Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: Q1 Q2 Q3 Q4 Sales $850 $880 $960

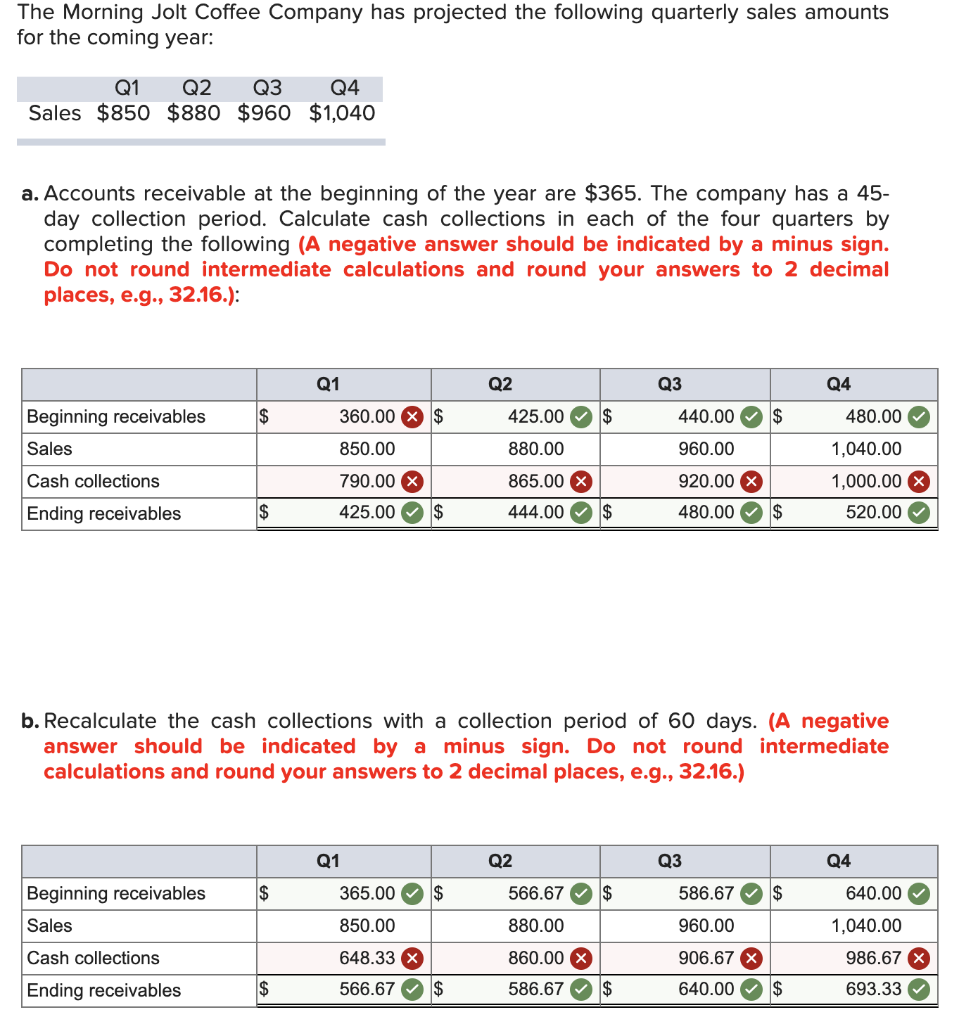

The Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: Q1 Q2 Q3 Q4 Sales $850 $880 $960 $1,040 a. Accounts receivable at the beginning of the year are $365. The company has a 45- day collection period. Calculate cash collections in each of the four quarters by completing the following (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Q1 Q2 Q3 Q4 Beginning receivables $ 480.00 360.00 $ 850.00 425.00 $ 880.00 440.00 $ 960.00 Sales 1,040.00 Cash collections 790.00 x 425.00 $ 865.00 X 444.00 $ 920.00 X 480.00 $ 1,000.00 x 520.00 Ending receivables $ b. Recalculate the cash collections with a collection period of 60 days. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Q1 Q2 Q3 Q4 Beginning receivables $ 365.00 $ $ 566.67 $ 880.00 586.67 960.00 Sales 850.00 Cash collections 648.33 x 860.00 x 906.67 X Ending receivables $ 566.67 $ 586.67 640.00 $ $ 640.00 1,040.00 986.67 x 693.33 c. Recalculate the cash collections with a period of 30 days. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Q1 Q2 Q3 Q4 Beginning receivables 365.00 Sales 850.00 Cash collections 931.67 X Ending receivables 283.33 $ 283.33 880.00 870.00 X 293.33 $ 293.33 960.00 933.33 X 320.00 320.00 1,040.00 1,013.33 X 346.67

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started