Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The filing status is

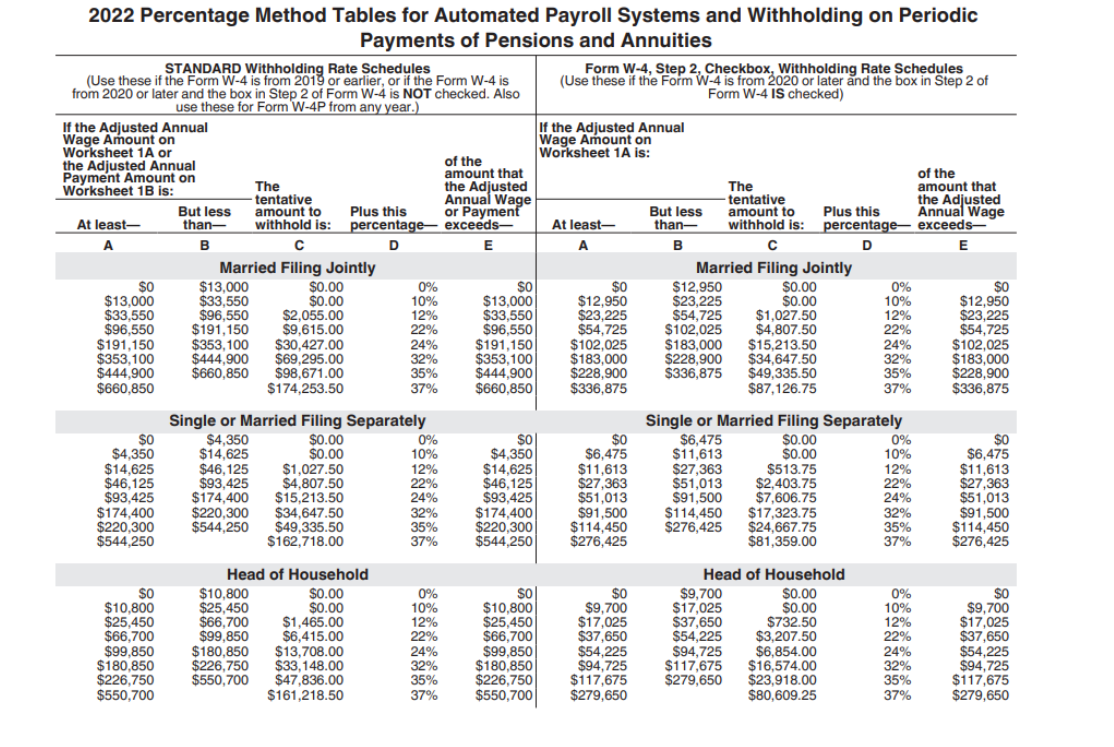

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The filing status is shown on the payroll register, along with each employee's weekly salary, which has remained the same all year. Complete the payroll register by filling in the gray shaded areas below for the payroll period ending December 20, 20--, the 51st weekly payday. The state income tax rate is 2% of total earnings, the city income tax rate is 1.5% of the total gross earnings, and the wage-bracket method is used for federal income taxes. *The percentage method must be used for John Matthew Period Ending December 20, 20- HOGAN THRIFT SHOP FILING STATUS NO. OF W/H ALLOW (a) DEDUCTIONS (b) (c) (d) (e) EMPLOYEE NAME John, Matthew Smith, Jennifer FS MFJ N/A TOTAL EARNINGS $2,720.00 FICA NET OASDI HI FIT SIT CIT PAY N/A 275.00 Bullen, Catherine MFJ N/A 250.00 Matthews, Mary Hadt, Bonnie Camp, Sean SSS N/A 320.25 N/A 450.00 N/A 560.50 Wilson, Helen S N/A 475.50 Gleason, Jose MFJ N/A 890.00 Totals $5,941.25 OASDI Taxes HI Taxes OASDI Taxable Earnings $ OASDI Taxes HI Taxable Earnings $ $ HI Taxes A B E 2022 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities STANDARD Withholding Rate Schedules (Use these if the Form W-4 is from 2019 or earlier, or if the Form W-4 is from 2020 or later and the box in Step 2 of Form W-4 is NOT checked. Also use these for Form W-4P from any year.) If the Adjusted Annual Wage Amount on Worksheet 1A or the Adjusted Annual Payment Amount on Worksheet 1B is: At least- But less than- The -tentative amount to withhold is: Plus this percentage D of the amount that the Adjusted Annual Wage or Payment exceeds- Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the Form W-4 is from 2020 or later and the box in Step 2 of Form W-4 IS checked) If the Adjusted Annual Wage Amount on Worksheet 1A is: At least- percentage- exceeds- But less than- The -tentative amount to withhold is: Plus this of the amount that the Adjusted Annual Wage B D E Married Filing Jointly Married Filing Jointly $0 $13,000 $0.00 0% $0 $0 $12,950 $0.00 0% $0 $13,000 $33,550 $0.00 10% $13,000 $12,950 $23,225 $0.00 10% $12,950 $33,550 $96,550 $2,055.00 12% $33,550 $23,225 $54,725 $1,027.50 12% $23,225 $96,550 $191,150 $9,615.00 22% $96,550 $54,725 $102,025 $4,807.50 22% $54,725 $191,150 $353,100 $30,427.00 24% $191,150 $102,025 $183,000 $15,213.50 24% $102,025 $353,100 $444,900 $69,295.00 32% $353,100 $183,000 $228,900 $34,647.50 32% $183,000 $444,900 $660,850 $98,671.00 35% $444,900 $228,900 $336,875 $49,335.50 35% $228,900 $660,850 $174,253.50 37% $660,850 $336,875 $87,126.75 37% $336,875 Single or Married Filing Separately Single or Married Filing Separately $0 $4,350 $0.00 0% $0 $0 $6,475 $0.00 0% $0 $4,350 $14,625 $0.00 10% $4,350 $6,475 $11,613 $0.00 10% $6,475 $14,625 $46,125 $1,027.50 12% $14,625 $11,613 $27,363 $513.75 12% $11,613 $46,125 $93,425 $4,807.50 22% $46,125 $27,363 $51,013 $2,403.75 22% $27,363 $93,425 $174,400 $15,213.50 24% $93,425 $51,013 $91,500 $7,606.75 24% $51,013 $174,400 $220,300 $34,647.50 32% $174,400 $91,500 $114,450 $17,323.75 32% $91,500 $220,300 $544,250 $49,335.50 35% $220,300 $114,450 $276,425 $24,667.75 35% $114,450 $544,250 $162,718.00 37% $544,250 $276,425 $81,359.00 37% $276,425 Head of Household Head of Household $0 $10,800 $0.00 0% $0 $0 $9,700 $0.00 0% $0 $10,800 $25,450 $0.00 10% $10,800 $9,700 $17,025 $0.00 10% $9,700 $25,450 $66,700 $1,465.00 12% $25,450 $17,025 $37,650 $732.50 12% $17,025 $66,700 $99,850 $6,415.00 22% $66,700 $37,650 $54,225 $3,207.50 22% $37,650 $99,850 $180,850 $13,708.00 24% $99,850 $54,225 $94,725 $6,854.00 24% $54,225 $180,850 $226,750 $33,148.00 32% $180,850 $94,725 $117,675 $16,574.00 32% $94,725 $226,750 $550,700 $47,836.00 35% $226,750 $117,675 $279,650 $23,918.00 35% $117,675 $550,700 $161,218.50 37% $550,700 $279,650 $80,609.25 37% $279,650

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started