Question

The much-prized Concord site led Boston Properties to want to build a quality 148,000/SF office development using quality building materials and quality architecture. It would

The much-prized Concord site led Boston Properties to want to build a quality 148,000/SF office development using quality building materials and quality architecture. It would not come cheaply. Estimated costs, including land, were $25 million in 1984, or over $169/SF, which at $23.50/SF rents gross, less $1.00 for vacancy and reserves and $5.50 in operating costs and real estate taxes, would yield $17.00/SF or 10.0% on costs. The costs traditionally could be financed with a conventional loan of 80% -- requiring 20% equity including the value of the land. At market at a 9% capitalization rate, the value was estimated to be about $189/SF or $28 million.

- Vacancy Rate: 10%

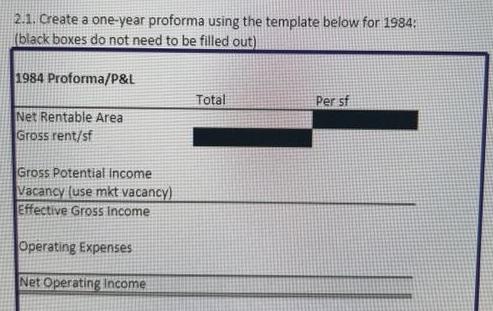

2.1. Create a one-year proforma using the template below for 1984: (black boxes do not need to be filled out) 1984 Proforma/P&L Net Rentable Area Gross rent/sf Gross Potential income Vacancy (use mkt vacancy) Effective Gross Income Operating Expenses Net Operating Income Total Per sf 2.1. Create a one-year proforma using the template below for 1984: (black boxes do not need to be filled out) 1984 Proforma/P&L Net Rentable Area Gross rent/sf Gross Potential income Vacancy (use mkt vacancy) Effective Gross Income Operating Expenses Net Operating Income Total Per sf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Gross Potential Income Net Rentable Area Gross rentsf Vacancy Gross Po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started