Answered step by step

Verified Expert Solution

Question

1 Approved Answer

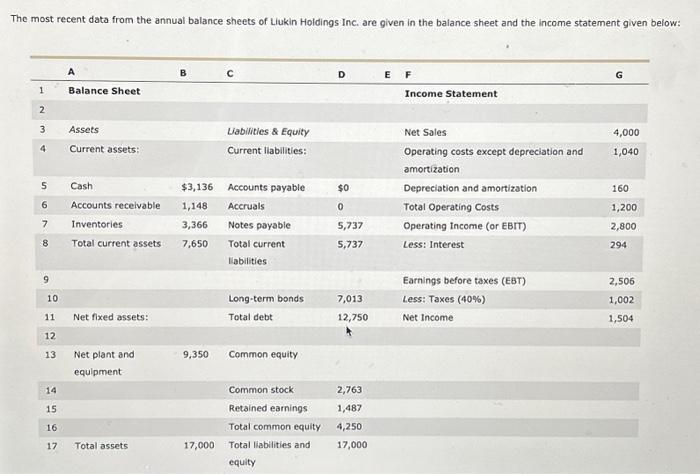

The most recent data from the annual balance sheets of Liukin Holdings Inc. are given in the balance sheet and the income statement given

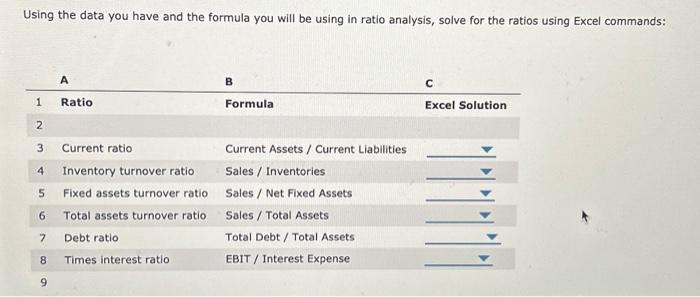

The most recent data from the annual balance sheets of Liukin Holdings Inc. are given in the balance sheet and the income statement given below: 1 2 3 4 8 9 5 Cash 6 Accounts receivable 7 Inventories 10 11 12 13 A 14 15 16 17 Balance Sheet Assets Current assets: Total current assets Net fixed assets: Net plant and equipment Total assets $3,136 1,148 3,366 7,650 9,350 17,000 Liabilities & Equity Current liabilities: Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total debt Common equity Common stock Retained earnings Total common equity Total liabilities and equity D $0 0 5,737 5,737 7,013 12,750 2,763 1,487 4,250 17,000 EF Income Statement Net Sales Operating costs except depreciation and amortization Depreciation and amortization Total Operating Costs Operating Income (or EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes (40%) Net Income G 4,000 1,040 160 1,200 2,800 294 2,506 1,002 1,504 Using the data you have and the formula you will be using in ratio analysis, solve for the ratios using Excel commands: A 7 8 1 2 3 Current ratio 4 Inventory turnover ratio Fixed assets turnover ratio 5 6 Total assets turnover ratio Debt ratio. Times interest ratio Ratio B Formula Current Assets / Current Liabilities Sales / Inventories Sales/ Net Fixed Assets Sales/ Total Assets Total Debt / Total Assets EBIT/ Interest Expense C Excel Solution

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Current Ratio Current Assets Current Liabilities 7650 5737 1334 Inventory Turnover ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started