Answered step by step

Verified Expert Solution

Question

1 Approved Answer

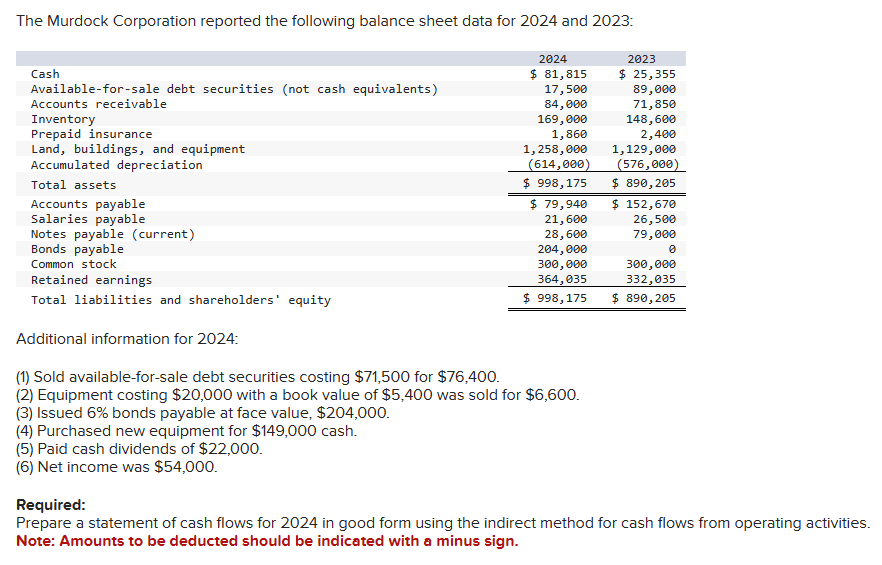

The Murdock Corporation reported the following balance sheet data for 2024 and 2023: Cash Available-for-sale debt securities (not cash equivalents) Accounts receivable Inventory Prepaid

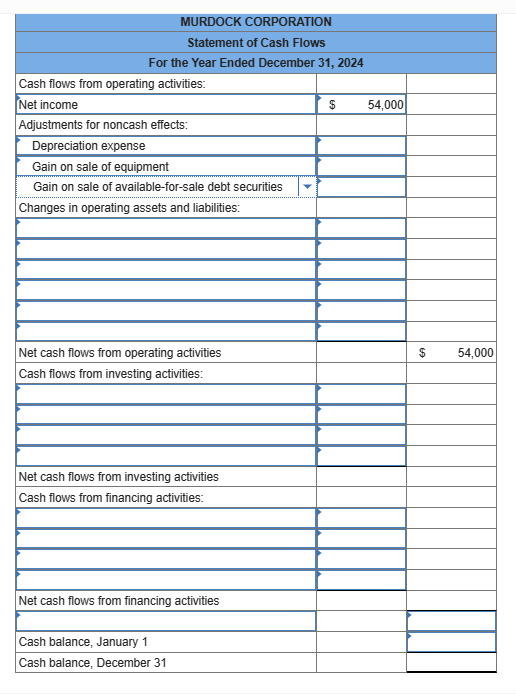

The Murdock Corporation reported the following balance sheet data for 2024 and 2023: Cash Available-for-sale debt securities (not cash equivalents) Accounts receivable Inventory Prepaid insurance Land, buildings, and equipment Accumulated depreciation Total assets Accounts payable Salaries payable Notes payable (current) Bonds payable Common stock Retained earnings Total liabilities and shareholders' equity Additional information for 2024: 2024 $ 81,815 17,500 84,000 169,000 2023 $ 25,355 89,000 71,850 148,600 1,860 2,400 1,129,000 (576,000) 1,258,000 (614,000) $ 998,175 $ 79,940 21,600 28,600 204,000 300,000 364,035 $ 998,175 $ 890,205 $ 152,670 26,500 79,000 0 300,000 332,035 $ 890,205 (1) Sold available-for-sale debt securities costing $71,500 for $76,400. (2) Equipment costing $20,000 with a book value of $5,400 was sold for $6,600. (3) Issued 6% bonds payable at face value, $204,000. (4) Purchased new equipment for $149,000 cash. (5) Paid cash dividends of $22,000. (6) Net income was $54,000. Required: Prepare a statement of cash flows for 2024 in good form using the indirect method for cash flows from operating activities. Note: Amounts to be deducted should be indicated with a minus sign. MURDOCK CORPORATION Statement of Cash Flows For the Year Ended December 31, 2024 Cash flows from operating activities: Net income Adjustments for noncash effects: Depreciation expense Gain on sale of equipment Gain on sale of available-for-sale debt securities Changes in operating assets and liabilities: $ 54,000 Net cash flows from operating activities Cash flows from investing activities: $ 54,000 Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities Cash balance, January 1 Cash balance, December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started