Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The name of Jacob's Business is Jacob's Property Management. Prepare the required General Journal Entries and Post the HST Payable amounts only to the

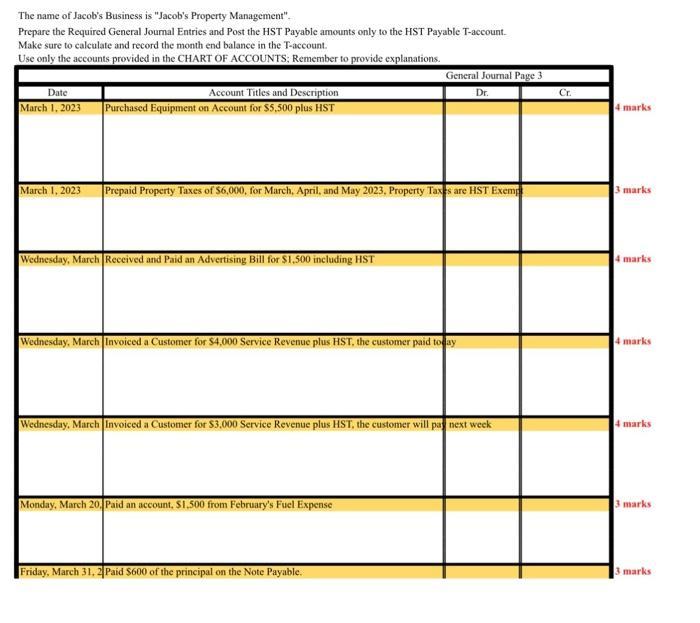

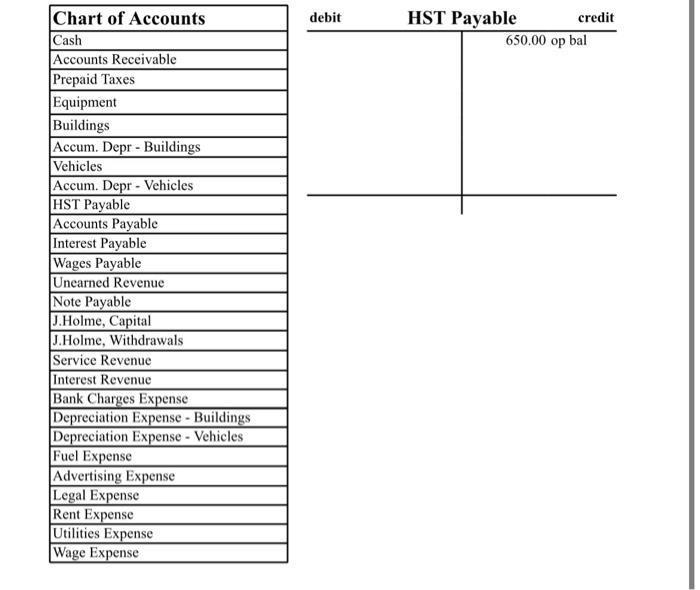

The name of Jacob's Business is "Jacob's Property Management". Prepare the required General Journal Entries and Post the HST Payable amounts only to the HST Payable T-account. Make sure to calculate and record the month end balance in the T-account. Use only the accounts provided in the CHART OF ACCOUNTS: Remember to provide explanations. Date March 1, 2023 March 1, 2023 Account Titles and Description Purchased Equipment on Account for $5,500 plus HST Prepaid Property Taxes of $6,000, for March, April, and May 2023, Property Taxes are HST Exemp Wednesday, March Received and Paid an Advertising Bill for $1,500 including HST General Journal Page 3 Dr. Wednesday, March Invoiced a Customer for $4,000 Service Revenue plus HST, the customer paid today Wednesday, March Invoiced a Customer for $3,000 Service Revenue plus HST, the customer will pay next week Monday, March 20, Paid an account, $1.500 from February's Fuel Expense Friday, March 31, 2 Paid $600 of the principal on the Note Payable. Cr. 4 marks 3 marks 4 marks 4 marks 4 marks 3 marks 3 marks Chart of Accounts Cash Accounts Receivable Prepaid Taxes Equipment Buildings Accum. Depr - Buildings Vehicles Accum. Depr - Vehicles HST Payable Accounts Payable Interest Payable Wages Payable Unearned Revenue Note Payable J.Holme, Capital J.Holme, Withdrawals Service Revenue Interest Revenue Bank Charges Expense Depreciation Expense - Buildings Depreciation Expense - Vehicles Fuel Expense Advertising Expense Legal Expense Rent Expense Utilities Expense Wage Expense debit HST Payable credit 650.00 op bal

Step by Step Solution

★★★★★

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Jacobs Property Management General Journal Entries March 2023 Date Account Titles and Description Dr ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started