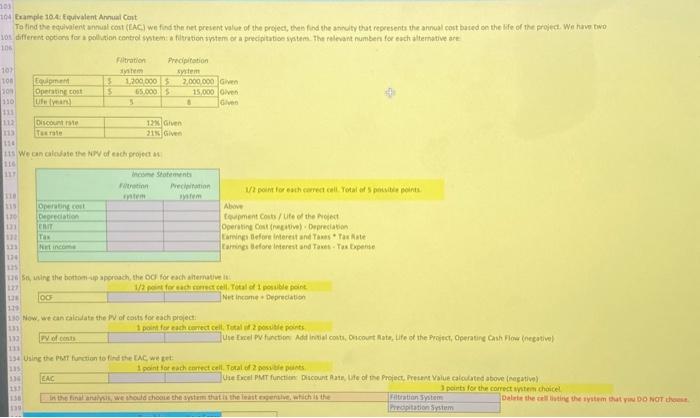

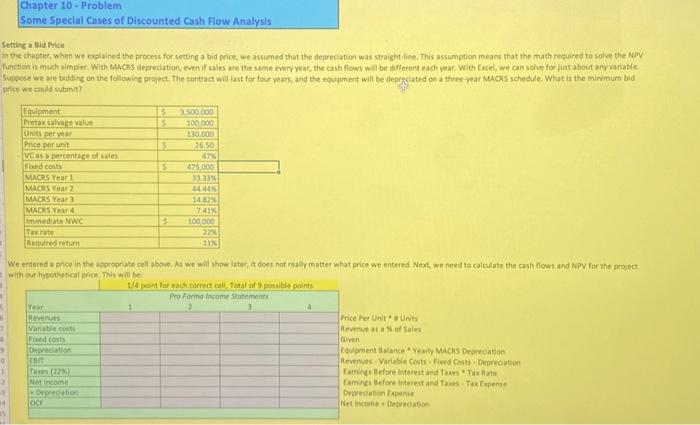

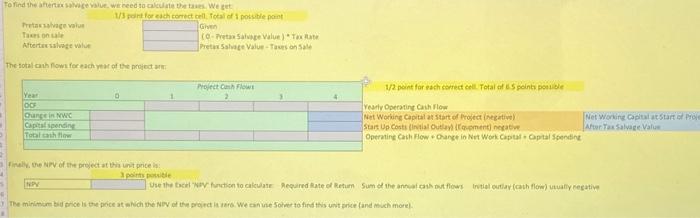

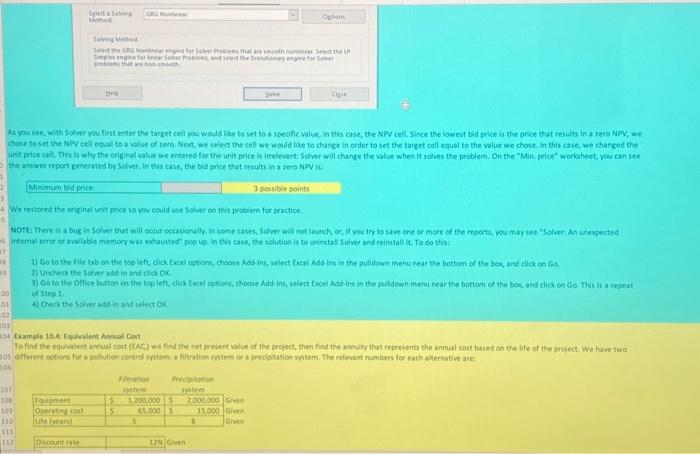

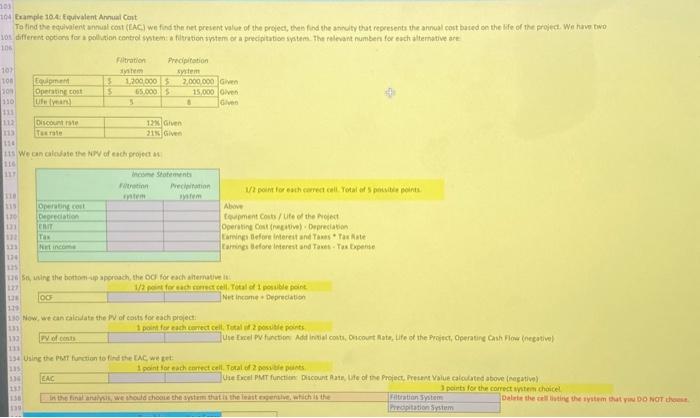

Settinc = Bid Price in the chapter, when we exglained the procets for setting a bid price, we assumed that the depreciabon was straicht-line, This assimption means that the math required to solve the NPV. Suppose we are biddins on the followire project. The contract will last for four vears, and the equipment will be depraciated on a three year Mchcrs schedule. What is the minimum bid price we could wamit? We entered a price in the appropriate cell above. As we will show later, it dost not reaby matter what price wer entered. Naxt, we need to calculate the cash flows and Npv for the provect With pur hypotevetical price. This will be: The sotal cath fown foreach vear of the project an 1/2 poins for wach sorrect cell. Total of 6.5 pointr posible Get Worine Capital as start of Prosect inecatiwe Net Working Caplu Afor Tas Salvage V Operatine Cabh Flow + Ohance in Net Work Captat + Optal Soendine. finully, the Nirv of the propect at this init price ia: Somma uropied intient that ais nescamsent the answee feport cencrated by Solver. In this case, the bid peice that rewults in a zero NAV is: We restored the original uni price wo vou could wes 5 olver on this problem for practice. 2) Uncheck the Solver asd ih and dick oK of step 1. 4) Oheck the solver ass in and welect of Coample 10.4: Fquevalent Amal Cost Irample 10.4:- fopivalent Annual Cant Abwe feupment Costs / ufe of the ficied Carrings before interest sad Tavet - Tas Lopente Net income o Deprediation Now, we can calisate the N of couts for each project: Settinc = Bid Price in the chapter, when we exglained the procets for setting a bid price, we assumed that the depreciabon was straicht-line, This assimption means that the math required to solve the NPV. Suppose we are biddins on the followire project. The contract will last for four vears, and the equipment will be depraciated on a three year Mchcrs schedule. What is the minimum bid price we could wamit? We entered a price in the appropriate cell above. As we will show later, it dost not reaby matter what price wer entered. Naxt, we need to calculate the cash flows and Npv for the provect With pur hypotevetical price. This will be: The sotal cath fown foreach vear of the project an 1/2 poins for wach sorrect cell. Total of 6.5 pointr posible Get Worine Capital as start of Prosect inecatiwe Net Working Caplu Afor Tas Salvage V Operatine Cabh Flow + Ohance in Net Work Captat + Optal Soendine. finully, the Nirv of the propect at this init price ia: Somma uropied intient that ais nescamsent the answee feport cencrated by Solver. In this case, the bid peice that rewults in a zero NAV is: We restored the original uni price wo vou could wes 5 olver on this problem for practice. 2) Uncheck the Solver asd ih and dick oK of step 1. 4) Oheck the solver ass in and welect of Coample 10.4: Fquevalent Amal Cost Irample 10.4:- fopivalent Annual Cant Abwe feupment Costs / ufe of the ficied Carrings before interest sad Tavet - Tas Lopente Net income o Deprediation Now, we can calisate the N of couts for each project