Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Nissen Company has a taxation year end of December 31. On January 1 the opening UCC of Class 10 was $60,000. The Nissen

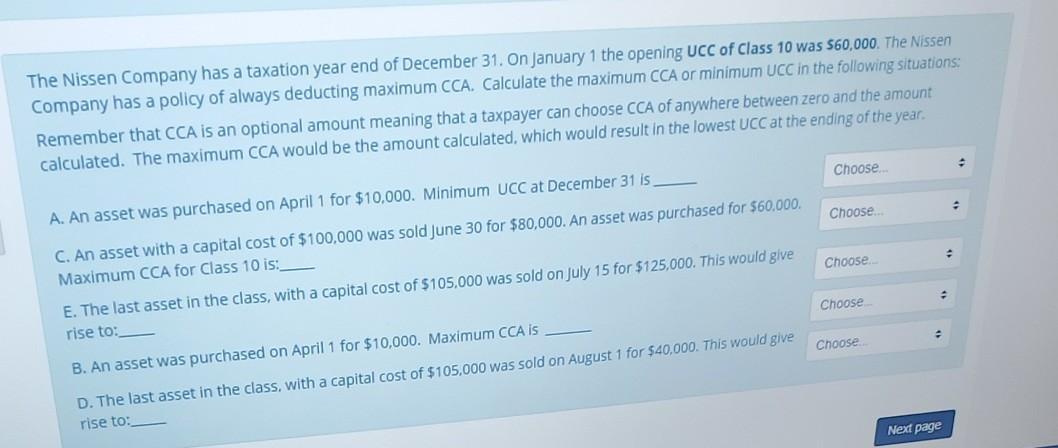

The Nissen Company has a taxation year end of December 31. On January 1 the opening UCC of Class 10 was $60,000. The Nissen Company has a policy of always deducting maximum CCA. Calculate the maximum CCA or minimum UCC in the following situations: Remember that CCA is an optional amount meaning that a taxpayer can choose CCA of anywhere between zero and the amount calculated. The maximum CCA would be the amount calculated, which would result in the lowest UCCat the ending of the year. A. An asset was purchased on April 1 for $10,000. Minimum UCC at December 31 is Choose. C. An asset with a capital cost of $100,000 was sold June 30 for $80,000. An asset was purchased for $60.000. Maximum CCA for Class 10 is: Choose. E. The last asset in the class, with a capital cost of $105,000 was sold on July 15 for $125,000. This would glve Choose. rise to: Choose B. An asset was purchased on April 1 for $10,000. Maximum CCA is D. The last asset in the class, with a capital cost of $105.000 was sold on August 1 for $40.000. This would give rise to: Choose Next page

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A The minimum UCC on Dec 31 will be 5950 Explanation Asset purchased 10000 30 10000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started