Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Mountaineers are a nationally recognized football team that recently purchased gym equipment for $112,000 cash. The equipment had an estimated useful life of ten

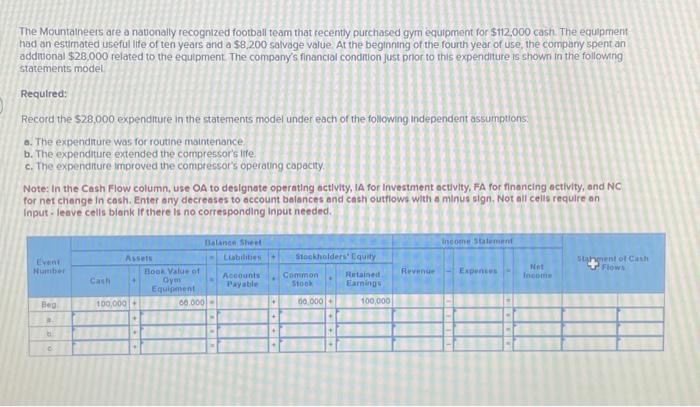

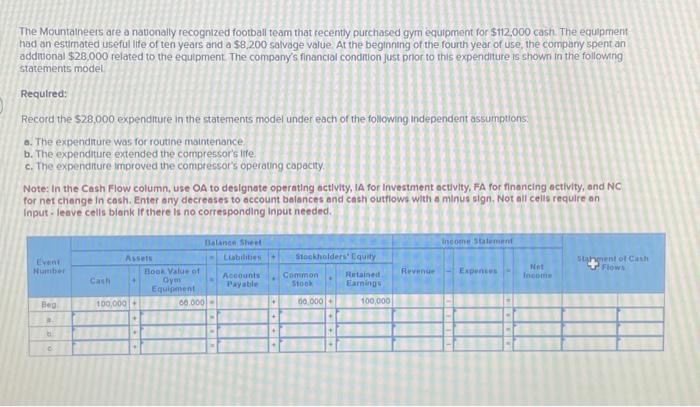

The Mountaineers are a nationally recognized football team that recently purchased gym equipment for $112,000 cash. The equipment had an estimated useful life of ten years and a $8,200 salvoge value. At the beginning of the fourth year of use, the compary spent an additional $28,000 related to the equipment. The company's financial condition just prior to this expenditure is shown in the follownig statements model Required: Record the $28,000 expenditure in the statements model under each of the following independent assumptions. a. The expenditure was for routine maintenance b. The expenditure extended the compressor's iffe c. The expenditure improved the comptersors operating capacity. Note: in the Cash Flow column, use OA to dealgnate operating activity, IA for investment actvity, FA for financing activity, and NC for net change in cash. Enter ony decreases to occount balonces and cash outhlows with o minus sign. Not ali celis require an Input - leave celis blank if there is no corresponding input needed

The Mountaineers are a nationally recognized football team that recently purchased gym equipment for $112,000 cash. The equipment had an estimated useful life of ten years and a $8,200 salvoge value. At the beginning of the fourth year of use, the compary spent an additional $28,000 related to the equipment. The company's financial condition just prior to this expenditure is shown in the follownig statements model Required: Record the $28,000 expenditure in the statements model under each of the following independent assumptions. a. The expenditure was for routine maintenance b. The expenditure extended the compressor's iffe c. The expenditure improved the comptersors operating capacity. Note: in the Cash Flow column, use OA to dealgnate operating activity, IA for investment actvity, FA for financing activity, and NC for net change in cash. Enter ony decreases to occount balonces and cash outhlows with o minus sign. Not ali celis require an Input - leave celis blank if there is no corresponding input needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started