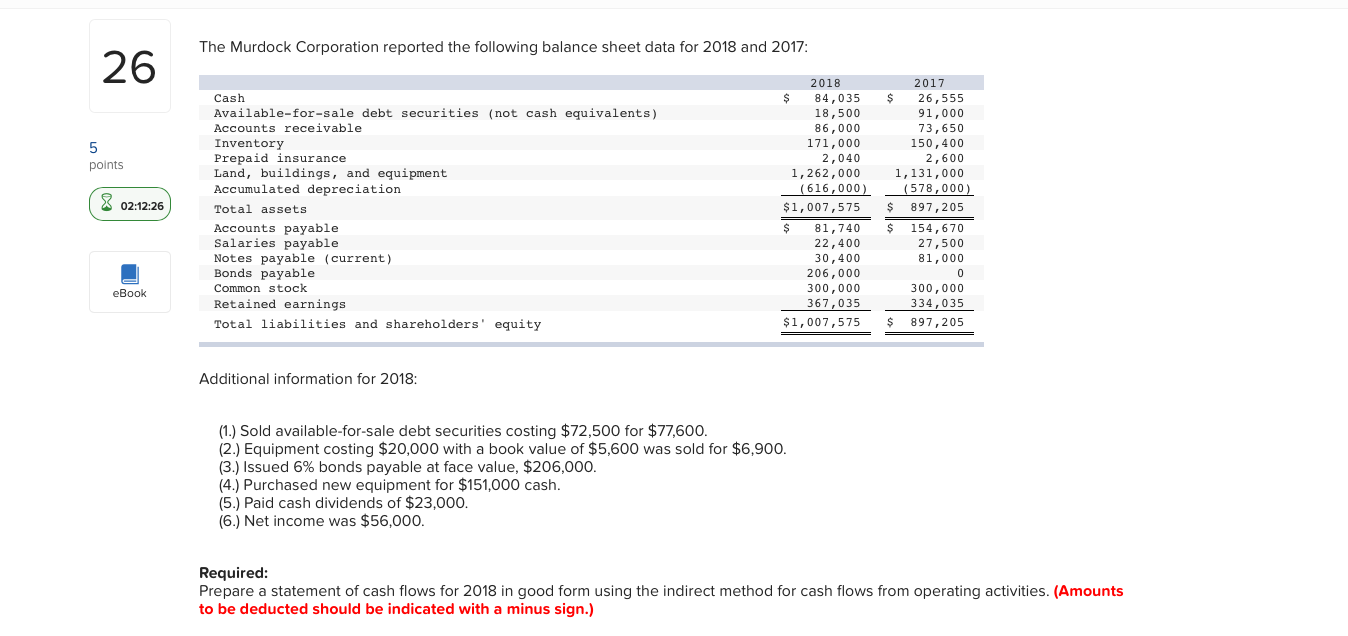

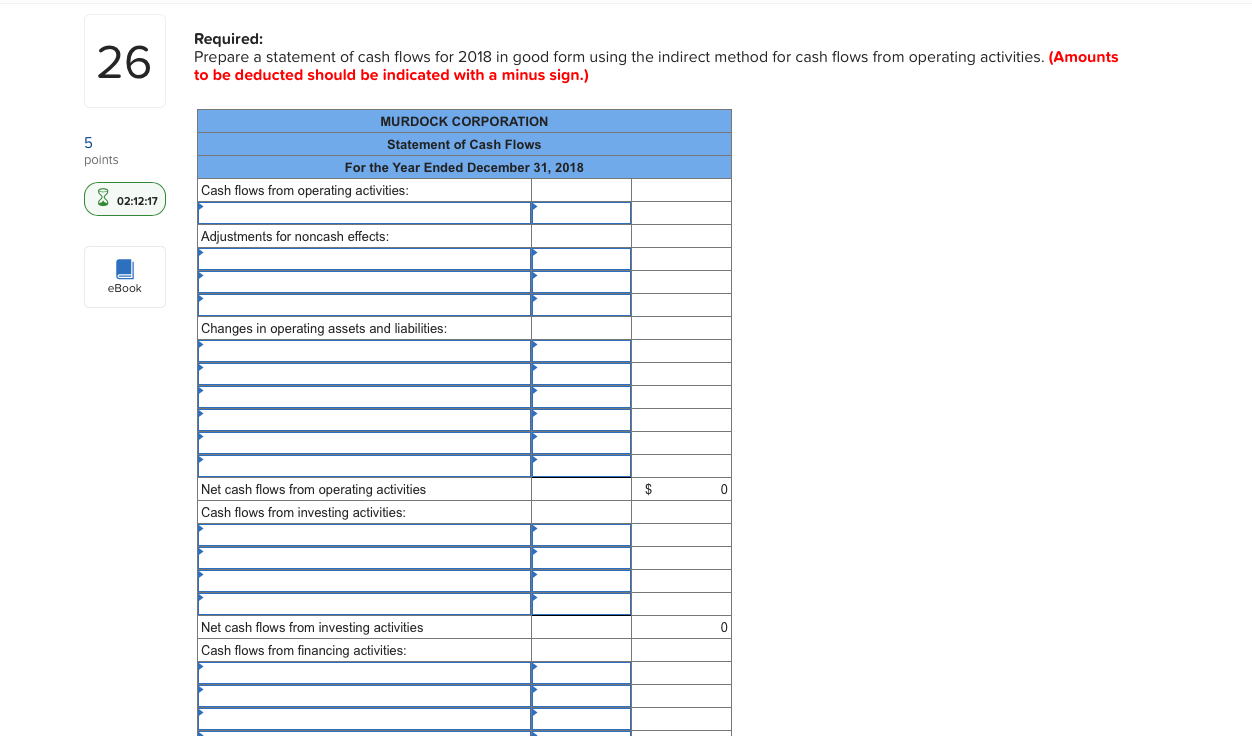

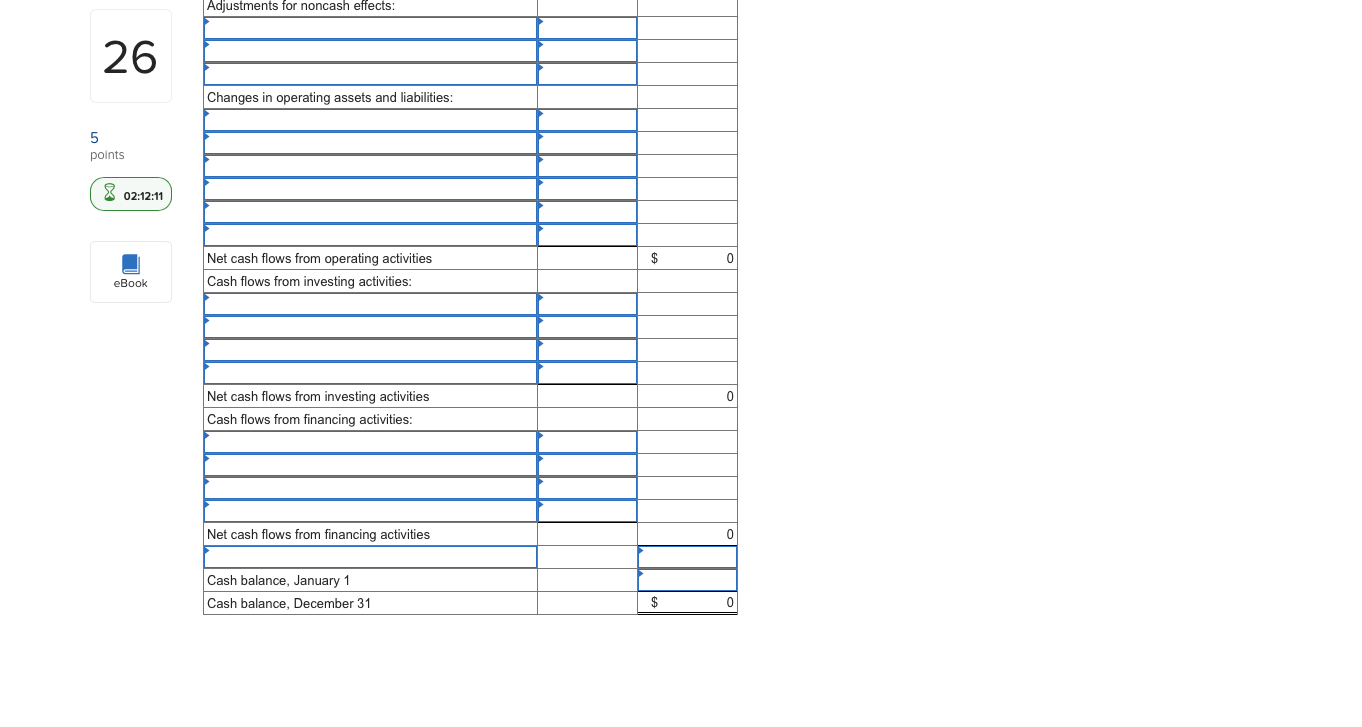

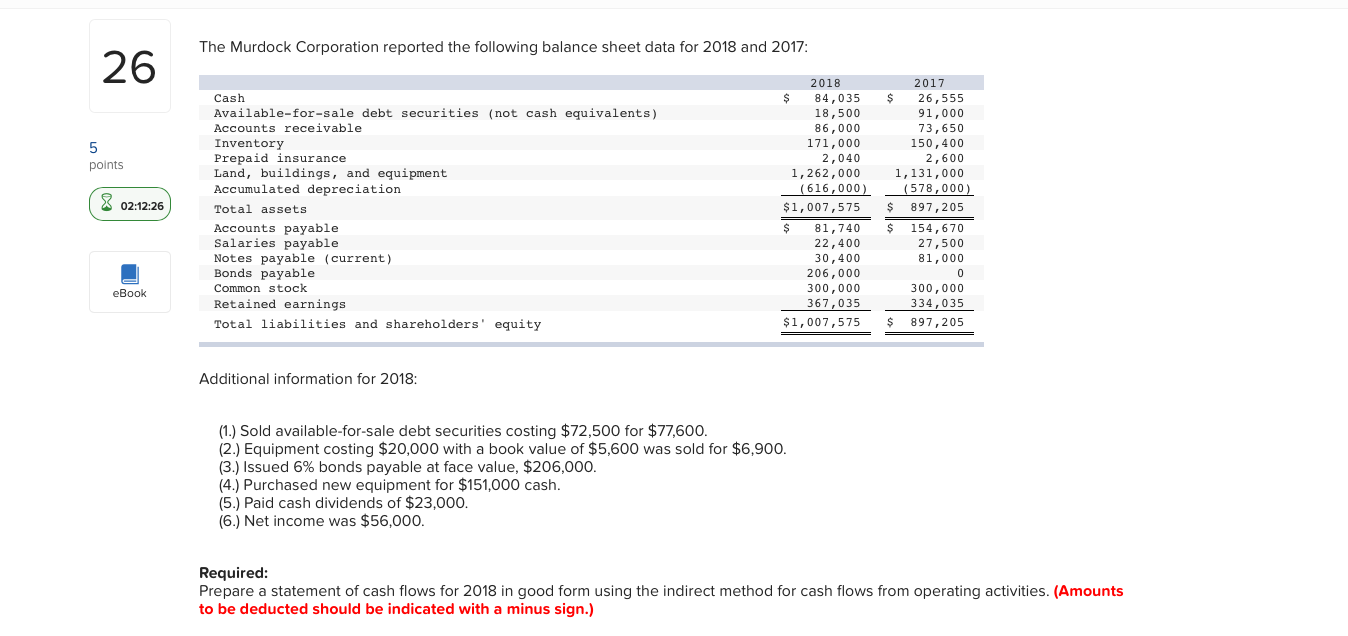

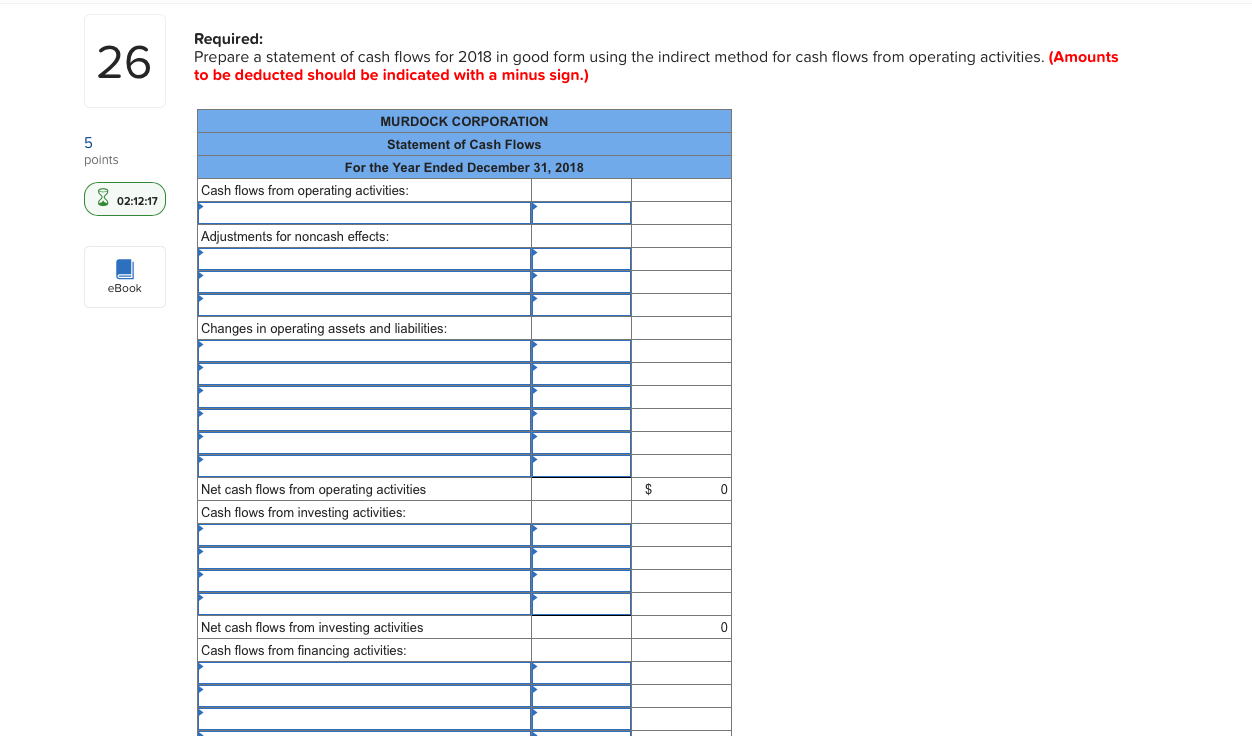

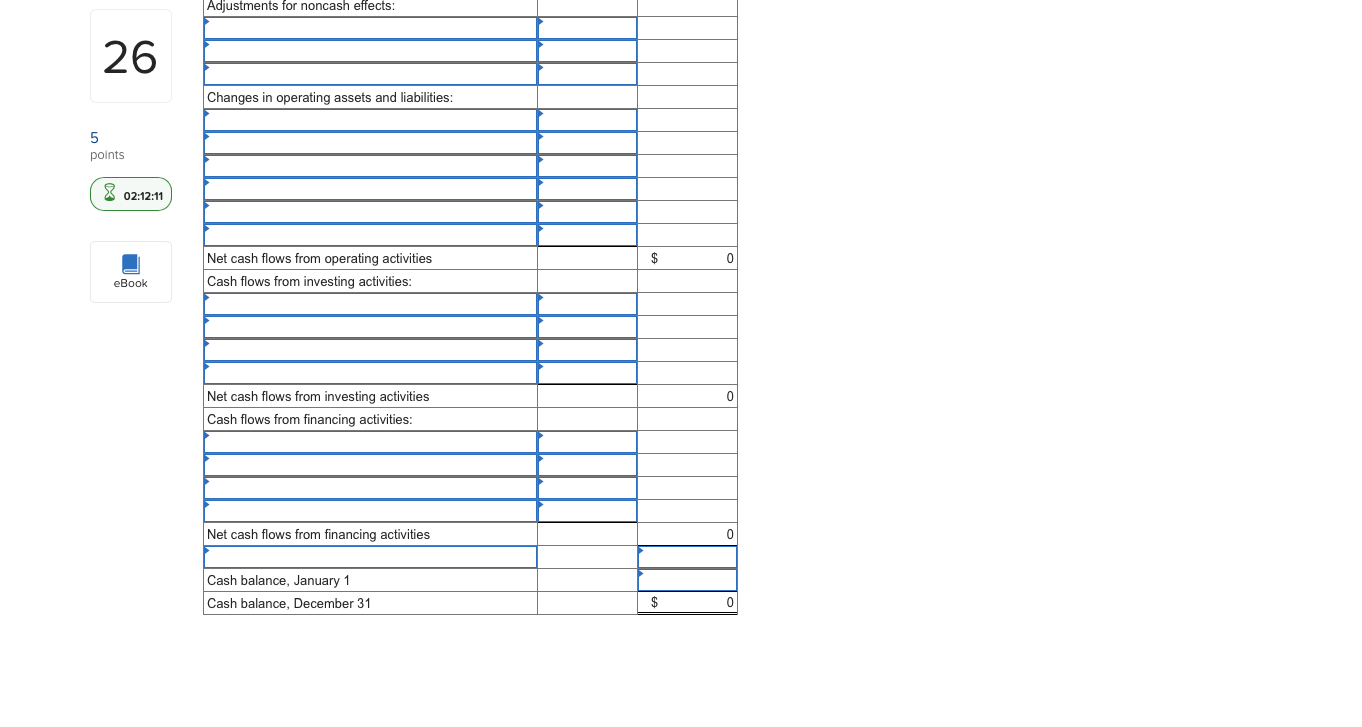

The Murdock Corporation reported the following balance sheet data for 2018 and 2017: 26 5 points Cash Available-for-sale debt securities (not cash equivalents) Accounts receivable Inventory Prepaid insurance Land, buildings, and equipment Accumulated depreciation Total assets Accounts payable Salaries payable Notes payable (current) Bonds payable Common stock Retained earnings Total liabilities and shareholders' equity & 02:12:26 2018 $ 84,035 18,500 86,000 171,000 2,040 1, 262,000 (616,000) $1,007,575 $ 81,740 22,400 30,400 206,000 300,000 367,035 $1,007,575 2017 $ 26,555 91,000 73,650 150,400 2,600 1,131,000 (578,000) $ 897, 205 $ 154,670 27,500 81,000 eBook 300,000 334,035 897, 205 $ Additional information for 2018: (1.) Sold available-for-sale debt securities costing $72,500 for $77,600. (2.) Equipment costing $20,000 with a book value of $5,600 was sold for $6,900. (3.) Issued 6% bonds payable at face value, $206,000. (4.) Purchased new equipment for $151,000 cash. (5.) Paid cash dividends of $23,000. (6.) Net income was $56,000. Required: Prepare a statement of cash flows for 2018 in good form using the indirect method for cash flows from operating activities. (Amounts to be deducted should be indicated with a minus sign.) 26 Required: Prepare a statement of cash flows for 2018 in good form using the indirect method for cash flows from operating activities. (Amounts to be deducted should be indicated with a minus sign.) 5 points MURDOCK CORPORATION Statement of Cash Flows For the Year Ended December 31, 2018 Cash flows from operating activities: 8 02:12:17 Adjustments for noncash effects: eBook Changes in operating assets and liabilities: $ 0 Net cash flows from operating activities Cash flows from investing activities: 0 Net cash flows from investing activities Cash flows from financing activities: Adjustments for noncash effects: 26 Changes in operating assets and liabilities: 5 points 8 02:12:11 $ 0 Net cash flows from operating activities Cash flows from investing activities: eBook 0 Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities Cash balance, January 1 Cash balance, December 31 $ 0