Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The most recent balance sheet and income statement for JPX (2020) is provided in the attached spreadsheet (sheet Q1). The target sales growth rate

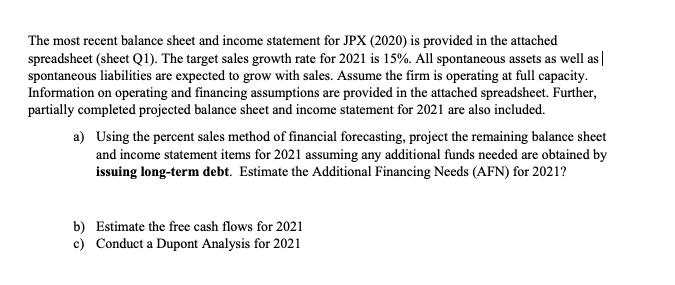

The most recent balance sheet and income statement for JPX (2020) is provided in the attached spreadsheet (sheet Q1). The target sales growth rate for 2021 is 15%. All spontaneous assets as well as| spontaneous liabilities are expected to grow with sales. Assume the firm is operating at full capacity. Information on operating and financing assumptions are provided in the attached spreadsheet. Further, partially completed projected balance sheet and income statement for 2021 are also included. a) Using the percent sales method of financial forecasting, project the remaining balance sheet and income statement items for 2021 assuming any additional funds needed are obtained by issuing long-term debt. Estimate the Additional Financing Needs (AFN) for 2021? b) Estimate the free cash flows for 2021 c) Conduct a Dupont Analysis for 2021 Operating and Financing Assumptions Sales Growth Tax Rate Payout Ratio Operating Income/Sales Cash/Sales AR/Sales Inventories/Sales Net Fixed Assets/Sales Acc Payable/Sales Accrua/Sales t of Borrowing for short and long term debt rce of External Financing -Plug item 15.00% 20.00% 40.00% 22.67% 2.12% 3.18% 6.14% Income Statement 2020 2021 $ 4,720 $ $ 3,050 200 24 158.90% Sales 5,428 9.53% Cost of Goods Sold 8.47% 14% Selling General and Admin E: $ Depreciation EBIT 400 $ 1,070 $ 2$ Long Term Debt 1,231 Interest Expense 350 Earnings Before Taxes 24 720 A- Estimate AFN using Financial Forecasting Method B- Estimate Free Cash Flow to Firm in 2021 C- Conduct Du Pont Analysis for 2021 Net Income %24 576 Dvidends 230 Addition to Retained Earning: $ 346 Actual Projected Balance Sheet 2020 2021 Surplus Cash 100 $ 115.00 %24 Cash 24 Acc Receivable 150 Inventory 290 $ 333.50 Total Current Assets 540 $ 7,500 $ 8,040 Net Fixed Assets Total Assets Liab + Shareholder Equity Accounts Payable 450 400 $ 460.00 690 $ Accruals Notes Payable 2$ 690.00 Total Current Liab 1,540 Long Term Debt 2,000 3,050 $ 3,050.00 1,450 Common Stock Retained Earnings Total Liab +SE 8,040 Proj Assets Proj Liab AFN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Sales Growth of Current Sales 015 Cost of Goods Sold of Sales Operating Expense of Forcast ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started